COVID-19 has not only impacted our economy, but it has also radically altered how Americans, work, learn, and interact with one another. To help Americans weather the economic storm, Congress passed an economic stimulus package in April, and by August, nearly 160 million payments totaling over $270 billion had been distributed.

As businesses have reopened, economic conditions have gradually improved. However, many businesses remain in financial distress and face ongoing challenges as they adapt their processes to accommodate social distancing requirements and shifting customer behavior.

While nearly every company must navigate this new reality, small businesses are feeling the strain the most. This is concerning because small businesses make up nearly 99.9 percent of all businesses, are responsible for 44 percent of America’s economic activity, and create two-thirds of all net new jobs. Given their economic importance, it’s not an exaggeration to suggest that the health of the overall economy is dependent on the health of small businesses nationwide.

Challenges around the flow and timing of payments

One of the most pressing concerns for small businesses is cash flow. “There are few activities more important to businesses than managing their daily cash flow,” said Sarah Grotta, director of Debit and Alternative Products Advisory Service at Mercator Advisory Group.

To operate effectively, companies must keep track of the money flowing in and out of the business. And while small businesses have struggled with payments and cash flow challenges in the past, the coronavirus pandemic has caused this pressure to mount considerably.

A PYMNTs and Visa survey found that a striking 76 percent of small businesses reported cash flow shortages during the pandemic, with 37 percent of small business owners using their personal funds to keep the business operating. These findings are not outliers; another collaborative study from Facebook and the Small Business Roundtable found 40 percent of small businesses reported that cash outflow was greater than inflow over the past 30 days.

Small businesses are looking for help…

Small businesses’ cash flow problems largely stem from a reliance on inefficient and outdated manual processes. For example, checks still account for 42 percent of all B2B payments, despite being slower and more costly than other payment methods.

In normal circumstances, using checks is just inefficient and expensive. But during the pandemic—with many offices closed and employees working from home—writing, mailing, and processing checks can prove exceedingly difficult.

As a result, many small businesses are seeking out more effective alternatives. Real-time settlement capabilities are of particular interest, with 42 percent of small business owners reporting they would switch banks to attain real-time settlement. But it’s not just quicker settlement that small businesses desire.

“Small business owners want a suite of online solutions to meet their specific needs,” Tina Giorgio, president and CEO of ICBA Bancard, explained in a recent blogpost. “In fact, 81 percent consider robust digital banking capabilities to be important, including the overall digital experience, online and mobile functionality, and online account-opening capabilities.”

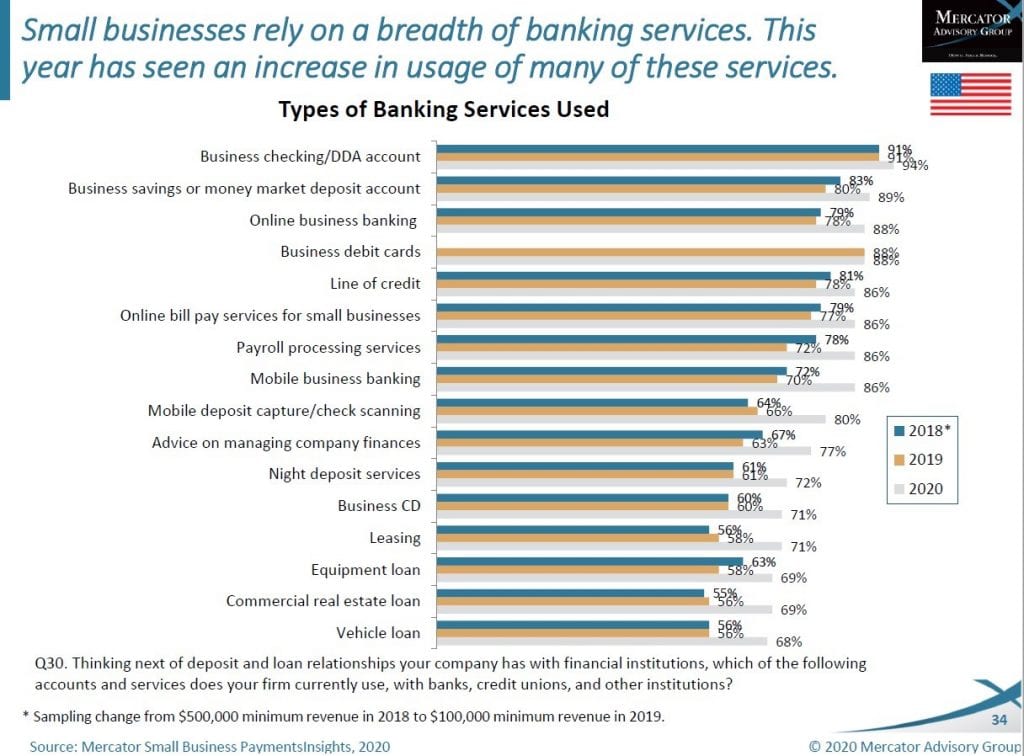

Survey work conducted by Mercator reveals how small businesses are increasingly turning towards banks for a breadth of banking services. Since 2019, for instance, the number of SMBs using mobile business banking shot up 16 percent, while the number utilizing payroll processing services rose 14 percent.

The high demand among small businesses for better accounting and payment services creates a great opportunity for banks. It is estimated that banks could drive almost $370 billion in annual revenue by meeting small businesses’ unmet cash flow needs.

…Community banks have the opportunity to provide the needed solutions

Throughout the pandemic, community banks have been a lifeline for small businesses, providing nearly $330 billion in Paycheck Protection Program loans, accounting for nearly 60 percent of the total loans and saving an estimated 33.7 million jobs. Even before the pandemic, community banks were prolific small business lenders, making 60 percent of all small business loans, further demonstrating how much small businesses rely on community banks for their financial needs.

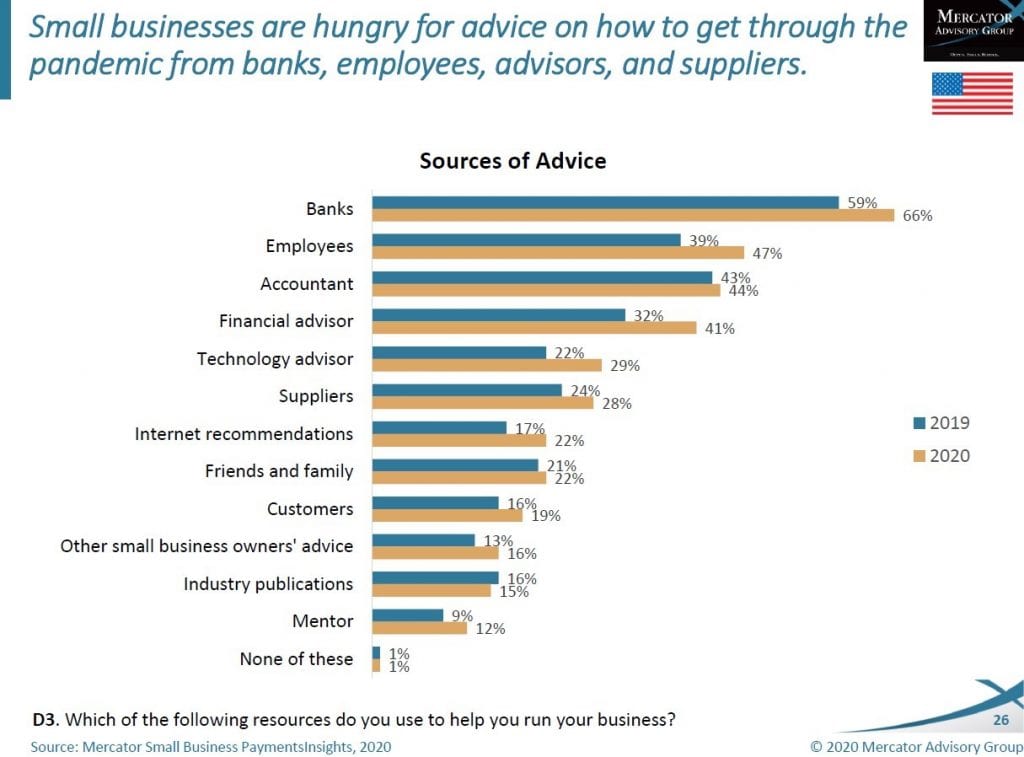

With so much goodwill in place, community banks are well positioned to provide the cash management services that small businesses so desperately need. As Giorgio noted, “small business customers are looking to community banks for the advice they need to remain in business.” In fact, the Mercator survey cited earlier found that 66 percent of small businesses turned to their bank for advice in 2020, up 7 percent from the year prior.

If they can meet this demand, community banks can improve existing customer relationships, forge new ones, and tap into almost $370 billion in potential revenue.

Helping community banks develop digital offerings

In order to provide the help that small businesses need, it’s more critical than ever for community banks to have a blueprint for innovation that aligns with their strategic goals and strengthens their all-important customer relationship,” Giorgio said.

Grotta agreed, adding that “a modern payment infrastructure that allows community banks to develop flexible tools to meet the needs of small businesses is increasingly important for acquiring and retaining clients.”

To help banks optimize their digital offerings, ICBA Bancard partnered with Aite Group to develop the second ICBA Bancard Digital Payments Strategy Guide℠—Small Business Edition. The resource is a responsive Q&A assessment questionnaire that enables community banks to refine their digital payment infrastructure by:

- evaluating their market opportunity,

- assessing existing offerings and identifying gaps,

- examining product development approaches, and

- creating a realistic roadmap.

“Our new tool aimsto make the digital aspect of that relationship even more helpful and efficient—giving community banks yet another competitive advantage in the financial services marketplace,” said Giorgio. “Now’s the time to dive deeper with current and potential small business customers—for your bank’s sake as much as theirs.”

To learn more about this tool, which will be available to all ICBA community bank members beginning Nov. 9, click here.