Fraudsters are constantly adapting and evolving their tactics, creating a never-ending game of cat and mouse with financial institutions’ fraud control measures. Despite these efforts, fraudsters have recently intensified their focus on social engineering scams, aimed at deceiving unsuspecting victims into committing first-party fraud and lining their own pockets. These malicious actors are constantly refining their techniques to evade detection, underscoring the need for continuous innovation and vigilance in the fight against financial crime.

The recently released 2023 Fraud Insights report from NICE Actimize offers valuable insights for financial institutions seeking to combat the most elusive and sophisticated scams. The report highlights the critical role of cutting-edge technologies such as artificial intelligence (AI), biometrics, and machine learning in detecting and identifying unusual customer behavior associated with these scams, enabling banks to stay one step ahead of fraudsters. By leveraging these advanced technologies, FIs can differentiate between the various types of scams, identify potential risks and vulnerabilities, and enhance their fraud detection and prevention capabilities.

Fraud Will Increase and Morph in 2023

Attempted fraud transactions increased by 92% in 2022 compared with a year prior, and attempted fraud amounts rose 146% during the same time, according to research from NICE Actimize.

There are different—and specific—areas of fraud that are causing stress at many FIs, including account takeover, unauthorized fraud, authorized push payment (APP) scams, mules, and first-party fraud.

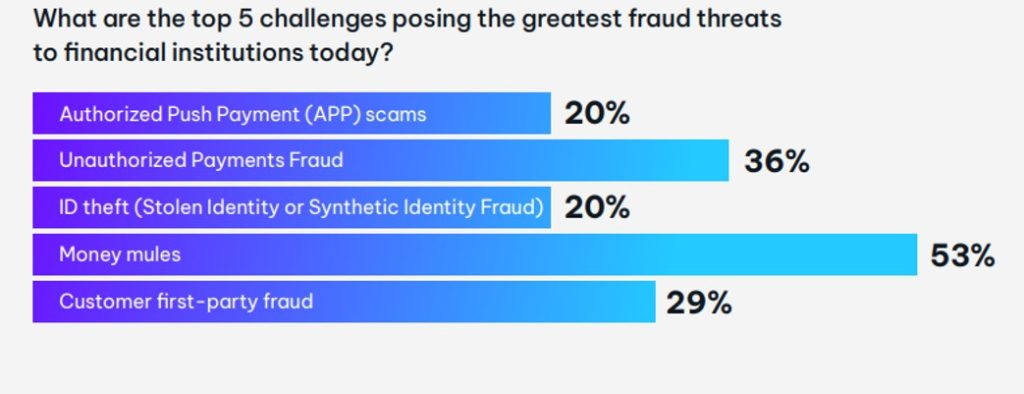

More than half (53%) of respondents said money mules were “one of the top five challenges posing the greatest fraud threats to financial institutions today.” More than a third said the same about unauthorized payments fraud, while one in five respondents felt that way about ID theft.

NICE Actimize 2023 Fraud Insights Report

The variety of fraud cited by respondents indicates a need for solutions tailored toward preventing suspicious transactions from going through and alerting customers when analytics indicate they may be a victim of a scam.

According to NICE Actimize, “FIs need to uncover the unique fingerprints of each scam type. By capturing and analyzing these scam types, they can tailor their approach. They need to target specific client segments with precision-crafted messaging and awareness campaigns and launch focused fraud and scam controls.”

Fraud reporting is a critical component in the fight against the various types of fraud scenarios that financial institutions face. It is imperative that fraud teams keep a watchful eye on the volume and types of fraudulent activities that occur within their organizations, reporting both authorized and unauthorized activities in terms of units and dollars, as well as successful recoveries.

To effectively combat fraud, reporting must occur at both macro and micro levels. At the macro level, reporting should focus on overall disputes, losses, recoveries, and detection/non-detection levels. At the micro level, more granular reporting should provide detailed information on false positives and negatives, and how the current rules and models are performing and where modifications in strategies might be need to curve loss rates in certain transactions and payment channels.

This reporting structure and routine will enable institutions to improve fraud detection and prevention measures and combat the evolving nature of fraud. By collecting and analyzing data at both macro and micro levels, financial institutions can better understand fraud trends and develop effective countermeasures to protect their customers and organizations.

The Rise of Scams

Because fraud poses such a threat, it’s especially critical that FIs amplify existing technology—and potentially new solutions—to look at customer activity through multiple lenses.

According to NICE Actimize, adopting a typology-driven approach is the key because each fraud has distinctive characteristics and FIs need to act accordingly, ensuring they have the necessary tools to mitigate fraud and protect their customers.

The cost of not doing so is significant, and it’s not just monetary. Unmitigated fraud can also cause reputational damage.

Fraud victims are 31% more likely to leave their financial institution, regardless of who is actually responsible, according to data from Javelin Strategy & Research.

A New Nemesis: Money Mule Scams

There’s a good reason many FIs are stressed about the impact money mules can have on their business. Indeed, 59% of new accounts that turn fraudulent show characteristics of money mules, according to NICE Actimize data. What’s more, fraud is likely taking place right away, as their accounts tend to go bad within 45 days.

Money mule scams are a growing threat to individuals and institutions alike. Typically, these scams involve recruiting unsuspecting victims to transfer money on behalf of criminal organizations. The scammers use a variety of tactics to persuade the victim to participate, such as offering them a job or promising easy money for receiving and forwarding funds.

Once the victim agrees to participate, they receive instructions to receive funds into their bank account, often from another compromised account or through fraudulent means. The victim is then instructed to transfer the money to another account or overseas destination, and may be told to keep a portion of the funds as payment for their services. These sophisticated scams often involve multiple individuals and can be difficult to trace, leaving the victim unaware that they’re participating in a criminal enterprise.

Different types of money mules exhibit different behaviors, and analytic solutions should look not only for fraud in general but also for patterns associated with each type of mule. Unwitting mules often have unusual account behavior based on their history, while witting mules show large transactions moving in and out of their accounts with little residual funds. Complicit mules may have several accounts with similar digital characteristics. Successful solutions will need to focus on more than individual accounts, considering non-monetary factors such as relationships among accountholders, senders, receivers, and payment types.

While declining transactions may not always be the best course of action, account owners can be warned that they may be caught up in a scam. Ultimately, combating money mule scams requires a comprehensive approach that involves not only technology and analytics, but also education and awareness campaigns aimed at preventing individuals from becoming unwitting participants in criminal activities.

Looking Ahead

It’s imperative for Financial Institutions (FIs) to have a comprehensive understanding of the diverse range of scams that exist in the current landscape of financial crime. In order to effectively combat these threats, FIs must leverage analytics to identify anomalous customer behavior that may be indicative of fraudulent activity. Although money mule scams are certainly a prominent concern, there are many other types of fraud that FIs must remain vigilant of.

By implementing machine learning and AI systems that are specifically tailored to recognize and flag suspicious behavior associated with particular types of fraud, FIs can significantly enhance their ability to proactively detect and prevent fraudulent activities. This proactive approach is especially crucial given the ever-evolving nature of financial crime.

Furthermore, a renewed focus on fraud detection and prevention can not only mitigate losses for FIs, but it can also serve as a unique selling point that promotes customer trust and confidence. By demonstrating a strong commitment to protecting their customers’ assets, FIs can establish themselves as leaders in the fight against financial crime and ultimately gain a competitive advantage in the marketplace.

According to NICE Actimize, “By using AI and ML to enhance their fraud detection capabilities, FIs can flip the script on authorized payments fraud and turn it into a competitive advantage.”

Using fraud detection not just as a defensive mechanism but also as a way to potentially drive customer growth is a winning strategy.