False declines cost merchants billions in revenue each year, but that doesn’t have to be the case. Using dynamic identity elements can help businesses determine the risk level of a transaction, verify a customer’s identity, and ultimately reduce the number of false declines chipping away at their revenue.

To talk more about how dynamic identity data decisioning enables companies to combat false declines, PaymentsJournal sat down with Arjun Kakkar, VP of Strategy & Operations at Ekata and Tim Sloane, VP of Payments Innovation at Mercator Advisory Group.

The steep costs of false declines

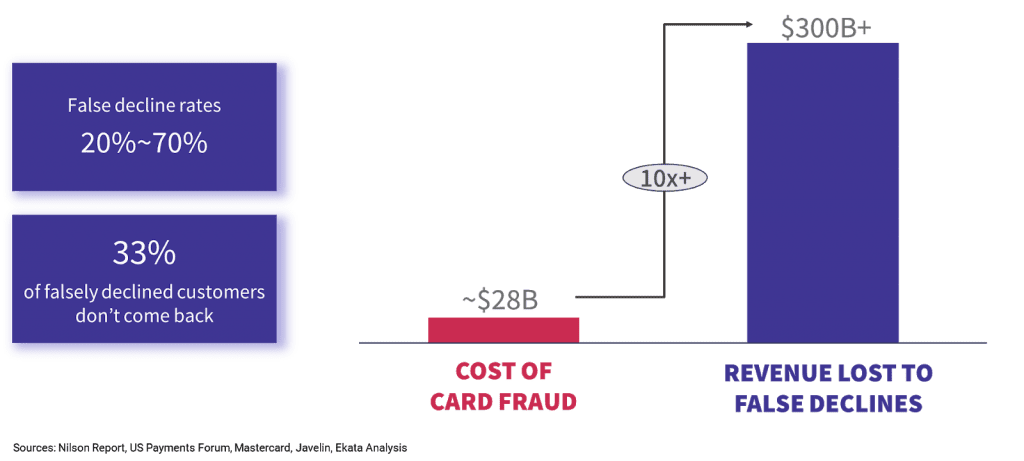

Businesses concerned about revenue loss often turn their attention toward fraud prevention, and for good reason. The total global cost of fraud in 2019 was almost $30 billion.

While that is undoubtedly significant, it’s a mere 10% of the losses caused by false declines, as shown in the following visual provided by Ekata:

False declines cost organizations a staggering $300 billion in 2019, and one in three falsely declined customers don’t return to the business that declined their transaction.

“When you decline a good customer, you don’t lose out on just that transaction and whatever the customer would have given you at that moment,” said Kakkar. “You lose out on the entire lifetime value of that customer.”

It’s important to note that decline rates are significantly higher for online transactions than they are for in-person shopping. Kakkar explained that while 97% to 98% of in-person transactions are approved, that approval rating drops down to around 83% for online transactions.

With the growing number of retailers shifting to e-commerce sales channels due to the COVID-19 pandemic, it’s important for businesses that conduct digital transactions to prioritize reducing false declines.

Digital identity elements enable customer authentication

To know which customer transactions should be approved, companies need to authenticate the identity of their customers. To do so, they rely on confirming their digital identity, which Ekata defines as a collection of attributes [or elements] that are true and useful for verifying a real world identity. These attributes or elements can be either static or dynamic.

Static vs. dynamic identity elements

Dynamic identity elements include things like a customer’s phone number, email address, and IP information. Unlike with static elements, it’s impossible to definitely determine a person’s identity using dynamic identity elements. But that doesn’t mean they aren’t a powerful form of authentication.

Probabilistic risk assessment

Dynamic identity elements “rely on what’s called probabilistic risk assessment as opposed to deterministic one in the case of static elements,” said Kakkar. Probabilistic risk assessment allows organizations to determine the risk level of approving a transaction. “These [dynamic identity] elements all come together to give rich information that helps you say whether a person is who they say they are online.”

“Probabilistic [risk assessment] is really critical,” added Sloane. “In other words, you’re trying to reduce friction, you’re trying not to give a false positive and make the client go away, and to do that… you better really dig in and do some authentication to make sure that individual is who they claim to be.”

The most sophisticated players are starting to use data and put less friction on consumers, so companies not moving toward a probabilistic approach are at a disadvantage.

How dynamic identity data offers transaction insight

The power of dynamic identity data is that it enables the usage of linkages, metadata, and usage patterns to form a multi-dimensional view that offers insight into online transactions. But what exactly does this mean, and what role does it play in authentication?

To provide clarity, Kakkar defined a few key terms:

- Linkages are connections between digital identity attributes or elements.

- Metadata is any additional data that can be linked to an identity element.

- Usage patterns refer to the online behavior of identity elements in a network, which can be monitored for further insight into a consumer’s behavior and identity.

Email addresses are a good example of a dynamic element that offers insight into a transaction. Just 3% of email addresses are less than a year old, which means that a slew of brand new email accounts can be indicative of a fraudulent customer. “Email is a dynamic, but also somewhat static element,” said Kakkar. “It shouldn’t be changing consistently, and Ekata’s network flags it as risky if it is.”

Reducing false declines through dynamic identity data decisioning

Dynamic identity elements can similarly help to identify customers who might be falsely declined. Ekata does so by leveraging machine learning (ML) based risk models that determine a set of scores assessing the risk level of different identity elements.

Two such scores are the transaction score, which validates linkages and metadata, and the identity network score, which determines risk based on the usage of identity data online. If the risk scores are low for both, it is almost certain that the customer is legitimate and that they should not be declined.

Determining risk using data is crucial to prevent false declines. While working with one customer, Ekata was able to determine that 20% of the transactions that were being declined were actually legitimate customers, which translated to nearly a million dollars in lost revenue.

The takeaway

Preventing fraud is important, but should not come at the expense of turning away legitimate customers. By leveraging dynamic identity data, businesses can authenticate valid customers and reduce revenue loss by having fewer false declines.

“The best way to do it well is to gain access to good data,” concluded Kakkar. Good fraud management and customer authentication decisions are “all about the data,” agreed Sloane.