A myriad of regulations has emanated from the EU, and separately the UK, during the past few years (the UK of course adopted the EU regulations agenda, but also has some of its own). One interesting UK regulation that may have slipped under the radar for some is called Confirmation of Payee (CoP).

This article posted in Which? reviews the upcoming compliance deadline. The UK Payment Systems Regulator (PSR) issued a formal direction back in 2018 to the six of the largest banks in the UK.

Essentially targeted at account push payments (APP) in real-time payments systems, the directive requires the bank to develop a protocol for their customers to check that the name of an account to which funds will be sent is correct before a planned transaction goes through. This includes both individuals and businesses.

‘Under the direction of the payments regulator, the six largest banking groups: Barclays, Lloyds Banking Group, Royal Bank of Scotland Group, Santander, HSBC Group (excluding M&S Bank) and Nationwide Building Society must all offer Confirmation of Payee (or ‘CoP’) to protect customers when they pay someone new or edit an existing payee…The new system was originally meant to go live in July 2019, but the major banks now have until 31 March 2020 to get up and running. But, with some banks and building societies not yet forced to sign up, and potential teething problems with those that are, customers are warned to remain on guard as some may remain unprotected.’

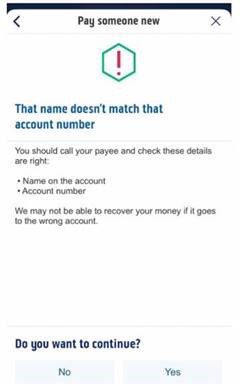

The piece goes on to discuss the reasoning behind the regulation and how it is supposed to work; four outcomes include ‘yes, exact match’, ‘partial or close match’, ‘no match’ and ‘no name check’. The piece includes a ‘no match’ screen shot from the Banks of Scotland’s app below, as an example.

The article is a bit lengthier than most we comment on, but it’s worth a read because it covers a few bases and answers questions that most individuals and businesses using real-time payments will find useful.

There is no equivalent regulation in the U.S., nor are we expecting any, but of course it is in the banks’ and networks’ best interests to help manage that experience as best they can to bolster usage and keep clients happy and whole. Some of the other dimensions discussed by the author are as follows:

‘Will all banks use Confirmation of Payee?

Metro Bank no plans to offer CoP

Will all payments be checked?

What if you don’t get a positive match?

What should you do if there is no name-check?

Will this stop bank transfer fraud?Can you opt-out of Confirmation of Payee?’

You’ll have to read the article to get answers to these questions, but since we regularly cover payments fraud, let’s just preview by saying that the key to this type of risk management is adapting to stay ahead of the curve, while placing barriers in breach sensitive places.

Overview by Steve Murphy, Director, Commercial and Enterprise Payments Advisory Service at Mercator Advisory Group