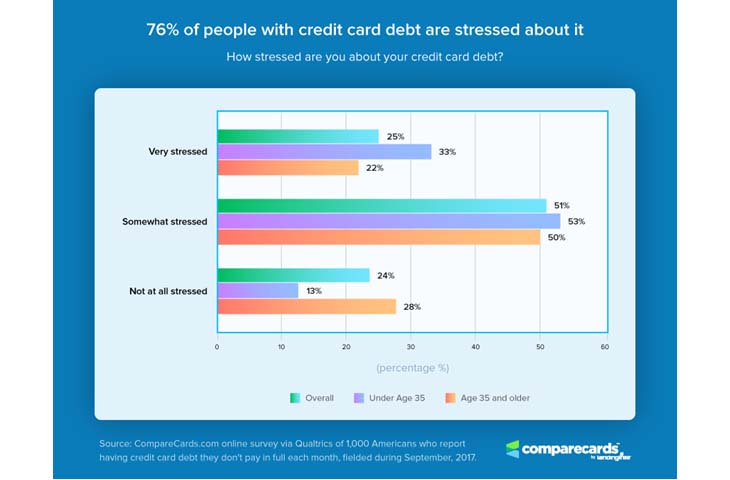

A clear majority of Americans currently in credit card debt are stressed about their financial predicament, no matter how they accumulated the debt in the first place, according to a new survey from Comparecards.com.

Three out of four Americans with credit card debt said they were stressed about their credit card debt, according to the survey conducted earlier this year. Millennials, especially, were more stressed than older credit card users with debt. According to the survey, 86 percent of millennials with credit card debt reported they were anxious, versus 72 percent of those age 35 and over.

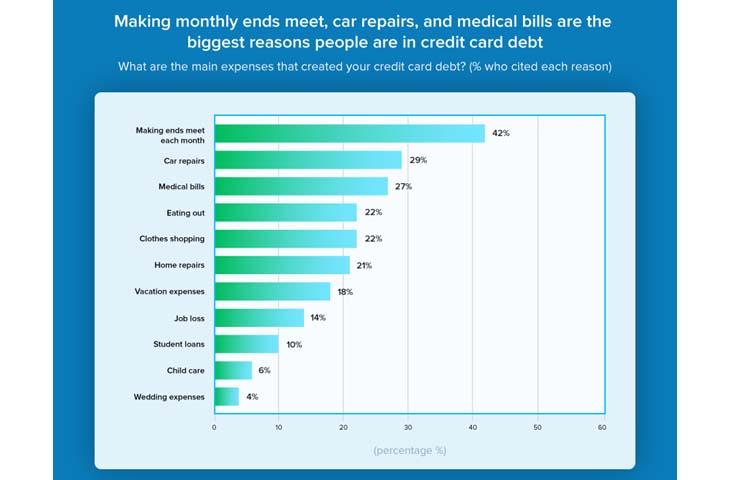

As for how cardholders accumulated the credit card debt in the first place, often it’s not from a particular expense like a wedding or costly vacation. Paying for basic needs was the reason most often reported. Some 42 percent of respondents said that “making ends meet each month” was how they got into credit card debt.

Month-to-month expenses trump big-ticket items

When this is the case, many financial experts suggest putting a number on one’s monthly expenses. The simple exercise of summing up their monthly expenses can help credit card users prioritize what’s essential and eliminate spending that isn’t.

When this is the case, many financial experts suggest putting a number on one’s monthly expenses. The simple exercise of summing up their monthly expenses can help credit card users prioritize what’s essential and eliminate spending that isn’t.

Among millennials, eating out was also a primary driver of credit card debt. Nearly one-third (31 percent) of millennials reported that eating out contributed to their carrying of a credit card balance, versus only 22 percent of the population as a whole.

Boomers need more time

Boomers with credit card debt have their own set of challenges. According to the survey, they’re more likely to have debt from unexpected expenses like car repairs, which often take more time to pay off.

Nearly half of baby boomers claim that their credit card debt will take more than one year to pay off, versus 28 percent of millennials. Although the survey doesn’t point to any clear reasons, the disparity could possibly be attributed to differences in credit card balances between the two cohorts. Generally, younger borrowers with newer credit histories will have lower credit limits than older borrowers, which means they might not be able to rack up as much debt as older borrowers.

Too stressed to be blessed

But no matter how credit card users accrued the debt, most borrowers find the burden of credit card debt stressful, although older borrowers appear to be slightly more relaxed than millennials. The vast majority (87 percent) of millennials say they are either “somewhat stressed” or “very stressed” about their balances, compared to 72 percent of borrowers aged 35 and older.

But no matter how credit card users accrued the debt, most borrowers find the burden of credit card debt stressful, although older borrowers appear to be slightly more relaxed than millennials. The vast majority (87 percent) of millennials say they are either “somewhat stressed” or “very stressed” about their balances, compared to 72 percent of borrowers aged 35 and older.

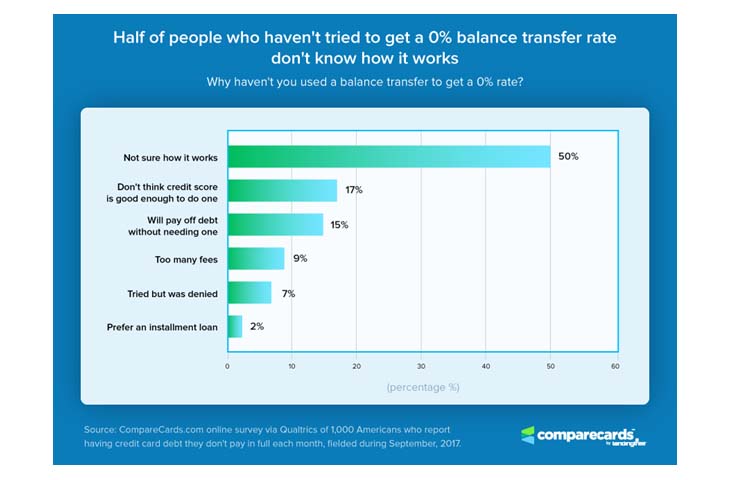

Balance transfer offers misunderstood or unused

When Comparecards.com asked respondents why they haven’t used a 0% balance transfer rate to obtain more favorable terms on existing balances, fully half admitted that they weren’t certain how balance transfers worked, while an additional 17 percent didn’t think they would qualify for the offer. Only 7 percent of those carrying balances tried to obtain a 0% balance transfer from another issuer but were denied an offer.

Despite not knowing how balance transfers worked, most of those surveyed (73 percent) claimed they had a plan to pay of their debt.

Despite not knowing how balance transfers worked, most of those surveyed (73 percent) claimed they had a plan to pay of their debt.

How balance transfers work

Balance transfer cards can help those with credit card balances lower their monthly payments by moving higher-interest debt to the new card with an introductory period during which no interest accumulates. Some cards will give users a year or more of 0% interest on those balances, which gives them time to pay off the balance without piling up additional interest.

And while the math of a 0% balance transfer is straightforward, cardholders who take advantage of those offers should still crunch the numbers to determine that users will be able to pay off the balance during the 0% introductory period. Comparecards.com offers a balance transfer calculator that allows users to enter their existing balances and the terms of the balance transfer offer, which usually includes a transfer fee of 3 to 5 percent of the total transferred to the new 0% balance transfer card.