As payment processes increase in variety and become more complex, they also represent a greater opportunity for retailers and digital businesses. Strengthening your payments setup can boost your customers’ experiences and scale with operational efficiencies at the same time. Optimizing payments doesn’t just increase efficiency and reduce the burden on your finance team. It can also unlock significant profit potential for your business.

These opportunities are underlined by all the new payment methods that are thriving around the world. In parts of Asia, for instance, 40% of consumers prefer using digital wallets like Apple Pay and Google Wallet to pay online. Buy Now, Pay Later is gaining popularity in European markets like Norway, Sweden, and the Netherlands. And Pay by Bank is a rising payment method in markets ranging from Brazil to Hong Kong.

That presents a number of targets for businesses to keep aiming for. The key is to shift perspective – digital enterprises need to leverage their payment methods strategically as a revenue driver to gain an edge in this highly competitive industry.

Source: Adyen Digital Report 2024: Unlocking potential: Drive business growth with payments optimization

Emerging Payment Methods

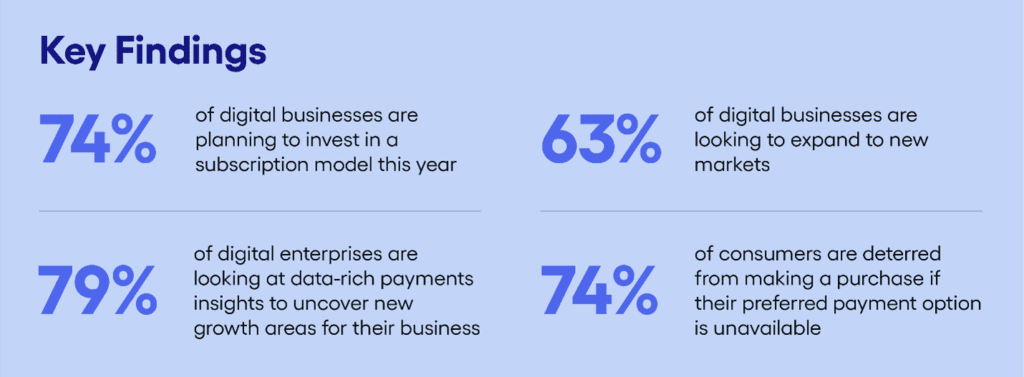

The subscription model is one payment method that has flourished in the U.S. as well as other parts of the globe. Recurring payments are convenient and seamless for customers, who can “set it and forget it” with a credit card or other local payment method. Three quarters of all businesses say they want to invest in a subscription model in the year ahead.

The subscription market is projected to grow globally from $690 billion in 2024 to over $900 billion by 2028. A survey from Adyen found that 72% of people subscribe to a film or TV entertainment plan, half subscribe to an entertainment plan for music, and a third subscribe to a food-delivery plan such as Uber One.

“Subscription based payment models have been a resounding success in the U.S. market. I’ve seen figures showing the average amount of subscriptions a typical consumer has ranging from three all the way up to twelve. The subscription economy is all about generating recurring revenue streams while offering customers convenience benefits and options to choose their level of service. If it resonates with the business model, a subscription program is a great way for merchants to grow their customer base and generate valuable recurring revenue.”

– Ben Danner, Senior Analyst, Credit and Commercial, Javelin Strategy & Research

Another online payments experience that is gaining popularity among both consumers and retailers is Click to Pay. Click to Pay uses a process called an express flow that lets customers store their payment details securely. They don’t have to fill out their details for each purchase, allowing them to complete a transaction with just a few clicks. It’s an especially helpful solution for guest checkouts, where a customer does not have an existing account with a digital business.

What makes Click to Pay such a vital option is that so many online sales get lost at the moment of checkout. In fact, 74% of consumers surveyed will be deterred from making a purchase if their preferred payment method is not available online, and 44% will abandon their cart altogether.

The good news is that businesses can create a mobile-optimized and secure checkout in minutes, with just a few lines of code. An optimized checkout page delivers a superior payment experience, boosting your sales conversion.

“Click to Pay makes a ton of sense in ecommerce as a simple way to confirm the identity of the person using the card presented for payment. Two-factor authentication has been proven to be effective in reducing many types of fraud. Consumers are familiar and comfortable with the process, and generally appreciate that the extra step is working to their advantage to protect their sensitive personal, financial, and payment credentials. Javelin believes that 2025 will be a tipping point that sees the majority of ecommerce retailers adopt Click to Pay technology.”

–Don Apgar, Director, Merchant Payments Practice, Javelin Strategy & Research

Vital Security Measures

Partnering with an experienced payments provider does more than offer your customers a new way to pay. It also secures the remittances once customers have made an order, protecting the business from fraud and other losses.

Take declined payments, for instance. There are a multitude of reasons why payments can be declined, including insufficient funds, technical issues, and wrongly formatted messaging, such as when the CVC or expiration date data may be set up differently depending on the issuing bank.

Recovering payments is much easier with the right solution. For instance, Adyen’s RevenueAccelerate help your business recover declined payments two different ways:

Auto Retries automatically re-sends, within milliseconds, transactions that were declined due to technical errors or outages. As much as 80% of failed transactions can be regained on the first attempt. Each successful automatic retry prevents your business from incurring extra card network fees.

Auto Rescue uses Smart Logic based on a wide range of payments data to retry failed transactions. Unlike Auto Retries, Auto Rescue reattempts the payment at a later time or date, making it ideal for subscription businesses.

The right partners can also help you recognize genuine customers and detect threats via fraud-detection technology. These systems use historical and cross-platform data between businesses to detect abnormalities.

To authenticate their customers and fight against fraud, many businesses have turned to biometric processes. These can range from the familiar thumbprint on the phone to more sophisticated measures, like analyzing a customer’s common decisions to detect suspicious anomalies. Worldwide, 40% of consumers use biometrics to authenticate online transactions. Markets in Europe and Asia have also been introducing regulations that mandate the use of authentication.

The key for online businesses is to balance convenience and security by offering the best authentication experiences. By leveraging payments innovation, businesses can detect and prevent fraud faster and reduce its impact with smarter methods of authentication.

The Path to Strategic Growth

Modern payments processes are about more than efficiency and convenience. Making full use of payments data is helping businesses discover new solutions and identify customer needs. Some 80% of the surveyed enterprises agree that payments data supports how they streamline business processes.

Source: Adyen Digital Report 2024: Unlocking potential: Drive business growth with payments optimization

The value of partnering with the right financial technology platform goes beyond just payments. A platform that combines payments, data-rich insights, customer loyalty, risk management, and banking infrastructure is the key to unlocking innovation and growth for enterprise businesses.

Payments, when optimized right, become a revenue driver instead of a cost center. Businesses that partner with the right fintech platform are able to make payments a crucial element in their growth strategies, giving these online businesses an edge in a very competitive and saturated market.

Adyen’s robust, all-in-one platform empowers digital enterprises to navigate the most complicated challenges of 2024: unlocking profits, simplifying global complexities, and going beyond payments processing. Find out how Adyen can help your business get the most from its payments.