For years, electronic payments have been taking market share away from the old reliable – cash. Now, we are at the point where people are starting to ask about the future of cash. This is not a new discussion, but it is one that is very relevant.

In a recent Forbes article, Is A Cashless Society Good For America?, the author explores the reality of a cash free America. He does a very good job of laying out the pros and cons of cash and cashless, noting that some municipalities are passing legislation that makes the acceptance of cash mandatory:

Even if a cashless society was good for America, there are legislations in place at this time to prevent that. Several states and cities have existing or proposed laws requiring merchants to accept cash. New Jersey, Massachusetts and Philadelphia have active rules banning cashless stores. Washington State, Chicago, New York City, and San Francisco are working on similar efforts.

The law in Massachusetts states that “no retail establishment offering goods and services for sale shall discriminate against a cash buyer by requiring the use of credit.” That discrimination may be one of the greatest barriers to eliminating cash.

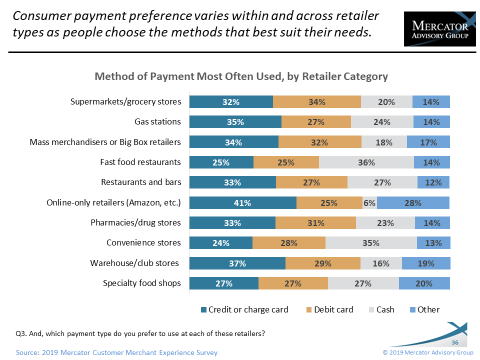

Regardless of how one feels about the above regulations, the cold hard truth is that cash is becoming an also-ran to the likes of debit and credit transactions. Mercator’s Buyer PaymentsInsights study has shown that cash payments are most often made at locations where small ticket sizes are the norm, like fast food restaurants and convenience stores.

Shopping channels with traditionally larger ticket transactions are more likely to be paid with a debit or credit card. Then, of course, there is the growing trend towards e-commerce, which is essentially cash free.

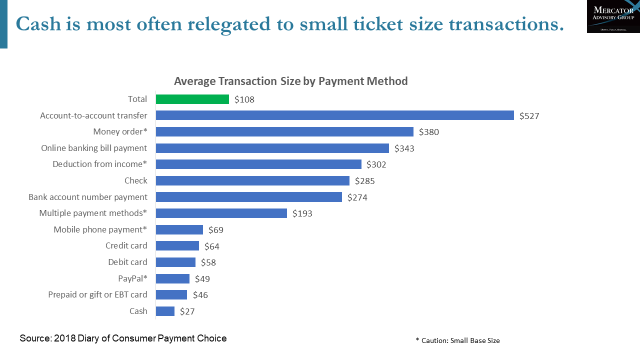

We turned to the 2018 Federal Reserve Diary of Consumer Payment Choice data to support the insight that cash is for small transactions. As the chart below highlights, the average transaction size for cash is less than one-half of the transaction size for credit and for debit.

Let’s face it: cash is no longer king. The trend away from cash will continue as people become more comfortable with using cards, smartphones, and wearables to pay for small ticket items. It’s going to happen. Consumer behavior will ultimately determine the fate of cash in the U.S. and globally.

Overview by Peter Reville, Director, Primary Research Services at Mercator Advisory Group