The challenge to banks is not small and neither is the competition

“The battle for U.S. retail banking customers is intensifying as Amazon is expected to partner with a bank to offer a co-branded, mobile-friendly, checking-account-like product initially targeted to young adults.” Bain, 2018

Amazon may soon be nipping at the heels of banks. Rumors swirled earlier this year when it was reported that

Amazon was in talks with JP Morgan Chase to build a checking account product that Amazon could offer consumers. With nearly 80 percent of Amazon Prime customers in the US (link) saying they would “try” a free online bank account offered by Amazon, the opportunity for Amazon is tremendous. It could also be a giant threat to banks.

Justin Post, Internet Analyst at Merrill Lynch told clients: “We think Amazon’s aim with expanding its financial offering is less about disrupting the financials sector and more about increasing engagement on its own marketplace.” That said, there are clear economic drivers. Moving into financial services would help Amazon save on interchange and give it direct access to consumer financial data. Whatever the reason, and however it ultimately decides to participate in the sector, the Amazonization of banking should be cause for alarm for incumbents large and small.

But why Amazon and why now? The disruption has been coming for a long time. First, consumer expectations have changed very quickly over the past decade, specifically around the end-user experience. Traditionally, consumers compared their bank experience with that of other banks. But today’s consumer compares their bank experience to the deeply personalized, digitally native experiences they have with brands like Netflix, Spotify, Facebook, and Pinterest — as well as Amazon.

Apps like PayPal and Venmo offer innovative products and have made consumers more accustomed to bank experiences that feel like tech experiences — and it seems consumers are responding positively. Peer-to-peer mobile payment company Venmo has nearly 23 million users in the U.S. and PayPal has a quarter billion worldwide.

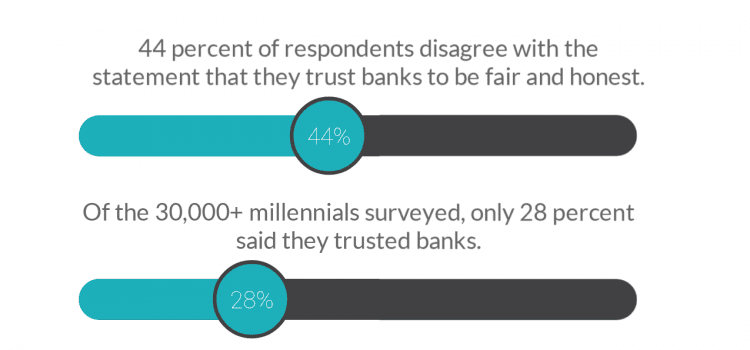

The reputation and consumer trust in traditional banks took a hit during the Great Recession, especially with millennials. Last year, a WEF’s Global Shapers Survey found that 44 percent of respondents disagree with the statement that they trust banks to be fair and honest. Of the 30,000+ millennials surveyed, only 28 percent said they trusted banks. We see a similar picture painted by Net Promoter Scores (NPS), a widely used measure of customer loyalty. Amazon has a materially higher NPS (47) compared to regional banks (31) and national banks (18), with USAA a clear outlier.

So, what does this mean for banks?

Blur industry lines

First, banks aren’t going anywhere, anytime soon.

Instead, the lines between banks, fintech, and big tech are blurring: big tech companies will bundle payments, lending, and other financial services into their products as they extend their ecosystems in order to capture margin and data. Banks will look more and more like tech companies with many already starting to reinvent themselves through diversification.

One method is to partner with tech companies in order to open new revenue streams. The rumored JP Morgan Chase / Amazon partnership is an example of this. Another method is to become an infrastructure player. For example Fidor Solutions (a subsidiary of Fidor Bank) offers a banking-as-a-service product…an end-to-end solution for creating a challenger bank…offered by a bank.

Lead with data

Amazon may know what customers do on Amazon, but banks have far deeper data on the spending behavior and financial needs of their customers, including details such as when they get paid, what and where they buy, recurring expenses like gym memberships and subscriptions, and when their mortgage is due.

Banks that exploit this advantage can lead the way, delivering an improved, deeply personalized experience for their customers, creating new products that are meaningful to their users, and ultimately driving accretive revenue streams.

Become customer-obsessed

Armed with this data, banks should double down on the customer experience and make it much more modern and tech-like.

When a bank provides a personalized digital experience for their customers, the customer becomes empowered. They take control of the experience, deciding when and how they will interact with their bank.

For example, instead of the spam-like bank solicitations that may not align with the personal profile of a customer, banks can deploy AI technologies — just as tech companies do — to deliver product recommendations and relevant information to the customer.

Using Netflix as an example, my Netflix recommendations will be different from yours because they are based on my viewing history, unique to me. My financial circumstances are also unique to me, yet my bank typically offers me the same standard online experience and offers , as they do to all of their customers.

Let’s say my bank data shows that I have no savings. Using AI, my bank could suggest a product that rounds up my purchases into savings or that transfers money into savings every time I get paid. By helping me increase my financial wellness, the bank will become a trusted partner.

In this way, banks can follow the Amazon model — starting with the customer and working backwards to the infrastructure that supports the experience. When you combine this proven model with the proprietary data banks own , Amazon will find it harder to tempt profitable customers to leave their banks.

Banks must evolve

The challenge to banks is not insignificant and neither is the competition. The Amazon threat is real. Along with directly taking market share, competition from new entrants such as Amazon is likely to compress margins across many core lines of business for banks. To compete, banks must evolve. This means emulating an Amazon-like experience, partnering with tech companies, re-inventing their business models — and, most importantly — delivering a truly personalized and delightful customer experience.