The uptake of Decentralised Finance (DeFi) has rocketed in the wake of Covid-19. With more transactions than ever before being completed within a decentralised system, smart contracts and blockchain-based banking are on the way to becoming mainstream.

In fact, a 2020 Global Blockchain Survey claimed that attitudes towards blockchain adoption within a number of leading sectors were more than positive, with 88% of respondents believing that blockchain adoption is “broadly scalable and will eventually achieve mainstream adoption.”

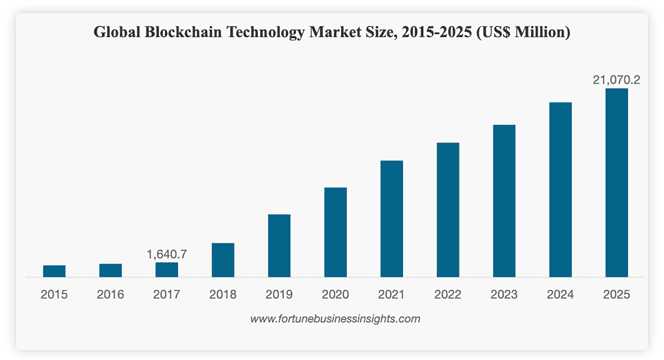

On track to be worth over $21.07 billion by 2025, blockchain technology has penetrated a number of banking, business and healthcare based initiatives, improving speed, efficiency and security within a number of organisations.

One particular blockchain initiative that is beginning to gain mainstream traction in 2022 is smart contracts. Known for automating the execution of an agreement, a once centralised banking sector are now competing with decentralised blockchain-based ledgers such as Ethereum that are simplifying the cross-border transaction process.

The question is, could smart contracts be on track for a global scale adoption in 2022? Let’s have a closer look into the digitalised future of banking and the blockchain-based applications pioneering the way forward.

What is a smart contract?

Smart contracts are powered by simple when/if statements that are written within a blockchain code. When predetermined decisions are met and verified, a blockchain-based network can execute the action immediately so participants can be certain of the outcome within seconds. Used to automate the execution of an agreement, the ai-focused encryption process cuts out involvement from centralised intermediaries and reduces time lost on signing physical contracts.

Smart contracts are continuing to revolutionise the financial industry. As blockchain continues to disrupt traditional banking models, a new uptake in smart contracts amongst a number of global banking institutions is allowing for more transparency between consumers and their money movement.

From real-time remittance and error-free processing, the future of banking is automated if they want to keep up with fintech based competitors such as PayPal. In fact, 60% of the smart contract market value is funded from the financial sector alone and is predicted to reach a total value of $708 million by 2028 if it continues to expand at 24.55% CAGR.

Is Ethereum leading the journey into decentralised banking in 2022?

Ethereum continues to take centre stage as the reigning supreme in smart contract deployment in 2022. With more than $148 billion locked in smart contracts across its market ecosystem, experts suggest that this blockchain ledger continues to catch the eye of a number of banking giants.

Peaking June 2021 at 2.5 million contracts deployed, Ethereum’s market-leading appeal to fintech based finance is quickly becoming a threat for centralised institutions. With trends predicting further growth in smart contract deployment in 2022, it’s clear that traditional banks are no longer holding the monopoly over financial transactions.

However, is Ethereum pioneering the way forward for a decentralised banking sector? Following a growing interest in the blockchain network that can provide decentralised technology for banking giants, a number of leading institutions such as JPMorgan and Mastercard were part of a $65 million funding round in the Ethereum powered, DeFi development company, ConsenSys in April 2021.

Head of economics at ConsenSys, Lex Sokolin claims that a move towards a future of decentralised finance could revolutionise traditional financial services. “We think that Ethereum will become a global digital economy, settling the movement of all types of value across the world, including a meaningful portion of traditional financial services,” He said.

A look into the future of mainstream blockchain

New data from CB Insights have revealed that annual spending on blockchain solutions will hit $16 billion by 2023.

From the financial sector to healthcare and education, blockchain adoption is aiding organisations to speed up processes increase transparency and improve audibility and automation.

While the true potential of blockchain ledgers still remains untapped, it is already being utilised by countless sector giants such as British Airways, HSBC and even the healthcare provider, Pfizer in the battle to defeat Covid-19.

For example, British Airways is trialling blockchain-based Covid-19 credentials in the form of smart contracts that can quickly simplify airline verification cross-borders and reduce the need for countless sharing of documents.

As we see more examples of traditional, centralised enterprises adopting blockchain as a service, it’s clear that this technology can continue to solve countless problems. As mainstream adoption becomes a reality, a decentralised and efficient future is on the horizon.