This article on digital identity discusses:

- The present state of identity ecosystem – its complexities, the root cause of identity issues and connected challenges

- The need to digitize identity management

- The pivotal role banks can play in creating a new trusted digital identity ecosystem

- The apt business and technology model that can help banks design a future identity world

- Blockchain as a technology option for digital identity

- The relevance of digital identity in the open banking era

A World Built around Your Identity

Imagine an international trip where you carry yourself as identity and get the liberty of not carrying a passport, ticket or boarding pass, or booking reservation details. In your identity basket, you also carry your financial identities (credit card, prepaid card etc.), identity of your things (laptops, gadgets etc.) and identity of co-passengers – really a long list indeed. In contrast, if we build a digital world keeping your identity in the center, then the re-imagined world would be one of extreme personalization and frictionless yet secured. Airports and its services will be aware of your arrival and will render personalized services to you based on secured verification of your identity.

Issues with Present Day Identity Ecosystem

The reality is in the present day world, identity is a headache for both the provider and user. For example, a bank performs a series of complex, expensive, time consuming and effort intensive checks before issuing a financial identity to you. However, the customer experience regarding this process is poor.

Moreover, the final product – verified identity of an individual or corporate- remains locked within the bank. The bank does not broker it and does not try to monetize it. The fate of other identity issuers are also the same.

Root Cause – Missing Identity Layer in the Internet

The cause of the problem with identity and its use finds its roots in missing an identity layer on the internet from the beginning. We are now using the internet for virtually all transactions. However, our basic identity is still created in a physical world and get translated in a fragmented manner to the digital world, resulting in a poor, frictional experience for us.

Fragmented digital identities of today need a unification in the form of an identity metasystem, which can protect other applications from the internal complexities of specific implementations. Such a system will allow digital identity to become a plug and play digital instrument. The role of an identity metasystem is to provide a reliable way to establish who is connecting with what – anywhere on the Internet.

Claim-Based Definition of Identity

To design an identity meta system, we need to define identity of a digital subject. The definition can be an assertion or claim based. The difference between the two is important as an assertion is an expression of strong belief and a claim has an element of doubt in its definition and requires evaluation. Like any evaluation, it may result in positive or negative outcome. In a closed domain system, attribution can work but claim is more suitable for an open, federated set up like the modern day digital economy.

Identity has Magnitude and Direction

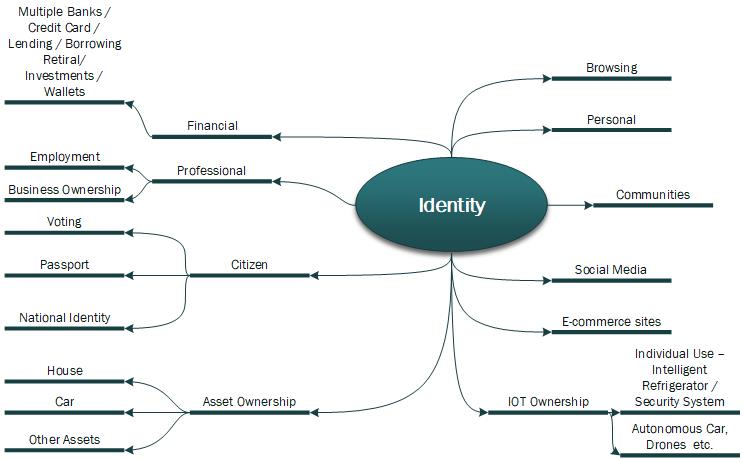

Let us look at the present day fragmented digital identity landscape:

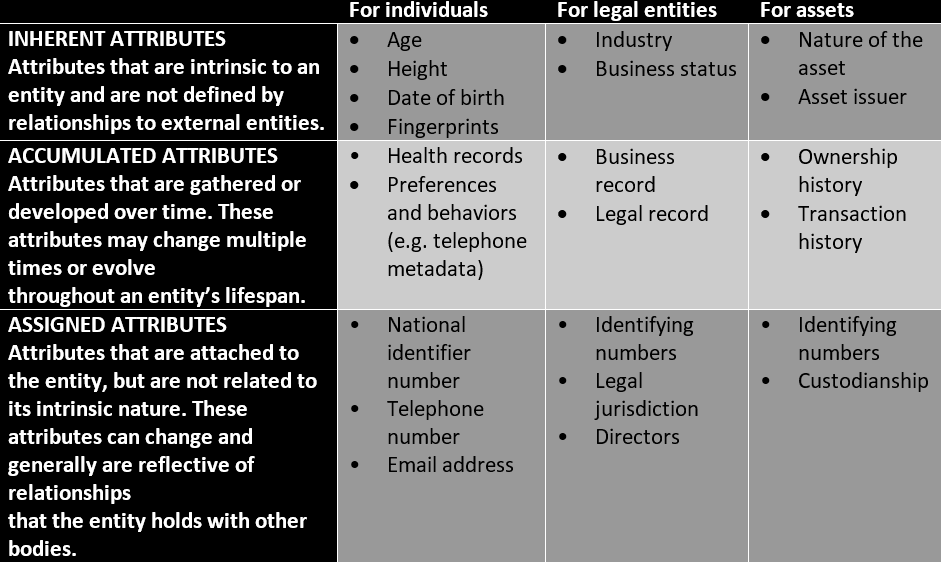

As per the blueprint of Digital Identity by the World Economic Forum, identity attributes are as follows:

While these attributes are atomic in nature, our identities are molecular, leading to unnecessary exposure of identity attributes. For example, you need to be 21 or older to buy alcohol, and if you show your driving license to prove it, you are exposing many attributes beyond your age. Hence, we need to digitize our identity attributes to avoid any unnecessary over-disclosure.

Now consider an identity beacon and a RFID based passport. While a beacon keeps emitting a signal, an individual passport does not emit a continuous stream of an omnidirectional signal, making it prone to eavesdropping towards any attempt of stealing national identity information. Hence, for identity, domain directional property is also important. If we combine requirements of atomicity and directionality of attributes, it becomes a no brainer to appreciate the need for a metasystem of digital identity.

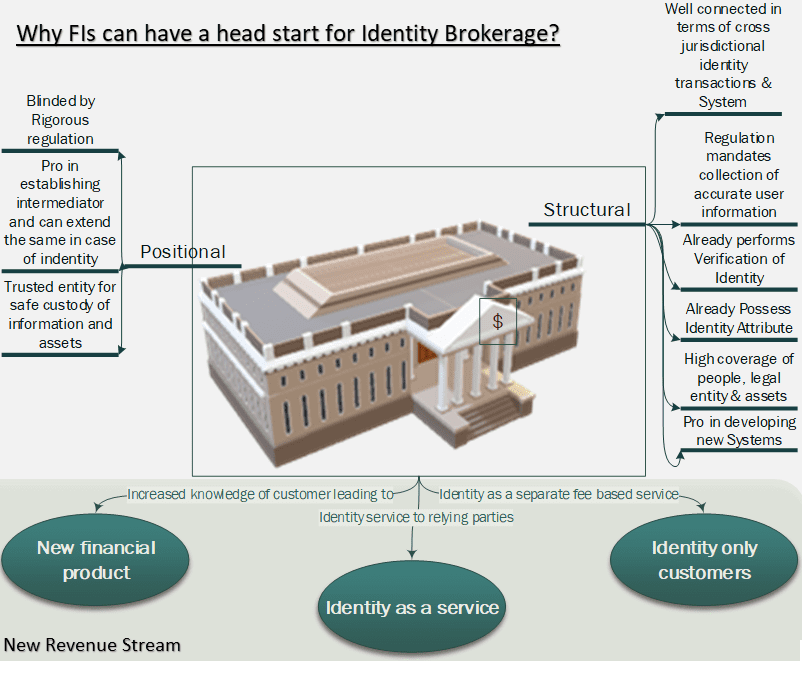

The Evolving Role of Banks as Identity Brokers

In the present industry landscape, the following diagram explains why banks and financial institutions can have a head start in creating such identity ecosystem.

Business Model for Identity Brokerage Business

The reward for building such an identity ecosystem is a gold mine. As an identity broker in the system, the owner can become an inseparable stakeholder in a federated de-centralized and open economy. However, the journey for being such a broker is painful and complex. The complexity will arise based on scope of operation in terms of industry and geography coverage, as the requirements for identities are different across industry and across borders. To increase market share, a corporation needs to get into a consortium or a utility platform mode. These approaches will further increase complexity.

Technology Model to Support Identity Brokerage Business

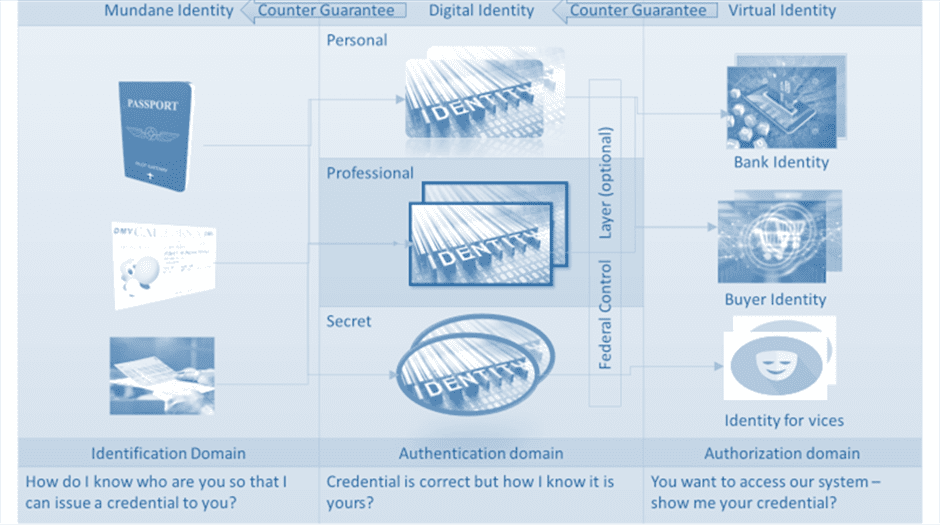

The pivotal question we need to answer from regulatory and socio-cultural perspectives is what do we want the identity system to be – transparent, translucent or opaque? Transparent and Opaque are both extremes. Hence, translucent approach is most suited for managing identity ecosystem. A three-domain approach of identity management is depicted below:

The issues in the above model are as follows:

- Currently, for one person, many identities are issued in the identification layer and then he or she creates many virtual identities in Authentication and Authorization domain for using digital services. These many to many identities of one individual across identity domains causes a cardinality problem. Hence, the issue of digital identity in authorization domain will solve this cardinality problem by binding all mundane identities of an individual into one digital subject.

- If we bind the mundane identities and virtual identities using one digital identity then it can render living in glass box effect. Hence, the creation of multiple identities for a digital subject can solve this problem by allowing users to maintain multiple persona based digital identities. User at his or her discretion, can use each such created digital identities and further create virtual identities to access services of digital world. This will enable him or her to maintain multiple persona in authorization domain but at the same time will allow a traceability and control in authentication domain.

- It also digitizes identity so that the principle of minimal disclosure can be implemented

- If we want to instill federal control in our socio-economic fabric, we can implement it at this authentication domain.

Overall Architecture and Need for Blockchain at the Virtual Identity Layer

The technology choice for developing a digital identity system needs careful consideration. In the digital identity domain, there are personally identifying information (PII) and hence a decentralized implementation like blockchain can be catastrophic as it is a susceptible honey pot. But, in the authentication domain, a blockchain based identity management system may be an ideal system to implement. Such a blockchain based system can also build reputation, which can be tamper proof, where trust is beyond human manipulation but ensured by an unbreakable algorithm.

Open Banking – an Transformation Opportunity in Architecting Digital Economy of Tomorrow

We have embarked on our journey of open innovation, open APIs, open data, open banking and the open economy, and we will experience a paradigm shift in digital life because of this open revolution. Identity, consent and PII are going to be critical in weaving a new socio-political digital construct. Banks are poised strategically to takes hegemony in this change. In this leadership journey, banks have to remodel their factory. They need to go beyond open banking regulation to the realm of Uberization and Amonznization of banking platform. Digital identity is going to play a pivotal role in the reinvented banking structure.

For more on this topic, download Wipro’s whitepaper on the topic here.