The New York Federal Reserve Bank regularly publishes a consumer credit study that is enlightening with deep data on how U.S. households handle their bills. An important takeaway this quarter is about millennials.

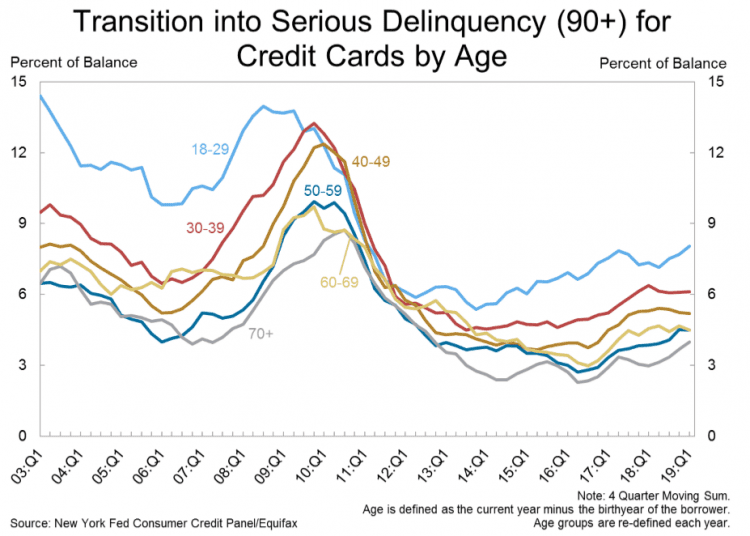

An interesting chart depicts the percentage of accounts entering 90+ day delinquency by age cohort, in tranches including 18-29, 30-39, 40-49, 50-59, 60-69, and (heaven forbid) 70+ years old.

A few notable trends.

- 18-29-year-olds traditionally outpaced other segments for delinquency entering the critical 90 delinquency segment.

- All segments clustered as the U.S. came out of the financial crisis. There was a period, coming out of recession between Q12010 and Q1 2012 where the numbers fell in unison.

- Coming out of 2012, millennial delinquency began to surge again. Today, through Q12019, 90+ delinquency for the 18-29 segment is at 8.05%, up from 6.11% in Q12012.

- The millennial parent, which fall into the 50-59 age bracket is a little more than half their children’s delinquency at 5.58% for the current period improving over the Q12012 metric at 5.75%.

When you study credit card delinquency, the reason for delinquency is more often in the ability to pay, rather than in the intent not to pay. People get sloppy. Their debt is often too much to handle. Or, they face a household crisis like a divorce, employment issues, or medical problems. Even the most critical curmudgeon in the Group Credit Office will project that the number of people with bad intent and a desire to scam the credit business by refusing to pay is minimal.

But the words of Ronald Regan, trust and verify still hold true. In this case, I’d opt for FICO Scores as a foundational component of credit management, from acquisition to payout. Alternative bureau data is not the answer and is unproven during various business cycles.

There are a few important takeaways here for millennials.

- First, the 18-29 age group was affected by the CARD Act of 2019. Unlike their parents, who made it through college with student credit cards offered by Capital One, Citi and MBNA (now Bank of America), this age group felt the test of the Ability to Repay rule, and a requirement to show proof of income or parental approval. As a result, the segment fell by about 85%, notably affecting the sale of pizza and beer in many student markets.

- With less credit to rely on, getting new loans and credit cards became a harder option. Now the ones that ran the gamut and became seriously delinquent, such as the 8.05% referenced above, will carry the weight of bad credit for another seven years, where many of millennials will be entering their thirties, a prime area to build households with spouses and partners. Mortgages and credit card loans will certainly be affected.

For credit card issuers, who face market saturation and tighter margins, there is a risk factor. Millennials are the next feeder group for cross-sells and account growth, but there are the debt burdens of student loan and fancy auto payments, as the New York Times recently mentioned.

Perhaps it is time to get ready for Generation Z, those born in the mid-1990s to early 2000s.

And, pity the millennial’s grandparents, the 70+-year-old cohort, who find themselves with a 4.49% 90 day+ delinquency rate!

Overview by Brian Riley, Director, Credit Advisory Service at Mercator Advisory Group