A recent article in Forbes, titled Fueled By Increased Consumer Comfort, Mobile Payments In The U.S. Will Exceed $130 Billion In 2020, discussed the increase in mobile payments. From 2018 to 2019, the mobile payments volume increased by 41%, from $69.8 billion to $98.8 billion in the U.S.

As the article mentions, there are several reasons for this growth. There is the change of POS systems, as the mandated change in POS systems to accept chip payments brought NFC capability for many, therefore increasing the number of locations accepting mobile payments.

The second, and arguably more difficult, reason is the change in consumer behavior. Because swiping, dipping, and “handing over” a card has become so commonplace for many Americans, the switch of form factor from card to phone has taken time. It took a while for customers to see the benefits of a mobile payment, coupled with the increased acceptance at the POS of mobile payments as they become more mainstream.

The third reason for mobile payments ascent is generational. The increase in the digital native – those under 40 years of age who have grown up with technology – are more trusting of technology and using their smartphones in all aspects of their daily lives.

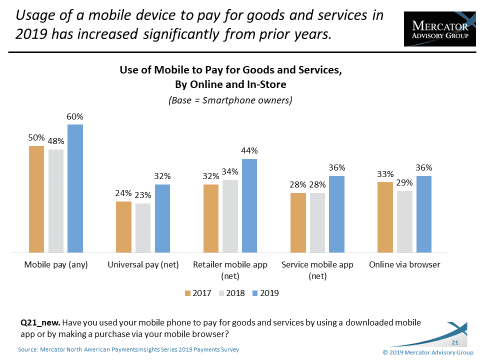

While the article talks about the increase on payment volume, it fails to mention the increase in actual users. That then begs the question “Are the same people using mobile payments more often, or are more people joining the ranks of mobile payments users?” To answer this question, I went to Mercator Advisory Group’s U.S. PaymentsInsights survey data.

The graph above starts to answer the question posed. For all manner of mobile payments, we are seeing more people joining the ranks. And, yes, these users are largely younger and more tech savvy.

Every new product has an adoption curve. These curves can take all different kinds of shapes because they have different hurdles to overcome. In the case of mobile payments, there were several hurdles, including:

- Trust – Trust that the product will work and will keep users money safe.

- Availability – The availability that they could use their mobile wallet when they wanted to

- Solving a need – Any successful product (fads aside) solves a problem – in this, it’s case convenience and security

In closing, while mobile payments are growing ($98.8 billion in 2019), they are still only a fraction of the trillions spent on credit and debit cards by consumers in the U.S. There is still a lot more growing to do.

Overview by Peter Reville, Director, Primary Research Services at Mercator Advisory Group