The COVID-19 pandemic has had a dramatic impact on consumer behavior and commonplace activities. Thanks to social distancing requirements and changing customer preferences, many banks began promoting in earnest digital banking alternatives. Is this an opportunity for community banks?

To discuss the evolving financial needs of customers and what the new normal will look like for banks and their customers in the wake of the COVID crisis, PaymentsJournal sat down with Tina Giorgio, President and CEO, ICBA Bancard and Sarah Grotta, Director, Debit and Alternative Products Advisory Service at Mercator Advisory Group.

Payment Trends

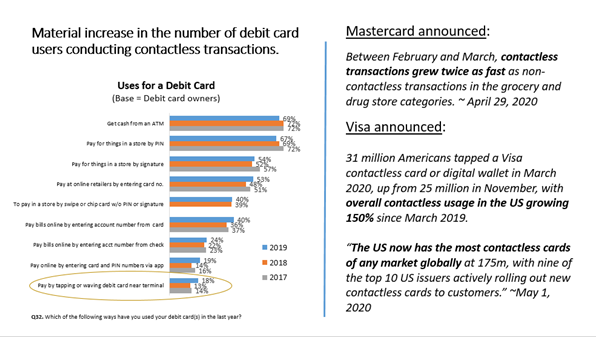

A 2019 research survey of more than 3,000 consumers looked at how they were using debit cards. Year-over-year comparisons for the past three years show that while using a debit card to get cash at an ATM and to make in-store purchases using a PIN are trending down, newer technologies, such as apps and contactless debit, are trending up. In fact, contactless debit had the most significant gain in usage between 2018 and 2019, even before the pandemic.

More recent statistics reveal adoption of contactless payments is also accelerating. At the onset of the pandemic Mastercard found that contactless transactions grew twice as fast as non-contactless transactions at grocery and drug stores. Reports from Visa indicated that 31 million Americans used a Visa contactless card or a digital wallet in March 2020, up 150 percent since March of 2019.

“I think what’s also really interesting is that Visa has noted that there have been more cards being used in a contactless environment than wallet. So for those thinking that cards might be a stepping stone to wallets, maybe that’s actually the case,” stated Grotta, “that might suggest [to issuers] that if you haven’t put a plan in place for contactless, you might want to start thinking about it.”

Giorgio agreed, adding that “The opportunity is ripe for financial institutions to create their own in app wallet. We’ve seen more adoption on credit than we have on debit, and I think now is the time for banks to really start focusing on debit.”

Changing Consumer Behavior and Opportunities for Financial Institutions

While some consumers will revert back to their old payment habits when the days of social distancing are behind us, others, having become accustomed to the new normal, are likely to continue to engage in digital and card-not-present transactions for the long haul.

Financial institutions need to assess current customer needs as well as trends in customer behavior to identify new product and service opportunities such as digital transactions, ATMs, digital wallets, fraud prevention via tokenization, and ATMs.

Digital Transactions

At the onset of the crisis, financial institutions were forced to close branches and handle many more transactions remotely. Going forward, banks will need to maintain their online presence and invest in innovative online solutions.

ATM vs ITM

With the temporary closure of bank lobbies, ATMs have seen an uptick in usage, despite virus related concerns about handling cash. However, long term trends show that the use of cash is consistently declining. Newer interactive teller machines (ITM) with a wider range of capabilities may be the better investment.

Digital Wallets

The convenience of using a cell phone to pay for purchases and bills coupled with pandemic-related fears over handling cash and cards at the point of sale have made digital wallets even more appealing in recent months.

Tap and pay can replace cash for low cost purchases such as coffee shops, quick service restaurants, and gas stations, and may be more appropriate given requirements for face masks in public settings which inhibit face biometric to authenticate transactions, Giorgio explained. “The more I can tap the more apt I am to use that financial institution’s card.”

Encouraging the use of digital wallets instead of credit cards for recurring payments such as online bill pay and subscription services using their debit card is another opportunity for financial institutions to get creative with incentives to become top of wallet, she continued. Although debit transactions are not typically associated with any type of reward, there is no reason why financial institutions can’t offer incentives to use their cards for recurring payments.

Online transactions that involve recurring payments require businesses to store a user’s card on file. Community banks also can capitalize on the fact that digital wallets are a more secure way to engage in these online transactions because account information is tokenized before it is placed in the digital wallet, rendering it useless to any hackers that may obtain it and eliminating the need to store cards at various businesses.

Tokenization and Fraud Prevention

Implementing procedures to mitigate fraud risk is essential for any organization that handles sensitive data. The key is to minimize fraud exposure as efficiently as possible, avoiding unnecessary friction that would slow transaction speed.

Tokenization is the most effective way to protect sensitive data, and it can be done seamlessly. Personal payment information such as bank account numbers are replaced with a token, a random string of undecipherable characters. When a payment is made, the token is transmitted along with a dynamic verification code, but not the actual account number. Tokenizing a payment card before it is placed in a digital wallet ensures that the primary account number is never stored in the mobile device or on a merchant server. The “card on file” with a merchant is not an account number at all, but rather a token.

Staying abreast of new initiatives from the card networks will not only help you make it convenient for customers, but also protects your customers and your bank from fraud, Giorgio added.

Takeaway

With change comes opportunity; as consumer financial needs evolve, new opportunities emerge for financial institutions. The first step for banks in determining what business-as-usual will look like in the wake of COVID-19 is to identify changes in customer behavior, interactions, and needs. Only then can banks implement solutions that satisfy current and future consumer financial needs.