At some point in their lives, many consumers find themselves in the position of having made a transaction that causes their bank account balance to go below zero. When an overdraft occurs, the consumer usually faces fees related to their bank’s overdraft protection service. Those fees can add up quickly if the bank extends this service to customers that can’t afford to repay the overdraft in a timely manner.

It’s important that banks establish effective overdraft protection programs to protect both the consumer and the financial institution. Poor overdraft policies can drive away customers (or put them into deep overdraft debt), while banks risk losing money at a time when interest rates are declining –placing more focus on a bank’s ability to retain non-interest income and other revenue sources.

To understand how banks can build customer loyalty and drive revenue through overdraft protections, PaymentsJournal sat down with Jeffrey Burton, Director, Financial & Risk Management Solutions at Fiserv, and Brian Riley, director of Credit Advisory Services at Mercator Advisory Group.

During the conversation, Burton and Riley identified the problems with the current overdraft landscape and sketched out how a consumer-centric overdraft policy can help banks during this declining interest rate environment.

Changes in the overdraft process since 2008

To gain perspective on current problems, Burton said you must understand how the industry got to where it is now. The overdraft process went through a significant amount of changes following the 2008 financial crisis. Regulations were put into place requiring customers to affirmatively consent to overdraft services for debit card transactions before a bank could charge the customer a fee related to an overdraft of the account.

“As a result of that type of change, as well as other changes that were made, bank revenue went down substantially after 2010,” explained Burton. Despite the decline in revenue, it was evident that the changes resulted in more consumer-friendly policies.

The major problems with current overdraft approaches

However, there is more work to be done to make overdraft services even better for consumers.

First, many smaller banks have largely adopted a “set it and forget it” approach to setting overdraft limits, said Burton. This means they give every customer the same overdraft limit irrespective of the customer’s ability to repay or historical behavior patterns.

Such an approach “doesn’t necessarily align the amount of service you’re providing with the actual credit risk profile of the consumer, which can lead to charge off or customers who can’t pay back their overdraft debt,” explained Burton.

When a customer can’t pay back the debt, the bank is often on the hook for absorbing the loss and will likely lose a valuable customer.

Second, Burton said overdraft was never designed to be a service. Instead, it was originally designed to be a penalty meant to discourage a type of behavior, much like a speeding ticket discourages speeding.

Burton noted that while banks have tried to do more to make overdrafts function like a service, the inherent penalty structure persists. This leads to situations where there is a mismatch between the “cost” and the “service.” For example, if a customer has very small overdraft of a few dollars, they may face a $35 fee. Such a fee seems punitive and can result in a type of charge off where the consumer simply refuses to pay the fee.

So, with these problems, Burton pointed out that two reforms are needed. First, the customer experience needs to be improved. Second, banks need to do a better job at assessing risk while crafting overdraft policy.

How consumers are approaching overdrafts

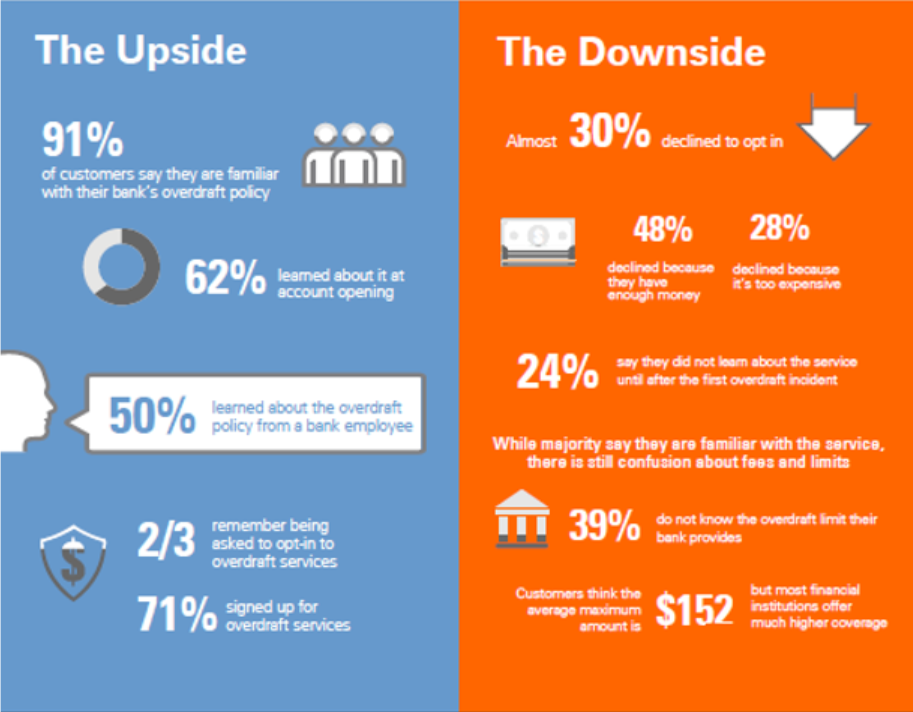

When it comes to how consumers react to overdrafts, there is both good news and bad news. A 2019 survey from Fiserv found that 91% of customers report to be familiar with their bank’s overdraft policy. Burton explained that this number climbs even higher among people who utilize the service, which is promising because being familiar with how to use the product is important for establishing expectations.

There is a downside, however. On follow-up questions probing customer understanding of a bank’s overdraft policy, it becomes clear that the understanding is mostly superficial.

For example, almost 40% of respondents didn’t know their overdraft limit and when asked to estimate, they were off by factors of three to four.

Also concerning is that more than 50% of respondents had no idea how much their bank actually charges for an overdraft. And when asked to estimate, they were often wildly inaccurate. This unfamiliarity gives rise to dissatisfaction when the actual overdraft experience doesn’t meet the expectations of the customer.

Statistics like this underscore the need for better education. Customers who truly understand how their bank’s overdraft policy works can utilize it effectively. But those who don’t run the risk of being embarrassed and losing even more money.

Getting overdraft policies back on track

While there are many reasons to retain customers, losing them because of overdraft policies can be a costly mistake. When you look at the data, overdraft revenue per account is typically between $60 and $80 per account. But if you look at it from a per overdraft user perspective, it’s about three times that amount, said Burton. With the average overdraft customer paying $200+ per account per year, losing that customer can prove costly for the bank.

Based on these numbers, Riley noted that when banks lose a customer who leaves the bank due to overdraft-related issues, it takes more than three customers to replace the revenue generated from the departing account. And with big tech companies, such as Google and Apple, looking to enter the already crowded banking space, customer retention is becoming more important than ever.

To prevent the loss of customers, Burton pinpointed three key considerations organizations should be mindful of when it comes to setting overdraft limits for their customers.

First, it’s recommended that banks better calibrate overdraft limits against the risk profile for each customer. Simply put, don’t allow customers to borrow more than they can pay.

Second, continuously work to keep customers educated on both the benefits and pitfalls associated with the overdraft service. This way, when they experience a fee, they understand what to expect.

A third area of focus for banks should be in offering other value-added customer services to augment the bank’s basic overdraft service. If consumers view overdraft fees as punitive, then offering products that provide liquidity, in a transparent and customer-friendly manner, will give customers options that improve their experience which, in turn, reduces the customer’s likelihood to leave the bank.

Improving overdraft policy with SmarterPay

Instead of adopting a one-size-fits-all approach, Burton recommended that banks consider SmarterPay from Fiserv. SmarterPay is an analytic solution that enables banks to establish dynamic overdraft limits based upon both the underlying riskiness of the accountholder and the accountholder’s ability to afford a specific overdraft amount according to their cash flow.

Burton also encouraged banks to adopt more forgiving overdraft policies, such as more structured forms of overdraft forgiveness. While this may seem counterintuitive, as banks ostensibly forgo revenue in doing so, Burton said that it can actually help retain customers which helps the bank grow revenue in the long run.

At the end of the day, banks need to retain their customers to grow. By carefully inspecting their overdraft practices, banks can make strides to both satisfy customers and earn the right to drive future revenue.