Every abandoned shopping cart is lost revenue for business, but it is more than just financial metrics. Payment friction leads to negative brand impression. And for a large business, operating at a scale of hundreds of shoppers per minute, even a small increment in checkout conversion can lead to significant improvement in customer experience.

Why is it so? Contrary to common belief, shopping experience is not based on the total sum or average of every moment of the journey. We judge it largely based on how we feel at its peak (i.e., its highest point – good or bad) and at its end. UX researchers have been using this behavioral psychology for product design, also known as the “peak–end rule” – a cognitive bias that impacts how people remember past events.

When applied to business context – designing shopping interfaces and experiences, pay attention to the most intense points of a typical user journey (the “peaks”) and the final moments (the “end”) which is usually the payment checkout.

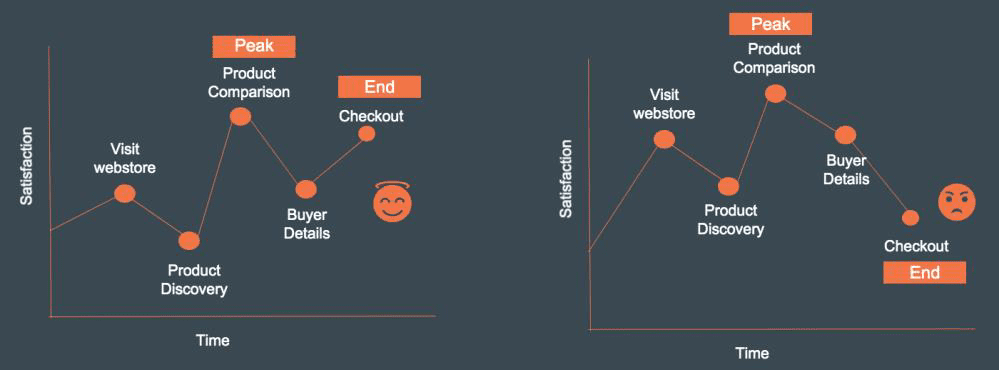

Let us see how this works. Say, two customers are buying from a webstore as shown in figure below. In the first example on the left, buyer has a positive “peak” and “end” experience. In the second case, buyer has higher positive experience at earlier stages of journey however is frustrated with payment failures and retires. When compared, first experience will be rated much more positively than second even though latter has higher average positive moments – except checkout.

Then the question becomes how do you improve payment conversion and therefore overall customer’s shopping experience? Some of payment conversion issues and associated best practices to mitigate are:

- Poor UX design such as non-responsive design, lack of localization, unclear call to actions or navigation flows, long and complicated checkout processes, forced registration, over-zealous fraud detection or technical errors result in cart abandonment. Reduce these frictions by conducting customer discovery exercises and optimizing experience based on customer needs, checkout behavior, devices used and location.

- Lack of preferred payment options is one of major cause of card abandonment. Payment options vary by region, country and even at personal level. Hyper-personalization and web technologies allow businesses to deeply understand customer needs and offer personalized payment options at by rendering dynamic pages.

- Too many or too long redirects to third party payment pages or during 3D secure can lead to dropouts. Typical fixes include using API based integrations to build consistent experience and risk-based authentication (like 3DS 2.0). Furthermore, some businesses are using backend smart routing technologies to recover failed transaction without creating customer experience friction.

And with latest data analytics technology you can address most of the common conversion issues. Some examples of such data driven approach are:

- Path analysis can help you examine the users flow, the pages they visited, their interactions with page elements like buttons. It returns deeper and useful insights on possible bottlenecks that prevent the completion of a purchase, thus optimizing the whole navigation flow.

- Conversion rate optimization analysis conducts extensive data analysis that considers multiple issues and appropriate optimizations to improve payment completion. This provides recommendations to be implemented such as redundancy in checkout process, effectiveness of call to actions, the navigations flow and if necessary, testing recommendations such as A/B testing.

- Predictive analysis forecasts what might happen in the future by extracting information from historical and current data sets, searching for patterns and correlations, trends in customers’ website browsing history or buying behaviors.

While 100% conversion rate in unrealistic, moving closer to 100% even in small increments will add tremendous overall value to any business. Hence, the effort to continuously improve payment conversion rate is more than financial metrics – it should be cornerstone of overall customer experience strategy.