When it comes to small dollar lending, most of the financial services industry and media attention have focused on how these programs meet the needs of low-income consumers with an urgent need to access short-term funds.

Fiserv put that proposition to the test with its 2020 Emergency Funds Survey. In the survey, Fiserv intentionally oversampled people with higher incomes and higher education levels to understand their interest and need for small dollar credit products.

To better understand the need for flexible liquidity from this segment, and how financial institutions could lose customers if they don’t have solutions that satisfy this need, PaymentsJournal sat down with Jeff Burton, Senior Director of Product Management at Fiserv, and Brian Riley, Director of Credit Advisory Service at Mercator Advisory Group.

Consumers want immediate access to funds…

While the market need for liquidity solutions for underbanked and low-FICO scoring consumers is undisputable, this segment of customers is not the only consumer segment that wants access to small dollar loans. Significant demand exists among the high-income, highly educated segment as well, and they too prefer that their financial institution provide deposit liquidity solutions to meet their time-sensitive liquidity needs.

In a most recent Emergency Funds Survey, consumers at all income levels expressed an interest in deposit-based liquidity solutions offered by financial institutions. “The survey itself demonstrated a couple of things. One, is that there is definitely a demand for [deposit liquidity] products irrespective of where [consumers] sit in the income spectrum and, second, an opportunity for financial institutions to offer the right product at the right time,” said Burton.

… And they are willing to switch banks and financial institutions to get it

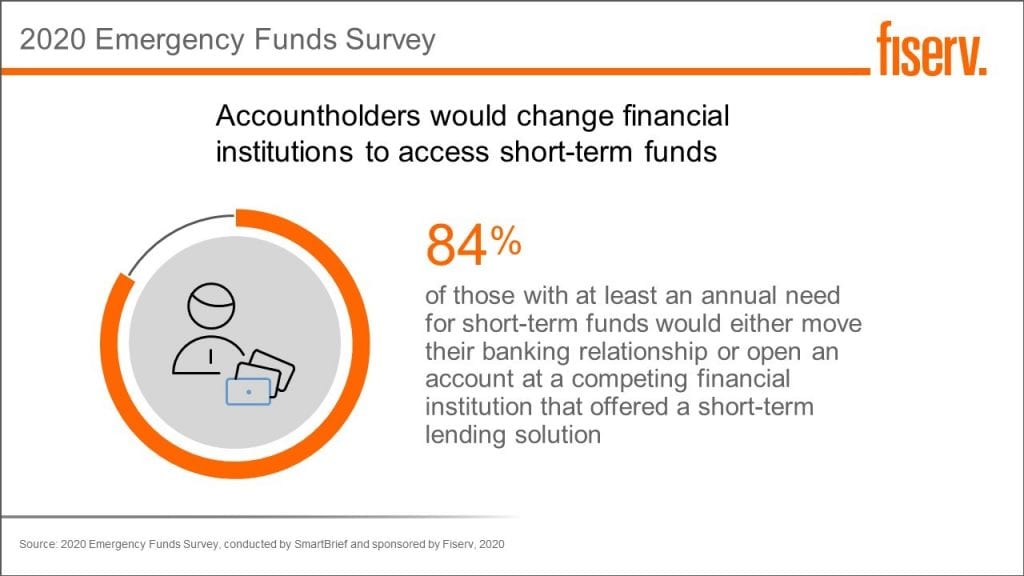

When Fiserv asked survey respondents whether they would be willing to open an account at another financial institution or leave their bank entirely to gain liquidity options, 84% said they would. This is demonstrated in the chart below:

“That’s a pretty large number, and when we’ve shared this metric with clients as we’ve walked through the survey, I’ll be candid with you, in the sense that we get a lot of skeptical reactions,” explained Burton.

According to Burton, skeptics have argued that what consumers say they will do versus what they actually do are often very different. “While we would agree with that in theory, the point is that even if this number is half correct, it’s important enough that you should be paying attention to it,” he said.

Precedence in the marketplace has shown that financial institutions can successfully align liquidity options with consumer needs. For example, much of the rapid growth in checking accounts within community banks and credit unions that occurred in the 2000s can be attributed to offering courtesy overdraft programs along with free checking.

“If a customer knew they had a $500 effective discretionary credit line that they could access when they opened their account, this secured loyalty to that institution because they knew that they had access to those funds,” said Burton.

Additionally, consumers have already demonstrated their interest in new lending products. This was apparent through the rapid uptake of Buy Now, Pay Later (BNPL) lending in the past year, which consumers were initially hesitant to use, but flocked to once they understood its value proposition.

By offering deposit liquidity solutions to meet the needs of consumers, financial institutions have the potential to both solidify existing customer loyalty and attract additional customers.

“Having that retention tool in place is important. When you look at the product itself, it’s engineered well, so that you can make this a seamless process. When people need money, they don’t need to wait two weeks for it,” said Riley.

New consumer data adds insight to previous findings

This is not the first time that Fiserv has conducted an Emergency Funds Survey. It conducted two similar surveys in 2012 and 2017. While they were similar to the 2020 survey, the previous surveys had a more balanced representation of consumers sampled when compared to the general population in terms of income level.

“In the 2020 survey, as I mentioned, we really wanted to hone in on the needs of consumers [in] higher income brackets,” said Burton. Given the higher income level represented, Fiserv anticipated seeing a downward shift in customer demand for liquidity with this most recent survey.

“We did, in fact, see that. In the previous survey in 2017, we saw about three out of every four consumers say they had an annual need for liquidity. In this survey, we see about half that amount,” he added. Around one-third of higher income consumers reported a need for annual liquidity, which should still be considered noteworthy for financial institutions.

The time is right for financial institutions to offer deposit liquidity solutions

The COVID-19 pandemic propelled the world into an era of financial uncertainty and difficulty. However, this story reads differently if you look at it through the lens of deposit balances. Thanks to stimulus funds and debt repayment freezes, overdraft occurrences and downstream charge-offs have dropped as much as 40%, as account balances have grown by 20% or more with the influx of stimulus payments.

However, that money will not last forever, and customers will soon have to repay debts and other obligations. In other words, the financial services industry has yet to see the true effect of the pandemic, and things may get worse for customers before they get better.

With that in mind, we are seeing that some institutions are shifting their perspective on their existing deposit liquidity solutions. “The focus has been on, how can we help more? How can we be more compassionate? It’s moving toward a mindset where [banks] want to put more at the fingertips of the consumer, let them control the situation while being more compassionate from a cost perspective,” said Burton.

Financial institutions can accomplish both these objectives, by rethinking their existing services, and, by taking a proactive approach and offering new and innovative liquidity options that customers choose to use. This will be crucial when the true financial effects of the pandemic become evident in the future.

The takeaway

The verdict is in. Consumers across income levels have expressed a need for access to emergency funds and an interest in having their financial institution service this need with new and innovative products. The catch, however, is that customers may not wait for their institution to get its act together, as many customers stated a willingness to switch financial institution to gain access to such services. Undoubtedly, the time is ripe for financial institutions to design flexible deposit liquidity solutions to stay relevant.