One of the most talked about trends in the payments industry is the changing consumer behavior driven by COVID-19. The pandemic has accelerated consumers’ adoption of e-commerce, contactless payments, and other digital forms of engaging with financial institutions.

The nature of the workforce itself is shifting too. The gig economy continues to expand and employees have settled into working from home for the near future. As these and other changes are ongoing, digital payroll solutions can provide modern workers with the convenience, flexibility, and value to meet their payment needs.

To explore how COVID-19 has accelerated consumer behavior trends, the changing nature of the workforce, and how digital payroll solutions enable employers to keep up, PaymentsJournal hosted a webinar, “Digital Payroll Solutions to Keep Up with the Future of Work”, featuring three industry experts: Ted Iacobuzio, VP and Managing Director of Research at Mercator Advisory Group, Adam Telem, North America Market Fintech, Prepaid, and Inclusion Product Lead at Mastercard, and Anthony Peculic, VP of Payments (Wisely) at ADP.

How account ownership and card usage have fared amid COVID-19

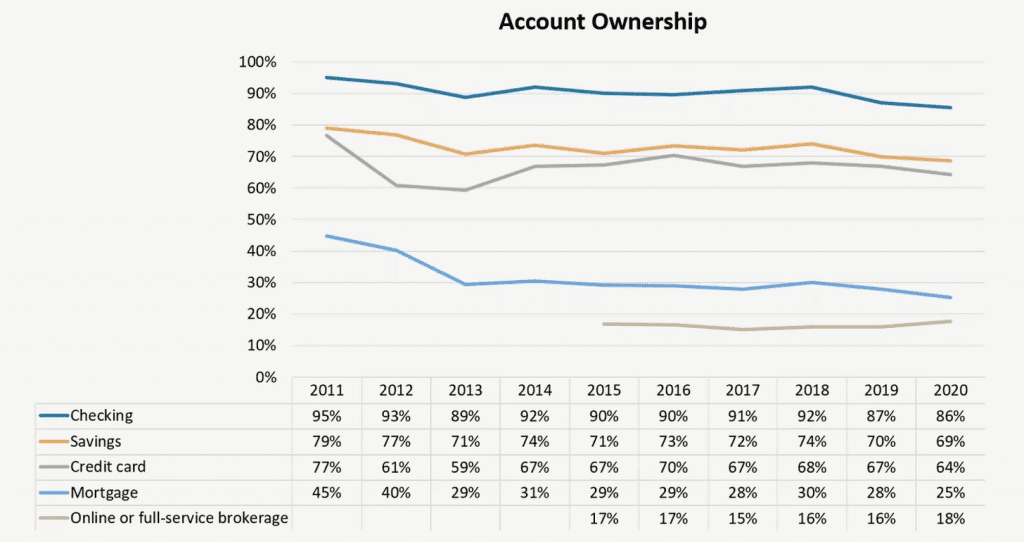

Mercator Advisory Group data indicates account ownership has fallen in 2020, with lower percentages of checking accounts, savings accounts, credit cards, and mortgages than previous years. The only category that saw an increase was online or full-service brokerage, which follows the digital shift. The following graph, which contains data from Mercator’s North American PaymentsInsights, illustrates this reduction:

Credit and debit card ownership have similarly fallen, but charge cards and prepaid card continue to see growth. “Consumers are showing a steady preference for either pay-before instruments, which is prepaid, or charge cards, which are largely payable on the 30th day,” explained Iacobuzio.

One of the largest growth areas within prepaid has been reloadable cards. “Consumers have an appreciation and familiarity with general purpose reloadable (GPR) prepaid cards as a means of controlling their finances, paying, and increasingly, getting paid,” he added. Making purchases with prepaid cards is particularly popular among consumers under the age of 45.

Other trends in consumer behavior

COVID-19 has also accelerated the shift toward digital commerce and contactless payment usage. Consumers moved their shopping online at a record pace when the pandemic hit. In addition, when consumers do venture out to brick and mortar stores, they are more widely using contactless payments to avoid coming into contact with potentially contaminated surfaces. These trends are expected to continue beyond the pandemic.

Consumers themselves anticipate that their changes in behavior will linger in upcoming years as people tend to stick to behaviors they get used to performing. This is especially true for digitally native Millennials and Gen Z consumers, who have long demanded robust digital experiences and are willing to go as far as switching financial service providers to have them.

What to know about the evolving workforce

U.S. workforce trends have become instrumental in shaping the future of payments. The proportion of financially vulnerable individuals is growing and has accelerated in the wake of increasing unemployment due to COVID-19. For the financially vulnerable that have been able to secure employment, payroll cards can be a valuable alternative to receiving pay via a paper check. After all, direct deposit may not be an option for many workers as 25% of households are unbanked or underbanked.

But payroll cards are being used by more than just the traditional demographic of the unbanked. In fact, 85% of payroll cardholders have a checking account, using their payroll card for budgetary purposes, spending, and other value propositions rather than as a replacement for a bank card.

“We’ve seen that this solution [of offering paycards] has grassroots, much like the prepaid business in general, within the underserved segment but it has also really proven itself as a valuable tool up and down the economic pyramid,” said Telem.

Lastly, a massive shift toward remote work has had many implications for corporations, one of which is that fewer payroll specialists to go into offices in-person to fill out and mail checks. On top of that, the gig economy is booming. Freelancers are expected to account for 43% of the labor force by 2023, as workers gravitate toward the flexibility and faster payments that freelancing offers. Both trends offer opportunities for businesses to implement safe and secure digital payroll solutions.

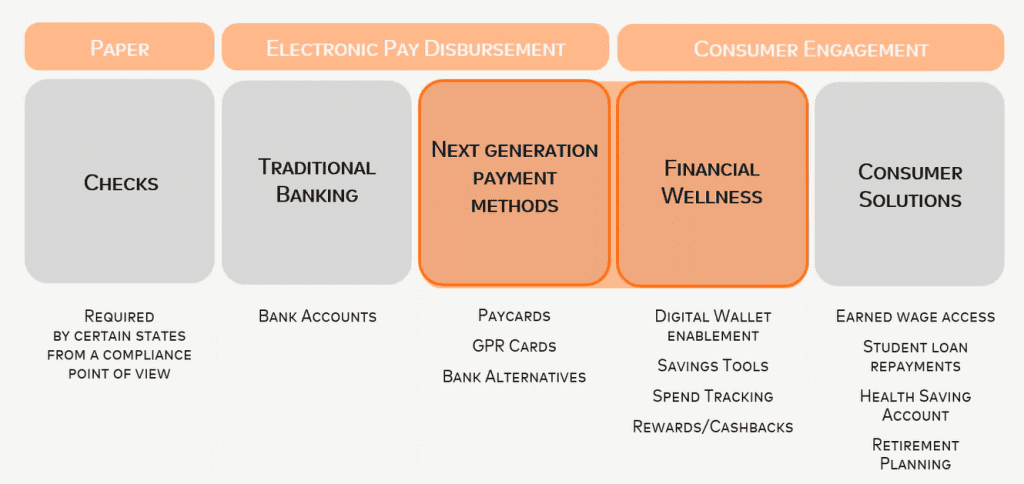

Employers must transform payroll to meet worker needs

Relying solely on the issuance of paper checks is an inefficient, expensive, and outdated payroll method that fails to meet the needs of today’s workers. As an alternative to check and even bank accounts, a paycard can offer a number of financial wellness tools to help employees manage their money the way they need. These additional benefits have proven to attract strong talent and drive employee productivity.

Paycards can provide additional value to employees with features like rewards, savings tools, instant notifications, early deposits, biometric security, and money management tools, while ensuring compliance with local payroll laws.

One such pay card solution, Wisely, is a worker-focused solution that combines the unique strengths of Mastercard and ADP to offer these features and more. “It is our duty and responsibility to provide a consumer-friendly solution that not only helps our employers get to electronic pay 100% as soon as possible, but more importantly, provides workers receiving the solution with something they can rely on, they can trust, has very low to no fees for most transactions, and offers the tools, benefits, and features they need,” concluded Peculic.

To learn more about the value of digital payroll solutions and how they meet the modern workforce’s needs, click the button below to access the complimentary webinar, “Digital Payroll Solutions to Keep Up with the Future of Work.”