As with most aspects of daily and commercial life, COVID-19 is changing the way people bank. Branch closures, limited hours, access by appointment only, and reduced staffing have disrupted traditional banking practices, forcing consumers to shift their financial activity to digital channels.

In some regards, COVID-19 has simply hastened existing trends in banking. New technology and shifting consumer expectations were already causing banks to focus more on their digital offerings in recent years. Still, the degree to which this digital transformation has accelerated is significant, especially as financial institutions try to plan for business after the pandemic ends.

To help banking professionals understand how COVID-19 is changing the industry and what this means for the future of consumer banking, PaymentsJournal and Cardtronics hosted a webinar titled “COVID-19 & The Rapidly Changing Face of the Distribution Channel.”

The webinar featured Justin Upton, General Manager of ATM Branding Solutions at Cardtronics, and Sarah Grotta, Director of Debit and Alternative Products Advisory Service at Mercator Advisory Group. During the event, Upton and Grotta discussed what branch transformation entails, trends in consumer banking prior to the outbreak of COVID-19, how the pandemic has influenced these trends, and what this all means for the future of banking.

“Branch transformation is not an event, it is something that is ongoing”

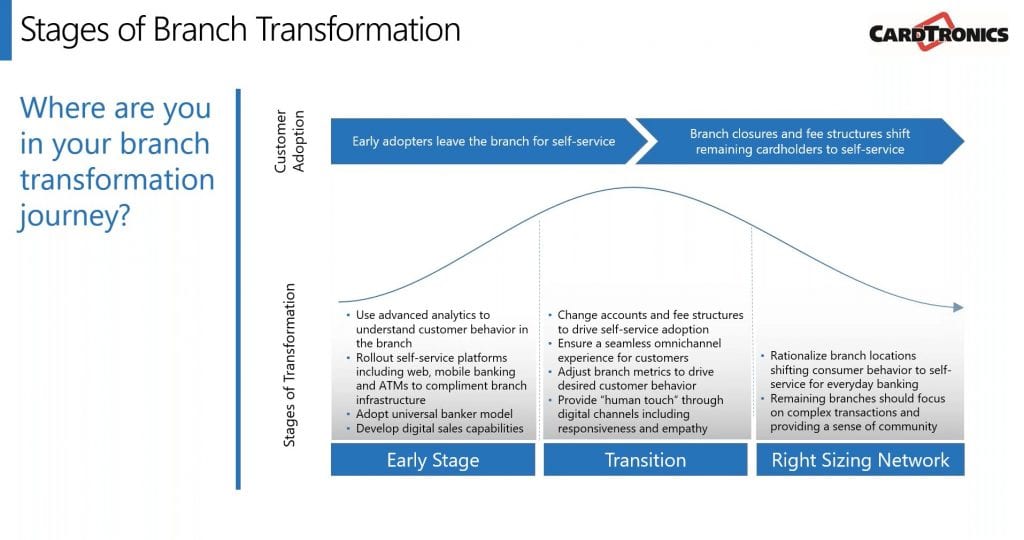

Unsurprisingly, branch transformation has become a hotter topic of discussion in recent months. The term means different things to different people, with some using it to describe the closure of physical branches to save money, while others use it to discuss changes in customer service practices.

Upton offered a more substantive definition: “To us, it’s really about looking at consumer behavior and how your cardholders choose to bank and then mirroring your service delivery after that.” He stressed that since different financial institutions serve client bases with unique needs, “there isn’t a one size fits all solution.”

Instead, each institution must determine how to improve its service delivery model without disenfranchising customers. The process should be gradual and spread out across different stages. Additionally, it should involve balancing the needs of customers, including those who prefer traditional banking in physical branches and those who are more comfortable with digital solutions. “Branch transformation is not an event, it is something that is ongoing,” Upton noted.

Pre-COVID changes to banking

To effectively right-size the branch network, financial institutions need to grasp trends in consumer habits and expectations. A good place to start is understanding what factors drive a consumer’s choice of their primary financial institution.

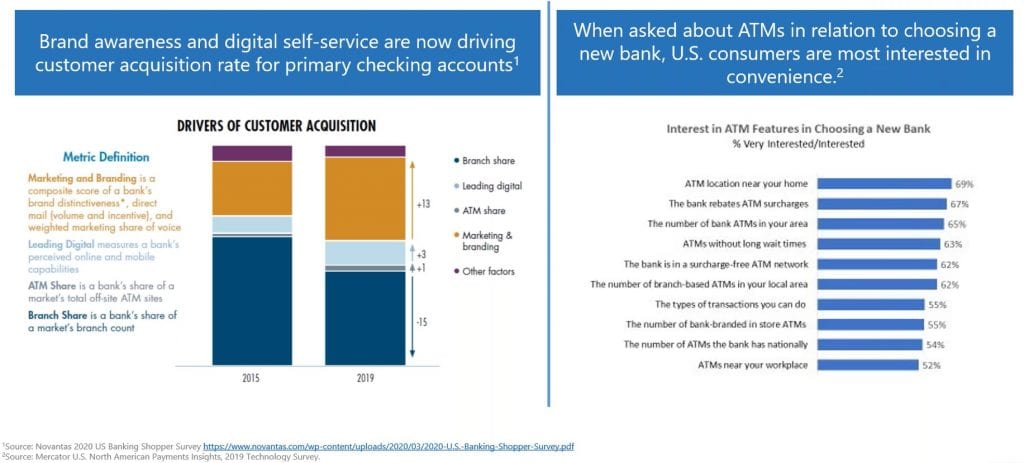

Upton explained that between 2015 and 2019, brand awareness and digital self-service became the primary drivers of customer acquisition for primary checking accounts, as the above graphic shows. In other words, people became less concerned with whether there was a physical branch they could go into and more interested in mobile capabilities.

Convenience goes digital

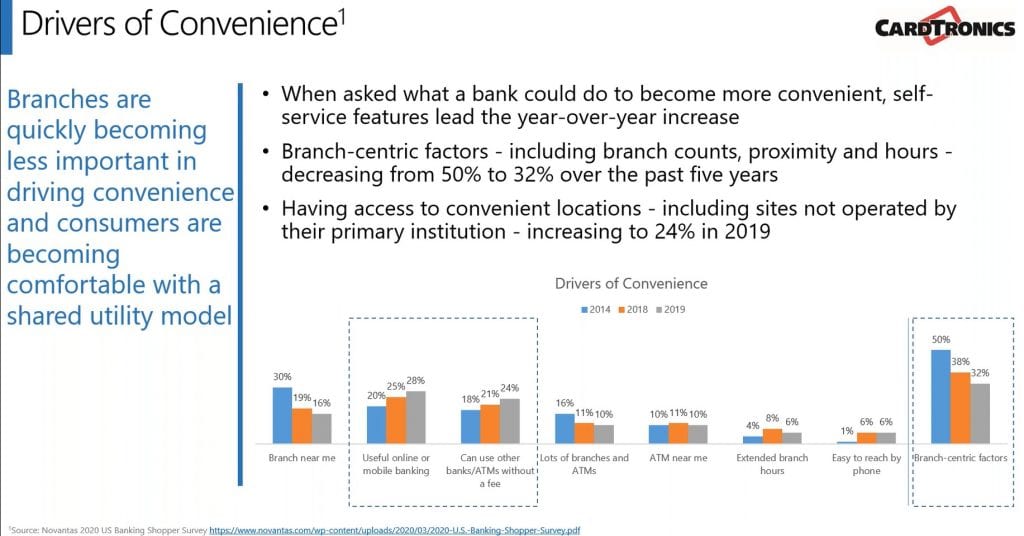

One of the most important considerations for consumers is convenience. People increasingly want quick, seamless experiences in all aspects of their financial lives. When it comes to today’s banking, convenience often relates to digital experiences rather than physical ones.

Upton also explained that when consumers were asked what a bank could do to become more convenient, they indicated that branch-centric factors (longer hours, number of locations, etc.) have become secondary in recent years. Instead, consumers are putting greater emphasis on self-service options that fit how they choose to live, showcased by the rising importance of mobile banking and the ability to use a variety of self-service ATMs fee-free.

Branch closures have been on the rise (but the branch is not dead)

The primacy of digital experiences contributed to many branch closures even prior to the pandemic. “You can see there have been a massive number of branch closures over the past 10-15 years,” said Upton. “We would expect this trend to continue even if the pandemic didn’t occur.”

That is not to say that physical branches became obsolete, as many customers still enjoy going into a bank and physically interacting with a teller. Customers still use branches for higher value interactions with branch staff—such as financial advice and welfare—although these tend to be by appointment only during this pandemic.

Moreover, people want to access to cash and therefore to ATMs, meaning that financial institutions need to maintain some form of a physical footprint for their customers. Grotta agreed with this assessment, pointing out that Mercator Advisory Group’s consumer surveys reflect similar trends. In one survey, 69% of consumers said that ATM locations near their home was an important consideration when selecting a financial institution.

Fees are also an important factor. Mercator found that 67% of consumers consider ATM fees when selecting a bank. Cardtronics’ data reinforces this finding; when consumers who recently switched financial institutions were asked the reason why, 28% reported it was due to fees.

COVID-19 has accelerated digital adoption

Since the pandemic forced physical stores of all sorts to close or drastically reduce hours, it comes as no surprise that it has reduced foot traffic in bank branches and accelerated branch closures.

Upton cited one survey which found that 65% of banks were considering branch consolidation in the near future. Even banks that aren’t closing have witnessed a steep reduction in people visiting physical branches. During April and May 2020, branch traffic fell more than 30% compared to the same time last year. The closure of branches and reduction in physical service means that consumers are forced to pursue digital alternatives. Mercator found that since COVID began, nearly a quarter of consumers reported using online banking more than they had before.

Further, a large portion of people (between 10-12%, depending on the technology) have reported using new payment technology for the first time, including mobile wallets and QR codes. While those percentages may seem low, Grotta pointed out that getting this many consumers to use a new product is exceedingly difficult: “Such a habit change would normally take years to achieve. Yet this year, due to the pandemic, it’s happened in a matter of a few weeks.”

Cash use is up too

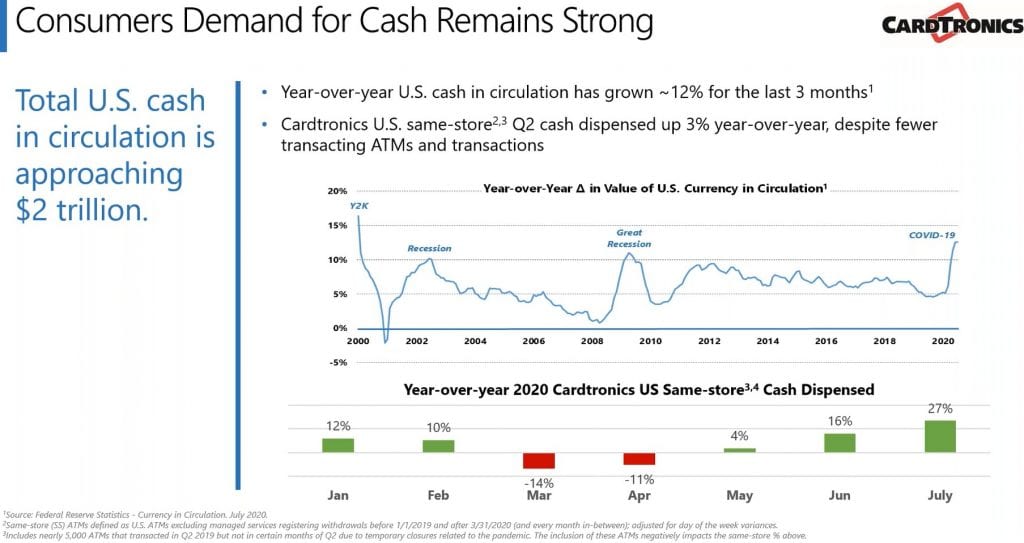

Another trend caused by COVID-19 is the rise in cash use. Despite sensational news stories heralding the death of cash during the pandemic, paper money has actually become more popular. Mercator found that 19% of consumers reported withdrawing cash from an ATM more frequently during the pandemic than they had before, while 47% reported no change.

Data from the Federal Reserve reveals that the amount of cash in circulation shot up during the pandemic. Upton attributed the surge in cash use to a variety of factors, including consumers’ desire to better budget their funds in a time of crisis, a lack of access to credit, and a general desire to be prepared in case of a catastrophe.

What does this mean for the future?

After fleshing out how consumer banking was changing before the pandemic and the ways these changes were amplified by COVID-19, Upton and Grotta delved into what this all means for the future. Those interested in learning what the future has in store can listen to the webinar here.