What is cryptocurrency?

Cryptocurrency is an encrypted and decentralized form of digital currency that is based on blockchain technology.

Blockchain is a type of distributed ledger—a decentralized digital database—that manages and records transactions across a network of independent computers. The high level of cryptography used in blockchain helps to secure transaction records, control additional coin creation, and verify the transfer of coin ownership.

Cryptocurrencies such as Bitcoin and Ethereum are not backed by physical assets or tangible securities. This distinguishes them from central bank issued digital currencies issued and backed by governments.

Types of cryptocurrencies

While many are familiar with the likes of Bitcoin and Ethereum, there are over 10,000 types of cryptocurrency.

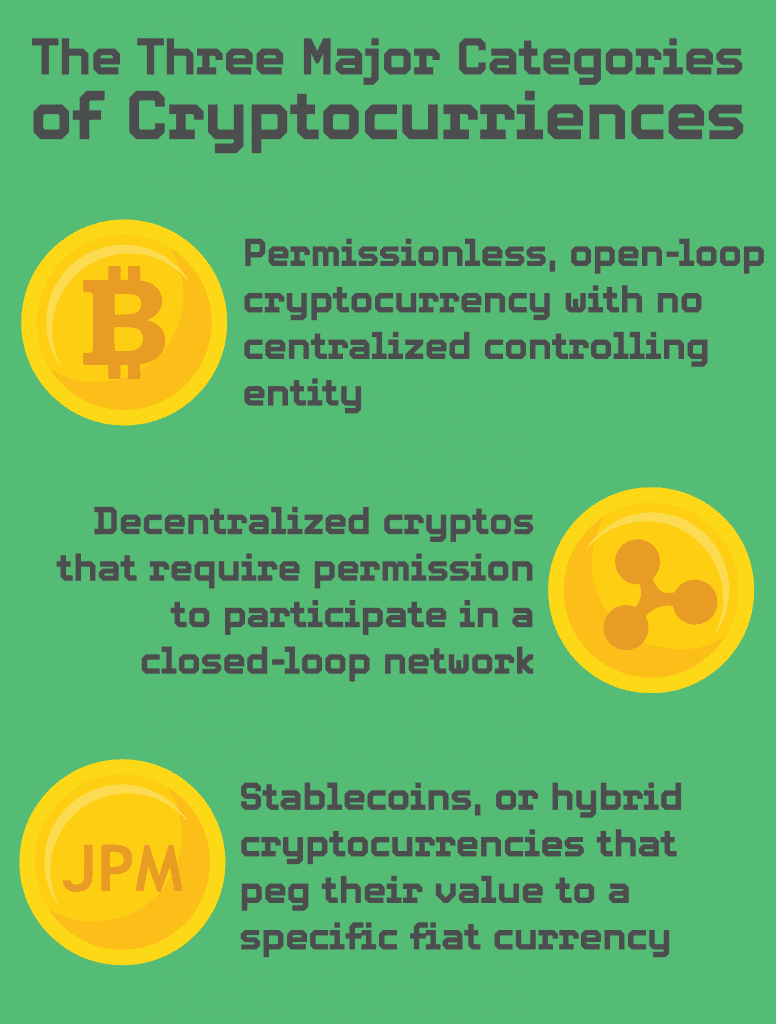

According to Mercator Advisory Group, there are three major categories of cryptocurrencies:

- Permissionless, open-loop cryptocurrency with no centralized controlling entity (e.g., Bitcoin and Ethereum)

- Decentralized cryptos that require permission to participate in a closed-loop network for specific use cases (e.g., XRP from Ripple)

- Stablecoins, or hybrid cryptocurrencies that peg their value to a specific fiat currency (e.g., JPM Coin)

What is cryptocurrency worth?

Released to the public in 2009, Bitcoin was the world’s first decentralized cryptocurrency. It is the most well-known and valuable cryptocurrency in the world. Bitcoin’s blockchain technology enables P2P transactions to occur without an intermediary third-party entity such as a bank or payment processor.

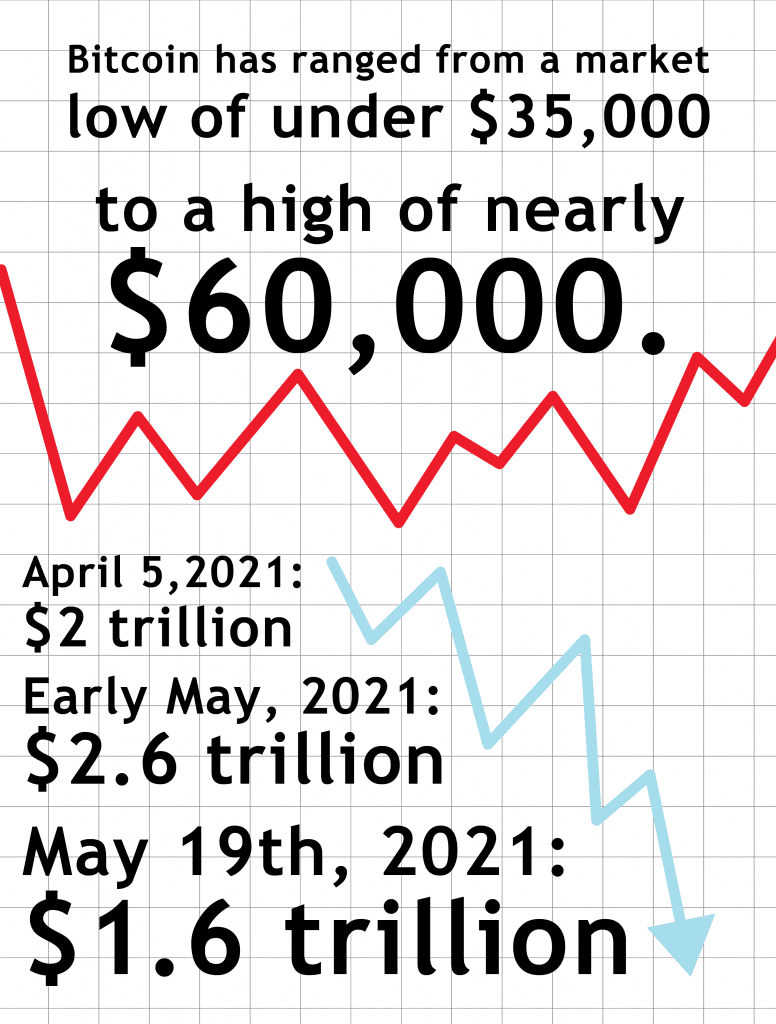

Despite its comfortable status as the world’s top cryptocurrency, Bitcoin prices—like many other cryptocurrencies—are volatile. In May 2021 alone, Bitcoin ranged from a market low of under $35,000 to a high of nearly $60,000. These rapid fluctuations make Bitcoin and other cryptocurrencies a risky investment.

This risk was on full display in April and May. On April 5, 2021, the total cryptocurrency market value topped $2 trillion for the first time. In early May, it reached a peak of approximately $2.6 trillion. Then came a drastic crash, with the market value of cryptocurrencies tumbling to $1.6 trillion on May 19.

Unlike decentralized cryptocurrency, stablecoins maintain a stable value. Their value is tied to other assets, such as gold, the U.S. dollar, or other fiat currency. For example, a JPM Coin always has the value equivalent to one USD.

Key players in the space

Several key players are involved in the cryptocurrency ecosystem:

- Cryptocurrencies (e.g., Bitcoin, Ethereum, Litecoin, Dogecoin, JPM Coin, and thousands more)

- Crypto exchange services (e.g., Coinbase, Kraken, and Binance)

- Regulatory bodies (e.g., Office of the Comptroller of the Currency, The Federal Reserve, the Internal Revenue Service, and the U.S. Securities and Exchange Commission)

- State and federal governments (e.g., New York’s introduction of a licensing process for organizations engaging with cryptocurrencies, the House of Representative’s passage of a bill that will ultimately help clarify crypto regulations)

- Banks operating in the crypto space (e.g., Anchorage Digital Bank, Silvergate Bank, and Signature Bank)

Elon Musk and other highly influential individuals have also played a key role in the cryptocurrency ecosystem. Thanks to the likes of Musk, the cryptocurrency Dogecoin saw its value increase by over 8000% from the beginning of the year to April 19th.

“Musk and other fellow Silicon Valley opinion influencers have shared praiseful tweets, feeding into the enthusiasm around Dogecoin along with other cryptocurrencies, often leaving observers guessing as to the seriousness of their intentions,” explained Mercator Advisory Group Research Analyst Sam Klevanov in a recent PaymentsJournal article.

Governments worldwide have drastically different crypto outlooks

In the United States, patchwork regulations regarding Bitcoin and other cryptocurrencies have hindered widespread adoption. But in 2020 and 2021, the regulatory and banking landscape surrounding cryptocurrency experienced significant development. Thanks in part to this development, the outlook for the future of crypto is favorable.

“While cryptocurrencies previously stood at the fringe of the payments space, in 2021, institutional interest has increased as governments and banks have invested in the space,” wrote Tim Sloane, VP of Payments Innovation and Director of Emerging Technologies Advisory Service, in a recent Mercator Advisory Group report summary. “The U.S. regulatory agencies have acted as key drivers by creating roadmaps and guidance for companies wanting to get involved with new or existing crypto projects.”

Globally, countries are incorporating cryptocurrencies to varying degrees. Some countries, such as Singapore, Bermuda, and the United Kingdom, are establishing themselves as crypto allies. On the flipside, India reportedly has plans to propose a cryptocurrency ban that would criminalize the possession, issuance, mining, trading, and transfer of crypto assets.

A patchwork of regulations hinders widespread adoption

As previously mentioned, patchwork regulation hinders widespread adoption of cryptocurrencies in the U.S. The complicated nature of the space continues to be a major challenge.

“Cryptocurrencies and blockchain-related financial services companies are regulated by a number of federal and state agencies, including the SEC, the Commodity Futures Trading Commission, the U.S. Treasury Department and Federal Reserve, among others, and the industry has long complained that this complicated structure makes it difficult to understand the rules of the road,” wrote MarketWatch reporter Chris Matthews.

The good news is that both political parties are recognizing the value of more cohesive federal regulation for crypto. According to CNBC reporter Thomas Franck, “Democrats and Republicans alike have made cryptocurrency regulation a top priority in 2021 as run-ups in the price of [B]itcoin and other digital assets last year sparked concerns of market manipulation and uninformed retail investments.”

Promisingly, the House of Representatives recently passed a bill to clarify crypto regulations in the U.S. The legislation seeks to set up a digital asset working group that will submit an analysis of the U.S. legal and regulatory framework for digital assets. Additionally, the IRS has announced new cryptocurrency reporting requirements for businesses that receive crypto assets with a market value of over $10,000.

Still, better coordinated federal action will be necessary for cryptocurrency to become a widely used means of exchange.

Learn how to seize the opportunities of the budding crypto industry

This article provides an overview of the cryptocurrency space, but lacks deeper insight into the current regulatory and financial developments and the trends and strategies financial services companies need to know to harness this growth. Mercator Advisory Group’s recent report, Cryptocurrencies: Governments and Banks Catch Up to the Adoption Curve, fills in these gaps.

Commenting on the report, Mercator’s Tim Sloane explained that “Mercator Advisory Group sees the potential in this budding cryptocurrency industry and believes there are use cases that banks, processors, and card programs can take advantage of to drive greater customer satisfaction, greater transaction volume, and greater assets under management.”

Highlights of Mercator Advisory Group’s research include:

- An overview of regulatory developments in the United States and Canada

- A broader look at worldwide players and their changing sentiment towards cryptocurrencies

- An analysis of centralized digital currencies and their implications for decentralized digital currencies

- Examinations of different blockchain infrastructures and stablecoin solutions implemented by institutions

- A review of financial products and payment solutions that current institutions have implemented to support cryptocurrencies

Members of Mercator Advisory Group’s Emerging Technologies Advisory Service have access to this report as well as the upcoming research for the year ahead, presentations, analyst access, and other membership benefits.