One of the questions we are often asked is whether or not faster payments will lead to faster fraud. There are many fraud vectors and of course having the ability to initiate payments 24×7 provides a broader window through which to carry out nefarious activities.

In that sense, yes, faster payments capabilities will provide some new opportunities, not necessarily faster fraud, since one can already use RTGS rails for fast fraud, just more access to fast fraud payments. This indeed requires banks and their clients to adjust monitoring controls and techniques to compensate for 24×7 payment windows. This announcement, which we picked up on IBS intelligence, indicates that Citi has gotten the memo and created a tool to help manage the risk.

“Citi has announced the launch of its new solution, Payment Outlier Detection. The new solution utilizes advanced analytics, AI and Machine Learning (ML) in order to assist in the identification, approval and rejection of outlier payments that don’t conform to the clients’ payment activity pattern.”

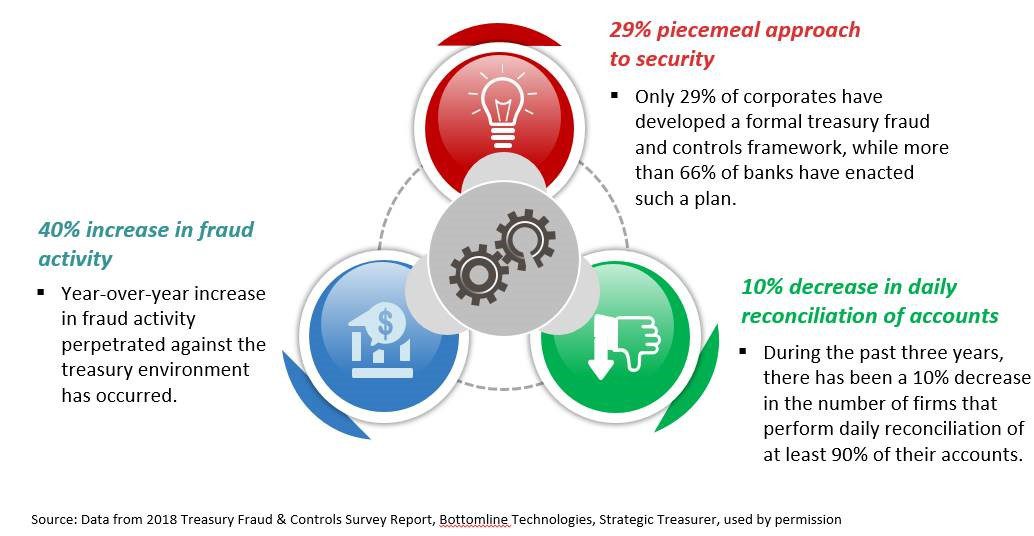

We pointed out this challenge in a recent research report titled Fighting Payments Fraud: No Rest for the Weary. In this release, we highlight information from a 2018 survey which clearly suggests that a lack of formal corporate security planning among industrials already exists, never mind being ready for the added challenge of an ‘always on’ environment. This can surely lead to big problems for everyone.

Announcing a rollout in 90 countries, Citi has developed a system to identify unusual payment activity outside a corporate’s normal behavioral pattern. Obviously these payment patterns change over time and as adoption of real-time payments grows in the U.S. and elsewhere, the machine learning algorithms will gain additional data for improved results, which is the nature of this form of AI.

Announcing a rollout in 90 countries, Citi has developed a system to identify unusual payment activity outside a corporate’s normal behavioral pattern. Obviously these payment patterns change over time and as adoption of real-time payments grows in the U.S. and elsewhere, the machine learning algorithms will gain additional data for improved results, which is the nature of this form of AI.

“According to the bank, the technology utilised by Citi’s solution is expected to adjust controls to monitor discrepancies and changes in client payment behaviour, allow for quick payment processing and identification of potential anomalies. The solution will benefit the clients with enhanced control and payments monitoring, reduced risk in terms of outlier payments, unique tailored customer profiles for individual payment patterns and real-time alerts for outlier payment processing.’…..“Achieving real-time visibility and fraud control over our payment processing is a major goal for Xerox. During our pilot we were very impressed with the power of Citi Payment Outlier Detection as it is very intuitive and easy to use and supports our ability to have payment fraud reviews that provide added transparency and control to Corporate Treasury, along with our internal partners such as Audit, Finance, Accounts Payable and Cash Operations,” said Gerry Maguire, Assistant Treasurer, Global Cash & Banking at Xerox Corporation, who was one of Citi’s early pilot clients.”

Overview by Steve Murphy, Director, Commercial and Enterprise Payments Advisory Service at Mercator Advisory Group