Fintech startups and banks have always been at the forefront of tech adoption, and they’ve been curiously following the growth and development of AI for many years. And there’s a good reason for it — we, the consumers of their services, want to have access to cutting-edge technology while dealing with our finances, as well as making sure that the companies dealing with our savings be equipped with the best of what tech can offer.

AI and ML have recently moved from the realm of futurism to the very crux of the conversation in the Fintech sector, and many aspiring businesses have started integrating it into their services. In this article, we wanted to touch on the ways various Fintech businesses and startups implement this technology in the services they provide their customers with and how it benefits their users. Let’s dive right in, shall we?

Should the finance sector tap into AI?

You may have already asked yourself whether banks and Fintech businesses should tap into such ambiguous territory such as AI? We’re here to tell you that the benefits for these businesses of implementing AI in their services are extensive and recurring.

It helps them take advantage of more efficient and effective marketing, use predictive analytics to improve the quality of their services and financial advice, along with minimizing risk by profiling their existing and potential clientele.

The principal idea that is worth underlining is that it’s not only the businesses implementing AI that benefit from this cutting-edge technology — customers are also in the win.

-

A holistic approach to financial advice

A lot of modern technology like Machine Learning, Artificial Intelligence, Neural Networks, Big Data Analytics, and so forth, has allowed scientists and developers in a broad spectrum of niches and industries to extract very valuable insights out of vast and varied datasets. This data will enable them to make very precise predictions and recommendations.

Some Fintech startups started using chatbots to provide their clients with advice and even coaching on improving their transactions and other types of actions they perform, like trading stocks and cryptocurrencies.

The beauty of chatbots in this particular case is their autonomy and how they eliminate the necessity of actual people having to be available 24/7 or at certain hours, while customers can reach an advisor at any time of the day or night. More importantly, they are effortless to integrate into social media platforms like Facebook Messenger.

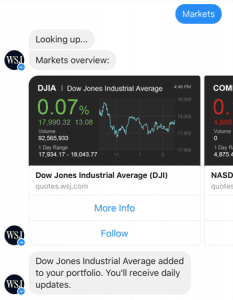

Such “machines” are built using NLP, also known as Natural Language Processing. These AI-based assistants can read and (in a limited way) understand a customer’s request and provide them with the data they’ve inquired. Here’s an example of a very straightforward request made using the Wall Street Journal chatbot that is integrated into Facebook’s Messenger:

Other businesses have created chatbots that can track your savings throughout a specific timeframe and assist you with better understanding your spendings, along with reducing your expenses in the long run.

Other bots assist their customers with taxes by allowing you to follow your business expenses and assist you with deducting your tax expenses. These bots help their customers have a more in-depth understanding of what their costs look like in a certain period and

Banks haven’t been sleeping on this technology either. There is now a large hall of fame of highly successful chatbots created by a wide array of world-renown banks like Bank of America, HSBC Bank, and Australia’s Commonwealth Bank.

However, it’s also essential to mention how vital the chatbot interaction design is. While it can be classified as artificial intelligence, the language it uses to communicate with its users is programmed by humans. There is now a plethora of useful resources and services like WoW Grade, Chatbot Magazine, SupremeDissertations, and the Messenger Developer Blog that can assist you with proper chatbot interaction design.

-

Understanding a Client’s Risk Profile

An essential part of a bank’s efficiency and success is understanding whether it’s safe to award a particular client a certain amount of money and whether they’ll be able to return the said amount along with the added interest. This action is typically performed using complex mathematics, designed to analyze a broad spectrum of factors.

AI is a fantastic tool that allows profiling their customer along with categorizing them, based on all the factors they have access to, along with their risk profile, of course.

More importantly, AI allows banks and adjacent businesses to automate this process, thus making decision-making much faster and much more precise, given the lack of human error.

This categorization, however, doesn’t just revolve around knowing what customers to deny when it comes to awarding them a loan, but it also allows them to calibrate the services they advertise to them.

These models are typically based and trained on actual customer data collected throughout the years, which ensures that the banks will be able to make their individualized offers with maximum precision and relevance.

“While on its face, this facet of AI application seems to act against their customers’ favor, it’s safe to say that customers are safeguarded from engaging in financial responsibilities they might not be able to address in the long run.” Daniel Baker, Marketing Strategist.

-

Detecting fraud and managing claims

AI-based tools are now implemented to gather evidence and provide banks and Fintech startups with the necessary data to allow them to identify fraudulent behavior or transactions.

Mastercard is an excellent example of a business taking its anti-fraud strategy very seriously. Very recently, the multinational corporation has acquired Brighterion, an AI company, a move that will help them improve the precision of and pretty much automate their fraud detection mechanisms.

Mastercard’s long-term goal is making all transactions performed using their card, both physically and online fraud-free. Considering that Brighterion’s product is an AI that is designed to train itself over time, Mastercard users might see a gradual decrease in fraudulent transactions.

Conclusion

These were the most intriguing AI applications in Fintech to this moment. However, it’s essential to stress that list by no means stops here. The technology expands and improves on a day-to-day basis and is projected to change our lives forever. All we need to do is sit back and watch.