This could be huge! An EU-sponsored wallet product that holds identity, enables payments, and tracks user passwords. The digital wallet market has many startups in it already, they all might be wiped off the map if the EU deploys a digital wallet that’s trusted and safe.

That of course is a tall order in that many of the existing digital identity wallets are use a self-sovereign design principle that aligns well with those that distrust centrally controlled anything —which appears to be a growing consideration by many. It will be interesting to see how it ranked different design criteria and if the implementation can address consumer, bank, and business concerns.

It will also be interesting to better understand who will code and maintain this digital wallet as operating systems and security algorithms improve over time. The description sounds very monolithic which is unlike the EU standards process which enables country-specific changes to address local conditions. It would also represent a huge centralized honeypot to criminal organizations so perhaps the articles have it wrong:

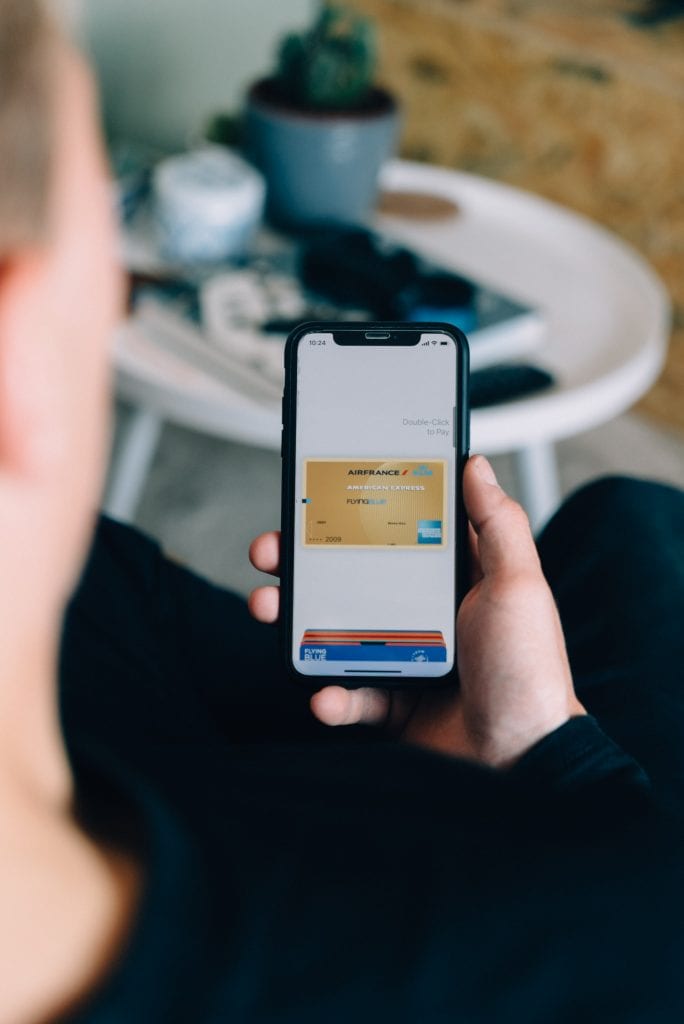

“The European Union (EU) is getting ready to unveil a digital wallet that will allow citizens in the bloc to store payments details and passwords, the Financial Times has reported. The app will also allow members in all 27 countries to store official documents like a driver’s license and access various private and public services with a single online ID.

Up until now, individual EU member states have issued their own digital IDs, but not all are compatible and take-up is relatively low at just 19 countries. With the pandemic forcing a lot of folks online, the EU will promote the idea of a bloc-wide ID as a way to access public and private services more easily.

Users will reportedly be able to open the app via fingerprint or retina scanning, though final details are not yet nailed down. The digital wallet will not be compulsory, but it will supposedly offer citizens greater digital security and flexibility. To protect privacy, the EU will prevent companies from using any data gleaned from the IDs for marketing and other commercial activities.”

Overview by Tim Sloane, VP, Payments Innovation at Mercator Advisory Group