The stressed economy is on everyone’s mind, and now credit card issuers are preparing for a downward shift in operational results. Money is tighter, and inflation may be slowing, but prices remain high. And credit card consumers are carrying higher balances and paying less of their contractual commitments.

What’s Happening

According to the FRB briefing, “Credit Cards Performing Worse Than Pre-Pandemic; First-Lien Mortgages Continue to Perform Well”

- Large bank credit card nominal balances continued to grow in Q3 2023 after surpassing pre-pandemic levels in 2022.

- All stages of delinquency rates now exceed pre-pandemic levels for the first time and are approaching series highs since 2012.

- In response to this deterioration, banks have granted fewer credit line increases and reduced credit lines more frequently in the recent four quarters.

Regarding mortgages:

- In contrast with credit card performance, first-lien mortgage delinquencies remain low.

- The spike in delinquencies during the pandemic was caused by the payment deferral programs as part of the CARES Act, with about 8.5 million borrowers entering forbearance during the first year of the pandemic, according to the Federal Reserve Bank of Philadelphia’s forbearance analysis.

How People Pay

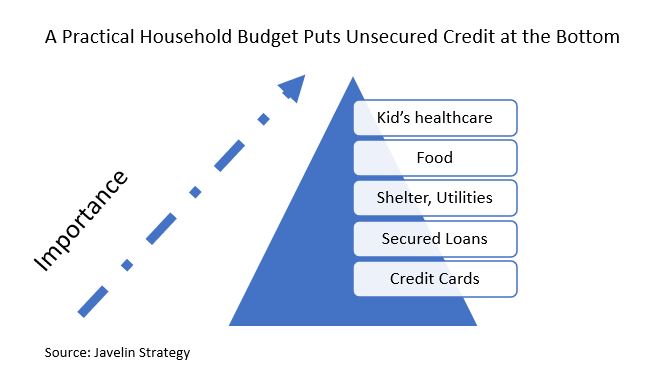

Few can argue with the wisdom of Maslow’s Hierarchy of Needs, where Abraham Maslow, a psychologist, talked about the motivations of human behavior in a 1943 study. Something similar exists when people handle their household budgets; you can see it in today’s world.

Managing a monthly budget is essential, as we said in the 2022 Javelin Report, Inflation: Keep an Eye on the Consumer Budget. There is not a collection manager in the world (or at least not one working for an insured financial institution) that would say: “Don’t take a child to the hospital; pay your credit card bill first.” Practically speaking, the budget will take care of survival needs before allocating to credit cards and unsecured debt.

What Javelin Research Finds

Last year, we stressed that issuers downgrade credit lines. It may be an adverse action, but it is a defensive play. We’ve rung the siren about how credit cards will build up as consumers face inflation, upset budgets, and other financial stumbling. We’ve warned about scaling past the $1 trillion revolving debt mark, especially when the increase comes from lower consumer payments rather than increased purchasing of durable goods.

What Issuers Need to Do

- Temper growth goals with tighter credit card delinquency metrics.

- Get in front of delinquency with rapid collector hiring and uptraining.

- Slow portfolio growth and weather the storm.

- Use FICO Scores to drive credit risk management, account queuing, and judgmental lending.

- Look at your credit card pricing in context with your competitors.

- Build loan loss reserves and wait until the economy is back on course.