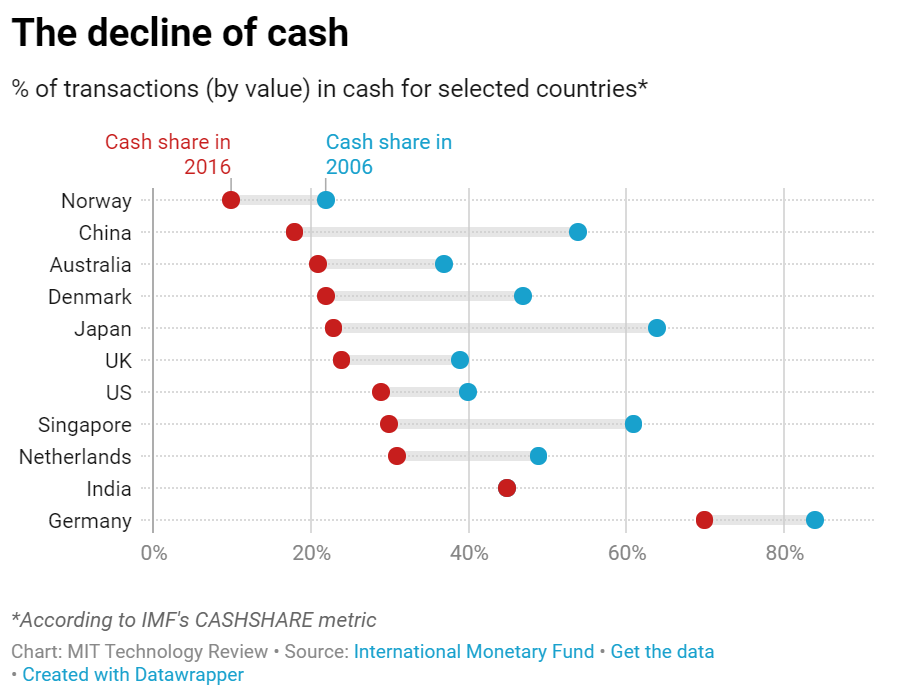

We frequently hear that cash is almost dead. This article is worth reading and provides a quick review of the demise of cash by country and suggests there are significant consequences when high tech solutions displace bearer instruments:

“In (government) money we trust?

We call banknotes and coins “cash,” but the term really refers to something more abstract: cash is essentially money that your government owes you. In the old days this was a literal debt. “I promise to pay the bearer on demand the sum of …” still appears on British banknotes, a notional guarantee that the Bank of England will hand over the same value in gold in exchange for your note. Today it represents the more abstract guarantee that you will always be able to use that note to pay for things.

The digits in your bank account, on the other hand, refer to what your bank owes you. When you go to an ATM, you are effectively converting the bank’s promise to pay into a government promise.

Most people would say they trust the government’s promise more, says Gabriel Söderberg, an economist at the Riksbank, the central bank of Sweden. Their bet—correct, in most countries—is that their government is much less likely to go bust.

That’s why it would be a problem if Sweden were to go completely “cashless,” Söderberg says. He and his colleagues fear that if people lose the option to convert their bank money to government money at will and use it to pay for whatever they need, they might start to lose trust in the whole money system. A further worry is that if the private sector is left to dominate digital payments, people who can’t or won’t use these systems could be shut out of the economy.

This is fast becoming more than just a thought experiment in Sweden. Nearly everyone there uses a mobile app called Swish to pay for things. Economists have estimated that retailers in Sweden could completely stop accepting cash by 2023. “

Overview by Tim Sloane, VP, Payments Innovation at Mercator Advisory Group