Recently, there’s been a lot of buzz about biometric smart cards. And for good reasons, as these cards are acknowledged to be one of the smoothest, smartest and most secure form of payment verification. Tap and pay – here’s what you need to know about biometric smart cards.

Let’s start by sorting out what exactly it is that we mean when we talk about biometric smart cards? We’re still talking about plastic cards, featuring integrated circuits allowing them to contain significant data. Modern payment cards, such as credit and debit cards, are the most common use case, but biometric smart cards can also be used for broader purposes such as access, ID or loyalty cards.

So how does it work then?

The use of a biometric smart card results in a trusted credential for authenticating your identity, by using one-to-one biometric verification. With your biometric template, i.e. a mathematical representation of your fingerprint, stored on the card the comparison is made locally, without any need for connecting to a database. All the biometric matching is done inside the card, and means no secrets ever leaves the card.

Security and integrity aspects are important to the end users, as recently conducted consumer studies shows that over 50 percent* were extremely concerned about payment fraud.

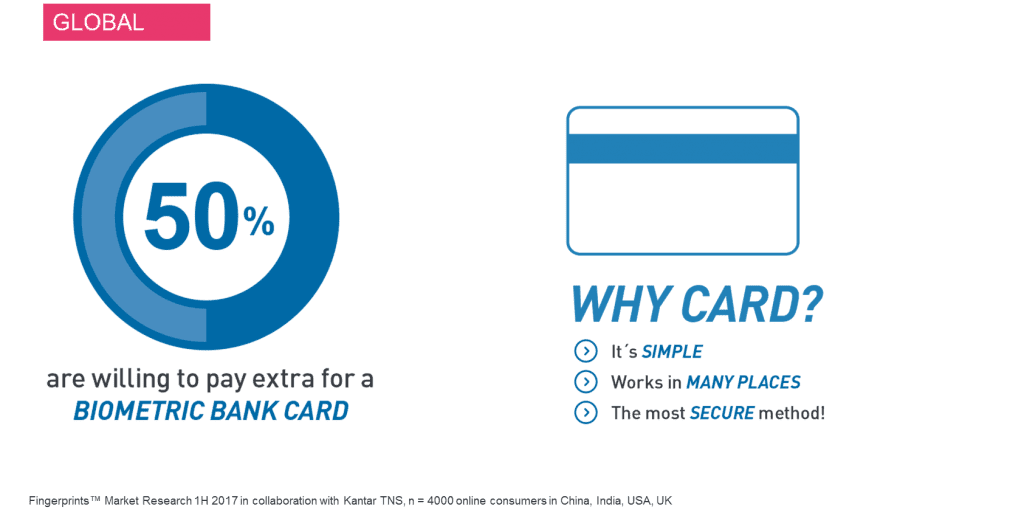

Security was also the key barrier to start using a contactless biometric payment cards, which 50 percent of the participants on these studies claimed they would be willing to pay extra for.

Contact vs contactless cards?

Contact vs contactless cards?

Most modern payment cards are dual interface, meaning they support both contact and contactless modes. In the contactless mode, the card does not need to be connected to any external power supply, instead it’s able to receive and use the power from the payment terminal, making this the most advanced power-harvesting technique on the market. Tap and pay, it’s as easy as it sounds. That’s why this market is growing and becoming increasingly popular around the world, from Canada and UK to Japan and Australia.

There are however barriers that needs to be removed to facilitate uptake and increased use.

The key one being how secure is it? What if you lose your card, anyone can pay with it, or if you get skimmed? The payment cap of ca. 20€ is another pain point. With biometrics, these obstacles can be removed. Just hold your card toward the payment terminal, verify the payment by touching the fingerprint sensor on your card – et voilá! You’re done. Easy, fast and secure.

Where will we first see successful implementations of these cards?

Time will have to tell. Currently, there’s a couple of financial inclusion projects going on in Africa and Latin America, which creates further demand for biometric smart cards. According to Swedish biometric company Fingerprint Cards (Fingerprints™), there’s also a strong tendency from retail banking, where contactless solutions have existed for a while, to add biometrics.

There are also ongoing trials with biometric payment cards in Europe, some examples are AirPlus corporate card with Fingerprint, and MasterCard pilot card with a bank in Bulgaria, as well as at a retailer in South Africa. The interest for biometric payment cards can also be found in the US, fueled by the transition from mag stripe cards to EMV smart cards.

Link till Fingerprints’ smart card webinar on September 21st: https://www.youtube.com/watch?v=jw_4uaRNsBA

*Further insight and full background information on the consumer studies refered to above:

Contact vs contactless cards?

Contact vs contactless cards?