Tennessee Ernie Ford’s classic 16 Tons come to mind on this one.

with Growth Percentages since 2018

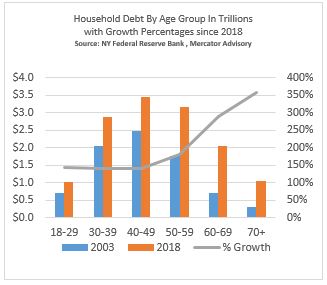

The NY Fed Study on Household Debt presents some concerning data on household debt by age cohorts. When you dig into the data, you see that the highest growth rate is not where you’d like to have it expand. In the 15 year period between 4Q2003 and 4Q2018, household debt for those over 70+ years old grew by 356%, from $300 billion to $1 trillion. The age group cluster for 60-69 years old, which is the feeder group that feeds into the old timer group, grew 288%.

During the same period, the sweet spot for household lending, between 40-49 years old, and 50-59 years old, grew only 139% and 179% respectively.

Millennials, where you’d like to see the most growth, experienced only 142% growth, slightly better than the 30-39 age cohorts and 40-49 year old groups with 140% and 139% respectively.

The short story on this data: the assumption of debt sky rockets as people age, particularly as they enter their retirement years. In the front end, growth is slower due to high volumes of consumer debt.

The American Banker uses the same data set in a report today that points out:

- Meanwhile, student, auto and credit card debt continue to surge. Student and car loan balances hit record highs again in the fourth quarter and credit card balances, at $870 billion, are once again at pre-financial-crisis levels.

- A large percentage of borrowers who are at least 90 days past due on car payments are between 18 and 39, and it’s this group that holds nearly 60% of the outstanding $1.46 trillion in student debt.

- As the cost of education has ballooned — student debt has more than doubled in just nine years — many borrowers have struggled to keep up with payments.

- Ninety-day delinquencies on student loans first hit double digits in the third quarter of 2013 and have hovered between 10.7% and 11.8% in every quarter since. They ended 2018 at 11.42%.

The Equal Credit Opportunity Act (ECOA) prevents discrimination on the basis of race, color, religion, national origin, sex, marital status, and age, but the numbers do not look too good for the golden years!

Overview by Brian Riley, Director, Credit Advisory Service at Mercator Advisory Group