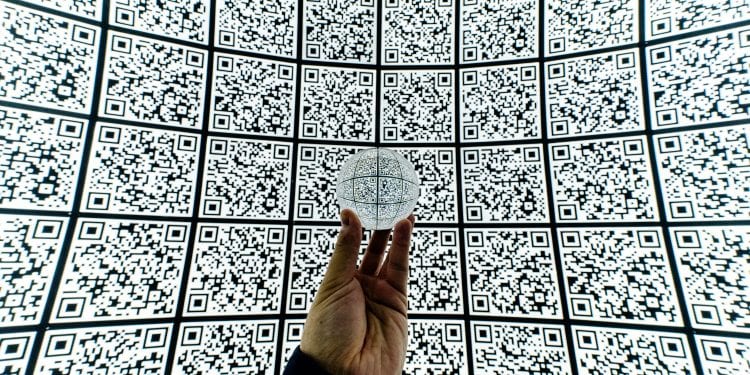

Walk into a restaurant and use the QR code on the table to view the menu, place your order. After you’ve eaten just walk out and the payment, reward credits and tip are automatically accommodated. This ability for QR Codes to connect your location and identity via a deep link into a mobile app can deliver compelling convenience.

While Apple, Google, and Samsung have tried to open up NFC’s enclave to associate incentives and other services around the cards that are held in the user’s mobile wallet, yet these solutions are more narrow and complex due to the security features which reduces convenience and increases the cost of implementation.

The EMVCo QR Code standard doesn’t address how to better integrate external signals with the card enclave that the networks require to hold card data.

Open banking in Europe is enabling new payment solutions that might prove incredibly compelling if linked to QR Codes. The payment service provider send the transaction details to the user’s bank which authenticates the user and presents the transaction information to the user for approval. When approved the bank notifies the payment provider.

Using this pay by bank capability with a QR Code might prove extremely compelling for consumers and merchants:

“Some trends like QR code-based payments are “here to stay,” CEO of Shift4 Payments (FOUR) Jared Isaacman told Yahoo Finance Live. Isaacman cited the ease of usage and convenience for customers to earn loyalty rewards as being reasons for the shift.

“[Before the pandemic, QR code-based payments] never really took off,” Isaacman said. “Throughout the pandemic, we obviously saw people pulling up menus with their phones. But then they’re also paying via QR codes. They’re even ordering with QR codes. I think some of that is here to stay because it’s just convenient.”

As businesses recover from the economic downturn caused by the COVID-19, it is clear that the pandemic has served as a catalyst for increased adoption of contactless payment methods by businesses in the United States. This coincided with 92% of small business owners adding contactless payment options as soon as the pandemic hit, according to a Skynova survey conducted in January.”

Overview by Tim Sloane, VP, Payments Innovation at Mercator Advisory Group