New and upcoming regulations are going to up-end how cryptocurrency exchanges operate. Listed below are the major regulations that need to be on your radar.

In recent years, there have been numerous anti-money laundering laws set in place to prevent people from transferring cryptocurrencies illegally. Although this is great news for those who use cryptocurrencies in a legitimate fashion, there are still many challenges that cryptocurrency exchanges face with heightened regulation requirements.

PaymentsJournal sat down with Neal Reiter, VP of Compliance Products at Acuant and Tim Sloane, VP of Payments Innovation at Mercator Advisory Group to discuss the nuances of crypto exchange regulation and the pros and cons of holding it to the same standards as other currencies

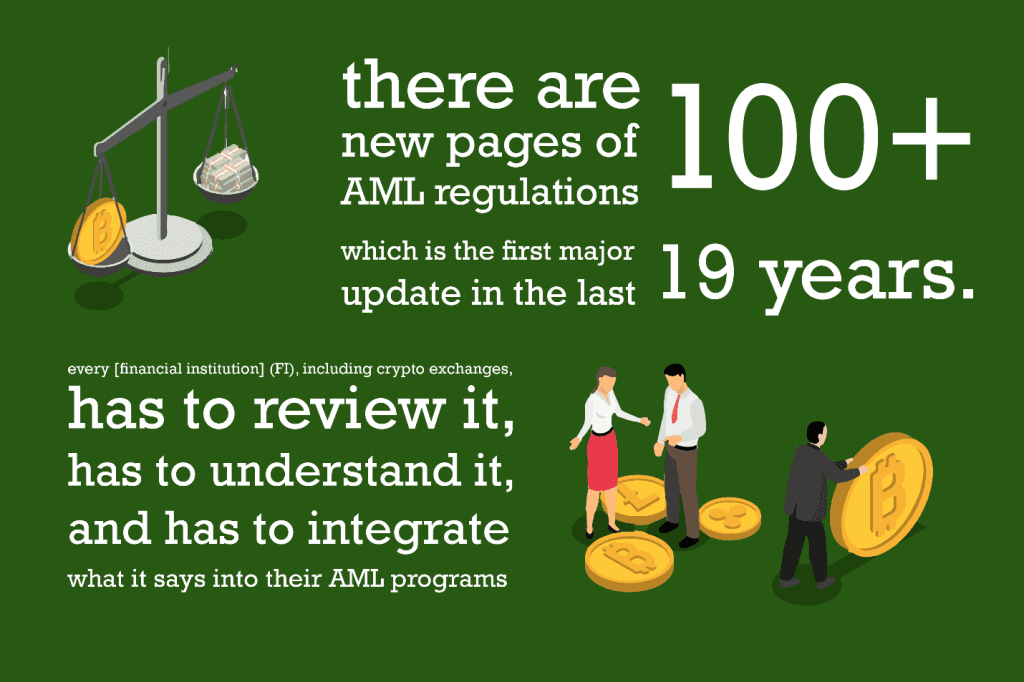

In the most recent budget bill (US only), there are several hundred new pages of anti-money laundering regulations, which is the first major update of the Bank Secrecy Act in the last 19 years. The new Anti-Money Laundering Act (AMLA) requires that “every [financial institution] (FI), including crypto exchanges, review it, understand it, and integrate what it says into their AML programs,” explained Reiter. Once legislation is passed, the act becomes law and must be followed accordingly, so it is crucial that all FIs review the content and inform themselves of the impact it will have on their day-to-day operations.

“There [are] some things that are really going to benefit financial institutions,” added Reiter. So what does this mean for cryptocurrency exchanges?

One big focus of the document is surrounding information sharing. Technically, Financial Institutions can share information via a 314(b), but it’s a very slow and manual process. “And what the government is looking for is for financial institutions to start sharing data more safely, of course, both within their own institution and with the government.” This is set to include everything from Currency Transaction Reports (CTR) and Suspicious Activity Reports (SAR), which will be mutually beneficial for all parties involved.

Next, the AMLA is set to increase potential fines and penalties for those not abiding by the new and existing regulation. Lawmakers have also made it easier and more lucrative for whistleblowing defectors to come forward when they witness potentially harmful activity.

Lastly, there’s a crackdown on shell companies, or companies used to obfuscate who actually controls or owns something. “What federal standards are saying is that this will no longer stand,” continued Reiter. The new AMLA will now require start-up companies to disclose who is in charge and any changes of ownership, something that has never been required in the US and doesn’t exist elsewhere.

“Big four items [are]: FIs must read this [AMLA] and understand how it’s going to impact them, there’s now new standards for disclosure for Know Your Customer (KYC) or Know Your Business (KYB), information sharing has increased, and potential fines have increased as well as who can be held accountable,” summarized Reiter.

What is the “Travel Rule?”

When funds are sent from Point A to Point B, certain information must be passed on. The recipient needs to know which FI is sending the money, from whom, how much, and on which date. It is also required for to know the beneficiary or who is receiving the funds. This is known as the Travel Rule.

“It totally made total sense for SWIFT messages and wires. And it’s a great way for law enforcement to know who’s moving money,” explained Reiter. “The challenge here is there’s no way to do this with Bitcoin currently.” And it’s not just Bitcoin that poses a challenge, but cryptocurrency in general.

Currently, there’s no good way to get this information because of the numerous exchanges that are not connected. “What this means is we…cannot comply with [the Travel Rule]. There’s no way to do this across every exchange,” said Reiter. If regulators start to enforce the Travel Rule, it’s going to be an issue for exchanges because there’s no way for them to actually follow all the mandates stated within the Financial Action Task Force regulations.

On the other hand, “it means that there’s opportunities for those that are able to manage the compliance functions within their gated community to grow with those who want to use Bitcoin, or crypto in a legitimate fashion,” responded Sloane.

The impact of FBAR (Foreign Bank Account Report)

Everyone has to file their taxes, but for some, there are a few extra steps. FIs outside the United States must file directly with Financial Crimes Enforcement Network (FinCEN) if a client is a US citizen who has had over $10,000 in a foreign bank account during one financial year. This may soon be a requirement for cryptocurrency, something previously omitted.

“What this means with FBAR is that US customers will stop using Non-US crypto exchanges. And Non-US crypto exchanges are going to stop servicing US customers,” warned Reiter. In 2014, the IRS said Bitcoin was not considered to be a currency. But in the final moments of that year, the rule was applied to crypto. Therefore, an account holder with at least $10,000 in exchange in Europe, Asia, or Mexico would have to report to the US government. The same rule was applied to FATCA.

How is Acuant onboarding and providing transaction monitoring for crypto clients?

Regulators have made it clear that when considering crypto and anti-money laundering regulations, everyone wants to take a risk-based approach. But how are FIs expected to face new regulations head on without a massive budget?

“You do it smarter.” In terms of onboarding, Reiter explains, FIs should not onboard everyone the same way. Mexico is currently using a risk matrix system that determines a customer’s risk score based on their location, age, and the source of their funds, then onboards them accordingly. “It’s a risk-based approach; you do the most KYC for those with the highest risk.”

There are also options for digital and scalable solutions that are low code and no code deployment. These can be fully compliant and ready to go, requiring fewer technical resources and a smaller budget.

Next, FIs are looking toward transaction monitoring. Companies are combining KYC results and the associated risk to transaction monitoring profiles. “So, you’re not setting everyone against the same set of rules, the same machine learning,” said Reiter. “You’re doing a lot of gradation.”

Lastly, there has been a rise in machine learning and its use in transaction monitoring in accordance with cryptocurrency exchange compliance. “Alert, prioritization, as well as alerts independent of the rules,” continued Reiter. “So, you’re seeing some supervised machine learning with deviation and seeing some unsupervised machine learning with clustering.”

FIs are seeing more and more crypto exchanges that are utilizing ML for a risk-based approach and transaction monitoring, which has proven useful in increasing the speed of onboarding, monitoring customers, and decreasing costs.