Social distancing has proved itself to be one of the many and most effective ways to slow the spread of the virus, even though we now have vaccines to help protect the population. As the pandemic continues at a low level, with enough people having COVID-19 or the vaccine to make them more immune (provided immunity lasts a year), we still do not know whether there will be more variants and how severe they will be. This uncertainty underscores the importance of post-pandemic digital transformation as businesses and societies adapt to new challenges and opportunities.

In a post-pandemic world, businesses had to satisfy consumer demands for online shopping, faster delivery and the deliberate investment they make in their employees, supply chains, physical stores and digital channels to be better positioned to spur growth.

As a result, many of the trends in the global economy have been accelerated by the effects of the pandemic. However, how these changes will address the deepening economic and social divide experienced by urban dwellers during the COVID 19 pandemic is a big question, as seven out of ten people are forecast to live in cities by 2050.

Are Organizations Providing Bad Service Post-COVID?

Recognizing change signals is essential for optimizing the customer experience and redefining customer value propositions in line with changing preferences and needs. Digital transformation is not less essential in this crisis. However, many organizations are being accused of using covid as an excuse for poor service.

These include long waits on telephone lines and poor delivery services. Research has found that customers were initially very tolerant of the delays and understood how places might be short-staffed. But as time has gone on, many believe it is a blanket excuse that is no longer sufficient.

As the number of complaints hit a record high since 2009, businesses need to look at alternative ways to better their services, and one of those ways is to use technology.

The new norm will improve the way we live today: the economy, education, human relations, and politics will be communicated. The way people used to think about technology has evolved along a continuum from the real to the virtual world. Embedded in the privacy, security, and protection of individual rights are the layers that run through the networks of the crisis. Still, in the new normal, they are modified so that technology can penetrate people’s lives.

The Future of B2C is Digital

The unprecedented behavioral changes that we have seen due to the coronavirus pandemic have transformed perhaps the third largest social change in our lives, affecting society as a whole. The covid 19 pandemic has accelerated the digital transformation.

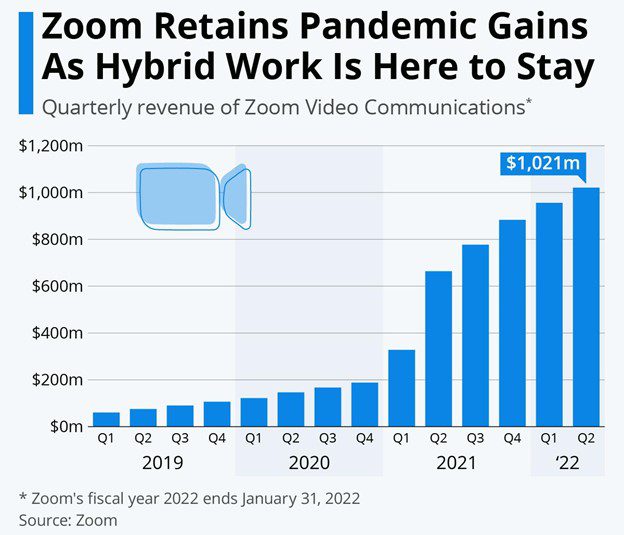

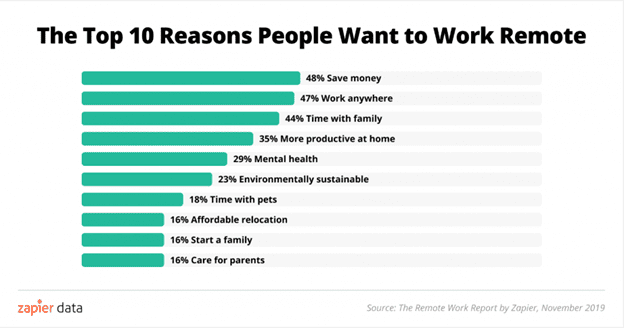

Many consumer-oriented companies are repositioning their businesses in the cloud to meet cost pressures, bolstering resilience and security and building infrastructure to allow innovation and position their businesses for the future and better customer service. At the same time, the pandemic is forcing a rapid shift of employees to work from home, with many expressing a desire for flexibility to do their work on the move.

During the COVID 19 pandemic, every corner of urban life – apartments, offices, parks, and pubs – has experienced a reboot: some cities have expanded parking spaces and other bike lanes; apartments have been redesigned to work from home. Generalizations about working from home have changed as people have moved away from city centres, but that is not the case: people still value their social life and are more likely to be young, in small cities than in large metropolises.

Increasing automation, the introduction of artificial intelligence, and the emergence of other contactless activities will reduce the number of people who need to work. For example, in Singapore and Estonia, companies already use technology to help people work and travel from home using smart devices and apps, scanners and check-in systems known as immunity passports to help people work and travel. In addition, automation will improve services for businesses which will equal better customer retention and relationships.

By introducing new ways of working for staff, as we slowly try and figure out how best to work around the pandemic, the challenges can help businesses move further. If staff members are off sick from work and cannot come in, if there is a system in place that still allows them to work with customers and offer excellent services, then there is a chance to excel customer service forward. If businesses are experiencing too many absences in a particular department and can automate the service, investing money into implementing new technology could, in the long run, help the business save customers and be more efficient. Embracing post-pandemic digital transformation will be key to achieving this balance, enabling businesses to stay agile while meeting evolving customer expectations.