Earned wage access (EWA), or on-demand pay allows employees to access the money they have earned at work before their scheduled payday. Unlike the weekly, bi-weekly and monthly pay periods, earned wage access enables employees to access their wages on their own schedule.

A recent Mercator Advisory Group study, titled “Modernizing Payroll Through Earned Wage Access: A Focus on Employee Tenure,” examines the benefits that DailyPay’s earned wage access solution provides to both employers and employees. To learn more about the report’s findings and the broader impact of earned wage access on employee turnover and tenure, PaymentsJournal hosted a webinar with the same name.

The webinar featured speakers Wendy Reiner, VP of Operational Processes at Staffmark Group, Jeanniey Walden, Chief Innovation and Marketing Officer at DailyPay, and Sarah Grotta, Director of Debit and Alternative Products Advisory Service at Mercator Advisory Group.

Earned wage access reduces employee turnover

Once seen as a “nice to have” feature, earned wage access is quickly becoming table stakes for employers hoping to recruit and retain employees. This is particularly true in the era of COVID-19, where unemployment and wage uncertainty peaked.

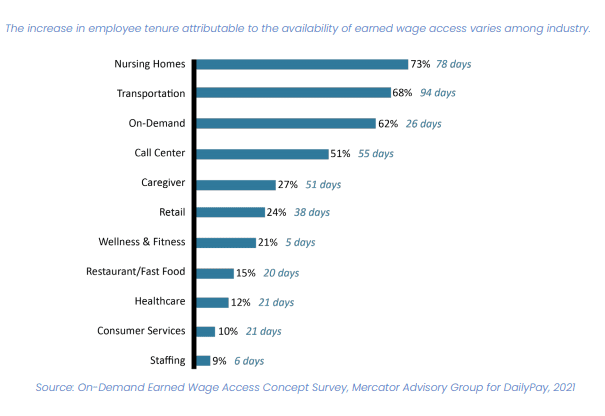

Mercator Advisory Group analyzed over one million anonymized data records across 10 key industries to compare the length of employment, or tenure, of employees who use DailyPay’s EWA solution with the tenure of employees who do not use DailyPay working at the same company.

The findings revealed that the use of DailyPay increased the number of days on the job in all 10 industries. As the chart below indicates, earned wage access had the greatest impact on the tenure of nursing home, transportation, and freelance or on-demand employees:

This has a significant impact on employers in terms of reducing monetary losses associated with turnover. “Industry guidelines tell us that the expense to replace an employee ranges from somewhere around one half to two times the annual salary of that particular position,” said Grotta.

Imagine a firm with 1,000 employees with an average salary of $75,000 and a turnover rate of 10%. Using these guidelines, the cost to replace these employees will range from $3.75 million to $15 million.

Cost reduction goes beyond monetary losses alone. By reducing turnover, companies will reduce the issues that it brings. High turnover rates are associated with team breakdowns, a reduction in company knowledge base, delayed customer product and service delivery, and increased overtime or work load for existing employees.

Earned wage access bolsters hiring efforts

Companies across industries are having difficulty filling open roles as the country begins its “return to normal.” This makes it important for employers to offer competitive pay rates, benefits, and other incentives to persuade prospective employees to return to the workforce.

“We’re thinking about things like peak performance pay, seasonal pay, hazard pay, bonus opportunities based on attendance and performance, and benefits like employee discounts and on-demand pay,” said Reiner.

When employees have access to on-demand pay solutions such as DailyPay, they can access the money they have earned for use in time-sensitive situations like stocking up on essential goods, paying rent, avoiding late fees on overdue bills, and purchasing gas for their car.

DailyPay can also be used for incentives such as on-demand bonuses. Walden used the example of working as a valet parking attendant to highlight this option. “[Imagine] it was a terribly cold, rainy day and there was a hailstorm, but you still made it in and valet parked those cars and your boss wants to give you a $50 bonus as a thank you for a job well done and it shows up two weeks later in your paycheck,” she said.

At that point, the impact of the appreciative gesture is minimized. “You lose the impact of that productivity boost that is inherent with any type of reward, so by doing a DailyPay reward, it’s immediately available, it’s seamless, it takes a second, it can be done remotely, and it really creates a stronger relationship between the employee and employer,” explained Walden.

Learn more about earned wage access

In the PaymentsJournal webinar, Reiner, Walden, and Grotta explore the topic of earned wage access in much more depth, emphasizing how it tackles labor challenges associated with turnover and faster hiring, how on-demand pay benefits employers and employees alike, and additional insight into the employee turnover rates across 10 key industries.

To access the complimentary webinar, “Modernizing Payroll Through Earned Wage Access: A Focus on Employee Tenure,” please fill out the form below.