For some time we have heard that the bank branch is bound to go the way of the dinosaur. Well, Mercator agrees with Jamie Dimon, Chairman and CEO of Chase who recently talked about Chase opening new branches in several markets. Around the 2:30 mark of this video he discusses how branches are not dying and that customers of all ages are using branches.

Our data supports Mr. Dimon’s assertion that branches still have value in the expanding collections of options consumers have to interact with their financial institutions. As he points out, branches are becoming less about transactional interactions that may be more easily handled with a computer or smartphone, and more about being a source for information and guidance.

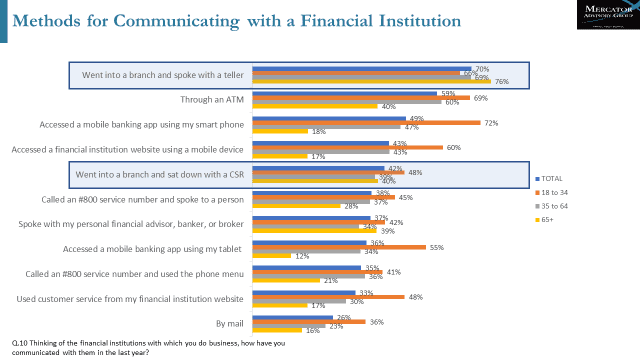

The chart from our PaymentsInsights study below shows, people use many different ways to communicate with their financial institutions, but the branch plays a very important role. Further, our data shows that younger adults are not eschewing branches. They, in fact, embrace the idea of using multiple channels for interacting with their bank.

The future of branches may not be as perilous and once believed. Our data shows that the American consumer is still using branches, along with a myriad of other ways of interaction with their bank. We agree that the branch will change into something more like what Mr. Dimon suggests than the old bank of teller. That said, I’m not sure they will all have a baby grand piano (see the video if you missed the piano).

Overview by Peter Reville, Director, Primary Research Services at Mercator Advisory Group