In an interview with PaymentsJournal at the 2021 Money20/20 event, Archie Puri, Chief Product Officer at Galileo, spoke about how financial services providers can create better and digital banking experiences. During the conversation, she highlighted key findings from Galileo’s 2021 Consumer Banking and Money Survey. The following transcript was edited and condensed for clarity.

Unpack this chart for our audience.

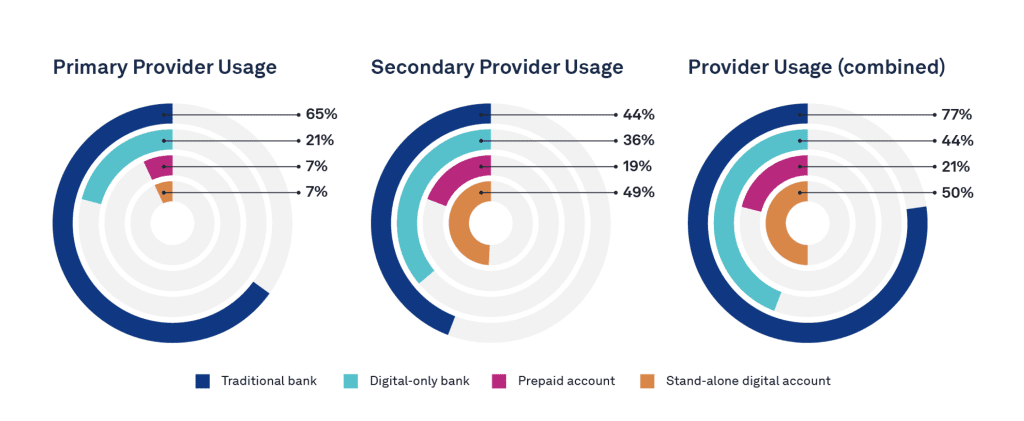

This study was done by Galileo as an independent study, it is our proprietary research. The intent of it started with wanting to understand what was happening in fintech and get a lot of feedback from consumers who use these products because of innovation that has happened over time. What you will see very interestingly from the data [is] 77% of people still use traditional banks as a primary or secondary bank for them. It is understandable… But then some interesting trends have emerged. About 49% of consumers still have a standalone digital account, and the standalone digital account could be something like a mobile wallet or a digital wallet that you use for your digital transactions.

Then another trend of evolution is happening where about 36% of consumers prefer to have either one of their primary or secondary providers as a digital only bank. It makes sense, right? When I look at what has happened in the last 18 months of not being able to go out, being bothered about health and safety, you want to be able to do a lot of things on your phone [and laptops] from the safety of your house. That is why I can get behind why that trend is important.

What was surprising about it is the diversity of choices among it. Because for different actions, like if I am shopping on my phone, I want to be able to pay for the convenience of a mobile wallet; if I am on the web, I want the security of a digital wallet so that I am not sharing my card transactions around. That is the trend that we are going to continue to see with consumers. With consumers, what we are starting to see is they want choice, they want–for every action and every walk of life–different ways of transacting. But there still isn’t one institution that caters to all their needs.

Do you see the trend of digital consumer behavior accelerating more?

Yes, absolutely. There are two different things. One, the generational side of it. People are changing. The needs of the children now are different. I have a daughter who is fourteen, and we are trying to teach her about financial responsibility. She has never actually been inside of a bank and teaching her financial responsibility and saving [involves] the notion of a bank. For her, her bank is on her phone.

And so having a digital first experience is important because you must relate to your customer, you have to meet your customer where they are. For my daughter, teaching her meant signing up with parent and teen digital products where I could get her a card, but I still have the safety and security of being able to monitor what she is doing with it and I was able to bring it to her in a medium that she is most comfortable with. For her, saving is as simple as dragging right and seeing money move into [her] savings account.

Those are the experiences that we have to look forward to. That experience is a great callout because, if you think about it, we have so much information coming our way from all sides. I don’t think people are reading text anymore. They are not reading headlines; they are not even reading big terms and conditions that you show them. People gloss over text, so they just barely have time to interact in the form of images and animation and UX. That is why you see a huge uptake in user experiences of that kind.

How do you think banks should use data to inform their product design?

I am a builder at heart, and for me [if] you build products, you lead with data. You not only lead with data to inform what you are going to build, but then as you build you measure along the way to see if the product is doing exactly what you intended it to do. What is the data telling you? And it goes back to the fact that our world was changing. It was already changing. We thought a lot of these waves [would] come in five years, but they came sooner than we expected.

18 months is very quick, so for a lot of traditional banks it is going to be about understanding the data to see what the mediums [are]. How do they connect with people like my daughter to be able to get their business as these children grow up and go through milestones? What do they need? And banks [will have to] go ask them and identify those insights.

Likewise, for challenger banks, it is also trying and understanding what the pain points [were.] What causes people to choose a financial institution and what causes them to switch from a financial institution? Because in the absence of that, you cannot really design a true customer-centric product. The world as we know it today always prioritizes experiences over the actual task. It’s no longer about the task. It’s about the experience you go through.

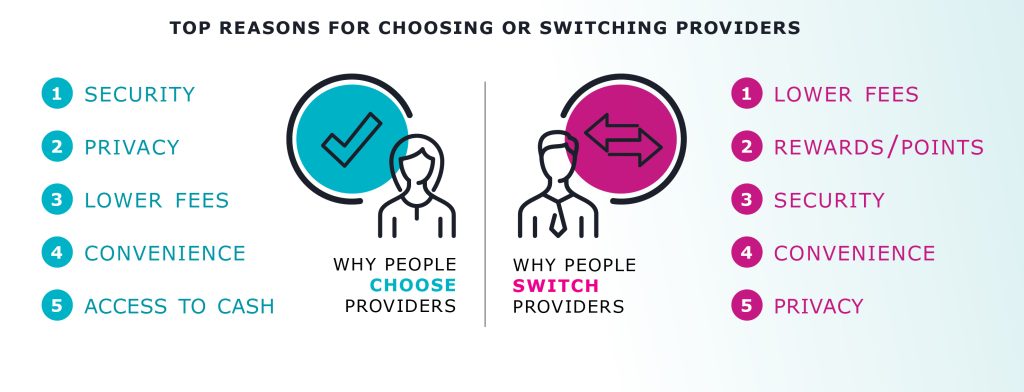

How do the reasons for choosing a provider compare with the reasons for switching providers?

That is very interesting. When we looked at our research… [we found that] when people are choosing a financial institution, the top three things that they look for are security, privacy, and fees. Then, as you establish that relationship with your financial institution and you are looking to switch, the things that actually end up bothering you the most that would cause you to switch are things like rewards and fees. What else can I get? How can I make my money work for me? How can I make it work faster? How can I get more out of it? Can I get rewards back that I can use to pay for experiences?

[Rewards] are like money multiplying. If I had $100 and I got $5 in rewards, now I can use the $5 toward something else. So, rewards were one, fees were one, and I think fees are the combination of understanding your fees very transparently and actually feeling like your financial institution has your back and is not fleecing you at every turn.

The third reason was security, especially when we think about where data is going. Do I have control of my data? Is someone making decisions for me without me knowing what will be done with my data or who I am? Making sure that we have that is oftentimes the reasons why people switch.

What are Galileo clients most interested in right now to gain and retain customers?

I am going to lean on experience because one of the ways in which we inform our roadmap is largely through talking to our customers and our clients. When we go out to talk to our clients, some surprising things that we have heard is people do not always want to be rewarded in cashback points. Sometimes they want to be rewarded in the form of a cause that they are passionate about; they want that every time they spend $1 for something, a tree is planted somewhere.

Sometimes they want to learn how to do investing, so they want rewards that can be converted into crypto dollars and crypto investing. Sometimes there are customers who are like, “I want to spend for charitable causes. Is there a way by which I can spend on a transaction and the pennies are rounded up for good? Can I collect these pennies over time and can they form into a larger pool that I can invest?” So, the patterns of people are changing and they want different kinds of rewards.

With Galileo, our aspiration is always to create a platform that enables our clients to configure the rewards that are right for their consumer base, for the businesses that they support. As a good platform, we abide by that responsibility very closely as we think about the future and what more is to come beyond what we have already seen in the past few months.

At this point, there are three things that we hear [that are] common themes from our clients. Number one is they are looking to increase the lifetime value with their customers as well as the stickiness. So, what are the ways in which they can help their customers not only get access to things such as rewards, but other capabilities so they do not find themselves in a situation where they have multiple providers to work with? Can [they] develop a relationship with a financial institution and meet all [their] needs? Creating that greater lifetime value then enabling greatest friend is one goal.

The second goal is as customers learn to get their money right and help grow their finances and get more fiscally responsible, are there better ways in which we can give them access to credit and lending products? How do we get them access to more? Then the third goal, which is the premise of our whole study, is… [making] data available to our clients as well. How do we get them the data about where our consumer is spending? What do we see as merchant activity? What [more] do we know about these people? Those three things between lifetime value, access to credit, and access to data are the three biggest things we are thinking about.