Checks have seen a steady decline in use — with a 2021 Federal Reserve survey finding a decrease of 7%-8% in check volume annually — but the same clearing processes must still be performed by financial institutions. This reduced volume is prompting financial institutions to consider ways to minimize costs and increase efficiencies in the item clearing and settlement process.

The Current State of Item Clearing

When Check 21 was instituted in 2004, there was great excitement about the new process of handling checks electronically. However, as with any innovation that involved image and electronic processing of checks, it was expensive. Over time, as more financial institutions adopted this technology, the costs did eventually decrease as these processes became more efficient and refined.

“I think the death of the check was greatly exaggerated,” said Tony Rosetti, Director of Fiserv Clearing Network at Fiserv. “Checks are still going to exist. And as the volume continues to decrease, financial institutions are at a tipping point where prices will increase.”

“Checks aren’t going to die,” said Brian Riley, Director of Credit and Co-Head Of Payments at Javelin Strategy & Research. “They’re going to decrease — I agree with that. But there are still times when consumers and businesses need checks, and that brings out the importance of engineering your clearance network properly.”

“You shouldn’t just set that and forget it. As volumes go down and pricing models change and the whole dynamics change, it’s really a good time to understand what’s going on in your clearance process and to make sure that it’s really managed and engineered to the best possible way.”

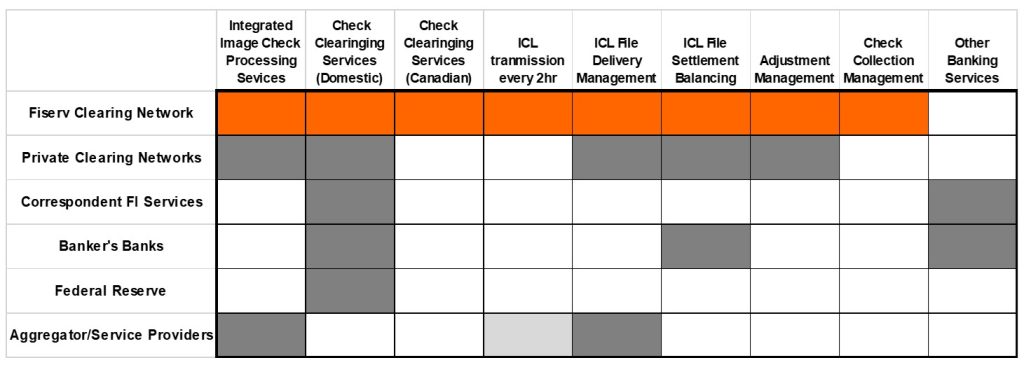

Banks currently have a few options for their check-clearing needs. These include the Federal Reserve, private sectors, and private exchanges.

According to Rosetti, the private sector was the catalyst that drove the costs of check clearing down through its less expensive channels over the years. Although the Federal Reserve basically sets industry pricing, they have increased fees over the past few years. The pricing increase is actually a participation fee that is assigned to every financial institution.

What Should FIs Expect from Their Clearing Network?

When it comes to the check-clearing process, financial institutions want to take the most affordable route.

Rosetti added, “Financial Institution’s want the least expensive way, but also want speed and accuracy with their available technology to present, process, and collect funds.” The Fiserv Clearing Network has a 24/7 processing window. The collection process starts in the early afternoon and continues throughout the day. Checks collected are transmitted for presentment within hours and the speed of collection is key to mitigating risk. Fiserv Clearing Network is poised with Fiserv technology to reduce collection time to transmit checks in a more “real time” environment.

Customer service is also very important to financial institutions. Private clearing networks, like the Fiserv Clearing Network offers an end-to-end experience including detecting duplications, adjustment processing, acceleration of exceptions, and mitigating fraud.

In addition, Fiserv has incorporated the collection of Canadian checks and is able to capture, transmit, and settle these items as well. The Fiserv Clearing Network Canadian Image Service, in partnership with PCBB, removes manual processes and any physical shipping, as well as significantly reduces collection time. The service provides collection for items in Canadian or US funds, offers daily exchange rates guaranteed at capture through presentment, delivers real time OFAC verification and 100% funds settlement within two business days.

Key Takeaways

As previously discussed, checks, much like cash, will never become obsolete. “Checks are still going to be around” said Rosetti. “As the check-writing generation ages, we are going to see less check writing, but they’re still going to be there. They are still an important payment vehicle.”

Their continued existence within the payment universe means that checks will need efficient processes in which to settle faster.

“With the Fiserv Clearing Network and Fiserv technology, we’re going to continue to provide the services and improve the services of check collection,” said Rosetti. “Whether it’s the last five checks that are out there, we’re going to make sure that they get presented and received and processed as quickly as they can.”

“Checks aren’t dead — they’re still going to be out there for a while,” said Riley. And you still need your check processing to work well. It’s not just submitting a check for payment; there’s settlement and clearance processes that need to be worked out. What do you do with exception items? That’s where service private network comes into play. You have the infrastructure there that allows leading-edge equipment and well-engineered processes to apply to financial institutions of any size.”