What is Buy Now, Pay Later?

Buy Now, Pay Later (BNPL) is a point-of-sale short term lending option that allows customers to make purchases at retailers without having to pay the entire amount up front. Instead, they pay off their balance in installments. Consumers usually make an initial payment at the point-of-sale, but not all BNPL solutions require an upfront payment.

Installment loans are a type of loan that consumers repay over a set number of payments. These payments, or installments, might be paid weekly, bi-weekly, monthly, or on another predetermined payment schedule.

BNPL vs. installment lending

There are a few key differences between traditional installment lending and BNPL lending. Notably, BNPL is more focused on closing sales rather than a customer’s ability to repay their loan.

BNPL generally requires less comprehensive credit checks than other forms of retail financing. This makes it appealing for consumers with low or limited credit who are ineligible for traditional lending options.

Is Buy Now, Pay Later the next new thing? Not quite.

While Buy Now, Pay Later became the buzzword of the payments industry in the era of COVID-19, the concept itself is not at all new. In fact, installment lending was the most popular form of credit prior to 1977.

In recent years, fintechs have rebranded traditional installment lending as BNPL by adding features such as the “Pay in 4” installments model, omnichannel access at retailer websites, and a friendly non-banker approach.

According to Brian Riley, Director of Credit Advisory Service at Mercator Advisory Group, “BNPL is not the ‘new thing’ in lending. It is a modernized version of retail finance. There is certainly a high appeal, but with limited credit policies, consumers need to self-govern their retail purchasing so that they do not overextend themselves financially.”

Key consumer demographics using Buy Now, Pay Later

There are a few key demographics of consumers with higher usage rates of BNPL.

This includes:

- Young adults (ages 18-24)

- Employed middle to high-income earners ($75-$149k)

- Consumers with limited credit

- Tech-forward consumers

Mercator Advisory Group findings from a spring 2021 survey of over 3,000 U.S. adults revealed that 52% of consumers ages 18-24 had used BNPL or short-term loans in the past 12 months, compared to just 12% of adults 65+. On a related note, it is popular among consumers without sufficient credit, which often are adults in the youngest age cohort.

With limited or poor credit history, BNPL becomes one of the only financing options available. Since young adults typically have fewer resources to finance their purchases, Buy Now, Pay Later becomes particularly appealing.

BNPL is also popular among middle to higher-income consumers. A possible explanation for this is that affluent customers are more likely to make aspirational purchases that offer short-term payment options.

Lastly, BNPL is used by online shoppers more often than it is in-store. This makes sense, as online merchants from Amazon to Zappos offer BNPL at checkout to e-commerce consumers.

COVID-19 triggered rapid consumer adoption

We can’t talk about the Buy Now, Pay Later lending space without mentioning its significant growth during the pandemic. According to The Wall Street Journal, consumers looking to avoid taking on new credit card debt during the uncertain economic times of the pandemic flocked to Buy Now, Pay Later offers by merchants.

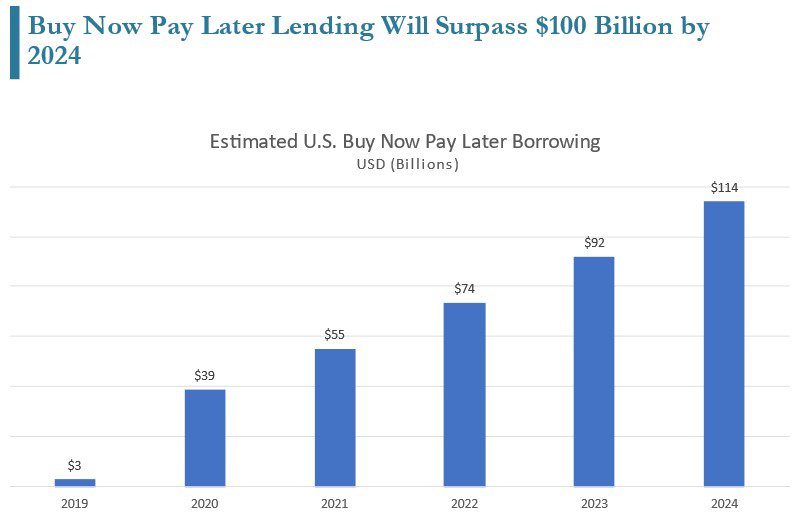

This is backed by Mercator Advisory Group research. The chart below is a featured exhibit in a recent Mercator report on how BNPL is scaling and disrupting the lending status quo.

As shown, the size of the U.S. BNPL lending market in 2019 was approximately $3 billion. In 2020, that number skyrocketed to $39 billion—a 1200% increase. By 2024, the market size is anticipated to surpass $100 billion. In other words, BNPL won’t be fading away any time soon.

The value of Buy Now, Pay Later

There are clear benefits for consumers who opt to use BNPL services. The most significant benefit is that they have the option of taking home items they haven’t fully paid for. A fixed payment schedule, simplified checkout process, fast approval, and zero-interest options are appealing to consumers looking to make purchases.

It also allows consumers spend more than they could using other payment methods.

According to a survey of 6,500 adults by Cardify.ai, 44% of consumers said Buy Now, Pay Later was somewhat or very important in determining how much to spend over the holidays. Nearly half (48%) said BNPL will allow them to spend 10% to 20% more than they would using their credit card.

For merchants, BNPL drives revenue by offering customers an accessible and seemingly more manageable way to make pricier purchases.

The hidden risks of Buy Now, Pay Later

While a common assumption about Buy Now, Pay Later is that it is a cheaper option for buyers and sellers than credit cards, Mercator’s recent research dispels that claim. In reality, late or missed payments can result in penalty fees and even impact consumers’ credit scores.

As previously mentioned, BNPL options tend to have less stringent credit checks and requirements. This makes it easy for consumers to rack up debt if they are spending money they don’t have.

“Like the layaway plans of old, but now called point-of-sale loans, ‘buy now, pay later’ lets shoppers break their purchases into equal installment payments without interest or fees, even using a debit card, which can make the biggest-ticket items seem affordable,” wrote CNBC news reporter Jessica Dickler.

If a consumer pays off their entire purchase before this interest-free period ends, they can avoid additional fees entirely. However, if it turns out those big-ticket items aren’t actually affordable, missed payments can turn into late fees, deferred interest, and other penalties. This underscores how important it is for consumers to self-govern their purchasing to avoid overextending themselves financially.

More regulation is needed

To curb concerns regarding the sudden influx of Buy Now, Pay Later, additional regulation will be needed. Reuters journalist Anna Irrera articulated the concerns of regulators, writing that “the ease with which many shoppers can make purchases is worrying regulators around the world, who fear consumers may be spending more than they can afford.”

These concerns have merit. One Credit Karma survey found that nearly 40% of consumers who have used BNPL had missed multiple payments. Perhaps even more alarmingly, 72% saw their credit scores decline.

“BNPL is a worthwhile, recently defined lending form, but it requires regulatory direction,” explained Mercator Advisory Group’s Brian Riley in a PaymentsJournal article. “Regulations ensure business continuity and protect consumers.” Regulation should not only cover the ability to repay, but also encompass consumer protections such as return policies and disclosures.

Key players in the space

There are a number of key payments industry players in the Buy Now, Pay Later space. These include:

- Fintechs offering BNPL services (e.g., Afterpay, Klarna, PayPal, Quadpay, Sezzle, SplitIt, Stripe, and more)

- Payment networks that have built options to service the BNPL market (e.g., Mastercard and Visa)

- Payment acquirers and processors that operate closely with merchants (e.g., FIS, Fiserv, and TSYS)

- Traditional lenders and banks looking to effectively compete with BNPL without lowering their credit standards (e.g., Petal)

- Retailers that offer BNPL to customers at the point-of-sale

- Consumers that use BNPL

It is worth noting that the retail vertical is not the only vertical dabbling in BNPL solutions. In a recent PaymentsJournal article, Mercator Advisory Group Director of Merchant Services Raymond Pucci talked about a travel industry BNPL platform being tested in the United States.

“Now awaiting takeoff for the U.S. travel market. That would be U.K. fintech Fly Now Pay Later, which has just raised additional capital and is testing a new lending platform for U.S. travel companies and their flying customers. BNPL is a hot lending and payments model right now for retailers and their customers,” wrote Pucci.

Other fintechs are applying the BNPL lending model to sectors such as healthcare and rent payments.

How to better understand the opportunities—and threats—of Buy Now, Pay Later

While this article provides an overview of the BNPL lending space using widely available information, it is only the beginning of what payments industry participants need to know about the future of Buy Now, Pay Later.

To provide deeper insight into the BNPL lending space, Mercator Advisory Group recently released a new report, titled Buy Now, Pay Later: Gaining Scale and Disrupting the Status Quo in Lending.

The report contains 22 pages and 11 exhibits with valuable insight into the BNPL space. Highlights of the company’s research include:

- Forecasted U.S. volumes through 2024, when they will exceed $100 billion.

- Placing the merchant at the center of the relationship, not the consumer.

- What will happen to the BNPL interest-free model when the prime rate rises.

- A discussion on interchange versus merchant discount and why credit cards can be cheaper.

- Market capitalization and why fintechs continue to lose money on BNPL.

Members of Mercator Advisory Group’s Credit Advisory Service have access to this report as well as the upcoming research for the year ahead, presentations, analyst access, and other membership benefits.