In a recent announcement, FIS has released it’s findings highlighting the growth in digital wallet vs cash for at the point of sale.

E-commerce spending rose at the fastest rate in five years in 2020, while cash usage for in-store purchases dropped sharply, as global customers made increasing use of mobile wallets and other alternative payment methods during the pandemic in 2020, according to a new report released today by financial technology leader FIS®

Worldpay’s annual Global Payments Study from FIS explores existing and potential developments in payments across 41 countries. Findings from the 2021 report show that during the global health crisis, lockdowns, shelter-in-place orders and personal safety measures accelerated the shift towards digital payment methods in all areas of consumer spending.

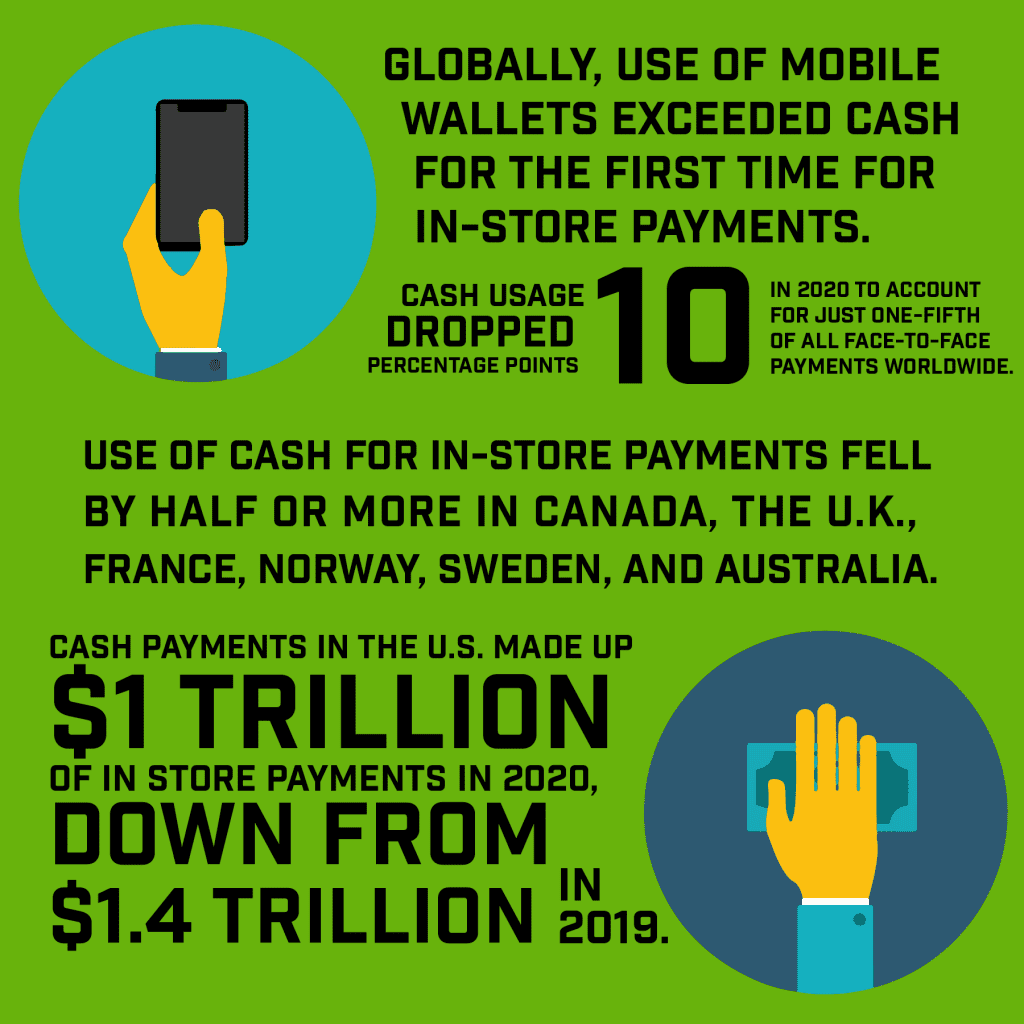

Some of the highlights from the report from an In-store payment trends include:

· Globally, use of mobile wallets exceeded cash for the first time for in-store payments. Cash usage dropped 10 percentage points in 2020 to account for just one-fifth of all face-to-face payments worldwide.

· Use of cash for in-store payments fell by half or more in Canada, the U.K., France, Norway, Sweden, and Australia.

· Cash payments in the U.S. made up $1 trillion of in store payments in 2020, down from $1.4 trillion in 2019.

· The Asia-Pacific region continues to lead in the use of mobile wallets at point-of-sale, with about 40 percent of in-store payments in that region now being done through contactless payments. However, use of mobile wallets accelerated across all regions in 2020 and now accounts for about 10 percent of payment methods in North America, 8 percent in Middle-East-Africa, 7 percent in Europe, and 6 percent in Latin America.

The report projects that cash will account for less than 10 percent of in-store payments in the U.S. by 2024 and only 13 percent of worldwide payments. The report projects digital wallet payments to account for more than a third (33 percent) of all in-store payments over that same period (16 percent in the U.S.).

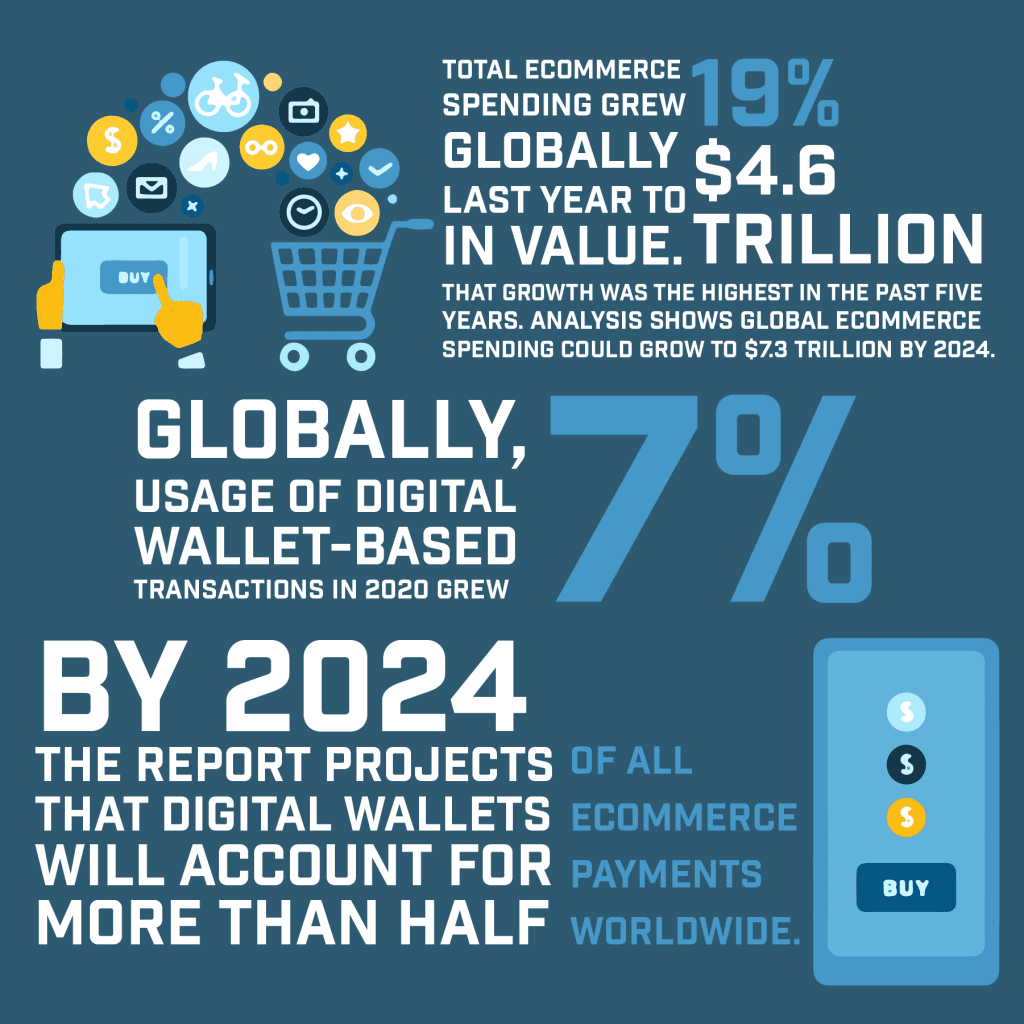

From an ecommerce trends perspective the report highlights the following trends:

· Total eCommerce spending grew globally 19 percent last year to $4.6 trillion in value. That growth was the highest in the past five years and represented two-to-three years of typical acceleration in a single year. Analysis shows global eCommerce spending could grow to $7.3 trillion by 2024.

· Globally, usage of digital wallet-based transactions in 2020 grew 7 percent. By 2024, the report projects that digital wallets will account for more than half of all eCommerce payments worldwide.

· The reports shows that the adoption of buy-now-pay-later transaction methods continues to rise rapidly in Europe and North America and is expected to double by 2024.

· Conversely, usage of traditional payment methods such as cards and cash-on-delivery are quickly losing share and expected to account for less than 40 percent of eCommerce transaction payment methods by 2024.

Jim Johnson, Head of Merchant Solutions at FIS, said, “Our new research shows that the world is entering a new phase of adopting digital payment methods.” A cashless future was brought closer to the horizon by the global pandemic. The implications are profound for merchants. In order to meet the diverse preferences of the rapidly changing habits of consumers, they must build technology-centered strategies and do so in a way that drives financial inclusion for underserved communities around the world.

“The growth opportunities will be huge and potentially game-changing for those companies that are savvy enough to embrace smarter commerce and invest.”