When it comes to business payments you may be thinking: “As long as invoices are paid, does it really matter how it all happens?”

It actually matters very much– not all business payments processes are created equal.

If you think about it in terms of a car, payments are like the fuel injection system of a business. When finely tuned and running under optimum levels of efficiency, a car’s fuel injection system enables the highest levels of performance from a vehicle. Throw in a few clogged injectors and performance will be dramatically decreased. So it goes with business payments. When optimized for efficiency, an organization’s payment approach provides the power a business needs to shift into high gear and overtake the competition.

So how can companies achieve the optimization necessary for success? Streamlined processes and a strong technology toolkit are important factors.

The current state of business payments and go-forward plans were explored in the recent “2018 B2B Payments & Working Capital Management Strategies” survey, which was conducted by Strategic Treasurer and sponsored by Bottomline Technologies and Bank of America Merrill Lynch. The report, which reflects the feedback of 275 professionals working in the corporate payments space such as treasurers, controllers, and bankers across more than 15 industries, highlights the specific payments challenges and focus areas for businesses and the banks that serve them. Important to note that 50% of businesses surveyed find B2B payables offerings to be very or extremely important when selecting a bank, underscoring the significant client acquisition and growth opportunity that payments represent for banks.

The survey results pointed to three main areas of emphasis: automation, security and innovation.

Automation

When it comes to payables and receivables, survey results indicated that the priorities of a business are overwhelmingly positioned around creating efficiency, and therefore automation. Not a surprise, since even today many organizations are still plagued by time-consuming, paper-intensive, manual processes. There was very little difference cited in the importance between advancing Accounts Payable (AP) versus Accounts Receivable (AR) workflows, but when asked specifically about AP, the automation of the process for efficiency and productivity was labelled as the top driver for nearly half of all corporates, ahead of factors such as security and cost.

The driver behind this need for greater efficiency comes from a variety of factors, including the complexity that

has risen exponentially for businesses in recent years (which is largely related to globalization). For example:

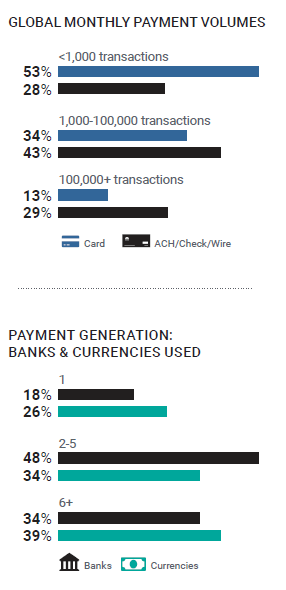

- In 2018, 45% of businesses generated more than 10,000 monthly payments via check, ACH and wire. 18% generated more than one million payments

- 56% of firms regularly make payments in three or more currencies and 39% regularly use more than six

- 34% of companies use six or more banks for payment origination and 12% use more than 21

These statistics make it clear that businesses are in desperate need of bank partners that can help them streamline the ongoing complexity of consistently higher payment volumes, numerous bank relationships, and multiple currencies, just to name a few. This will become especially important as world markets continue to grow and evolve, driving the need for simplified processes.

Security

With 50% of survey respondents having experienced B2B payment fraud in the past year (14% suffering an actual loss), it’s no surprise that fraud is a continued and growing area of focus. In fact, 46% of businesses cited having higher or significantly higher security concerns compared to last year.

Organizations have come to understand that they need to make fraud prevention a primary concern over other enhancements. This realization is reflected in the survey responses, with 49% of businesses indicating that their most important AP/AR B2B payments initiatives are centered on fraud control.

Ultimately, the threat of payment fraud will continue to be pervasive as long as fraudsters find B2B payments an easy target. As organizations continue to allocate funds to this issue and do so wisely, implementing fraud prevention methods that focus on predicting and stopping issues before they can happen, the threat should be an area of diminishing concern. This is provided that organizations have a high-level of confidence that their bank is also placing an equally elevated level of focus on payment security. The good news is that there’s overwhelming evidence from the survey that this is the case, with 63% of banks indicating that security concerns have a strong/very strong influence on their planned technology spend.

Innovation

Overall it appears that banks are doing a good job of meeting businesses needs when it comes to payables, as well as fostering innovation in the business payments landscape.

On this particular topic, the survey revealed that 52% of businesses believe that their bank is investing in innovative B2B payables offerings.

The focus of banks on innovation will be critical in a landscape ripe with payment advancements such as mobile, faster payment schemes, machine learning technology and more. Businesses will look to their bank to be a trusted partner that can guide them in the quest for new technologies and emerging opportunities. Banks that can provide that support will have a decided edge over their less forward-thinking counterparts. They certainly seem well-poised to take on that challenge. For example, three times more banks than corporates are actively using or piloting the use of blockchain payment rails, experience that will serve organizations well when they’re ready to take advantage of the technology.

Ultimately, as indicated by the data, most businesses are looking to their banks for solutions to their payments needs. To address those needs, banks can either build, buy, or partner. In this rapidly evolving payments landscape, partnering with financial technology providers that offer ready-made solutions is a fast path to delivering value to specific customer segments, and can help banks more efficiently grow revenue, deepen customer loyalty, and forge new business customer relationships.

View the full 2018 B2B Payments & Working Capital Management Strategies survey results.