Have you noticed that more and more retailers, fintechs and big tech organizations are building super apps? I don’t entirely know what that means, other than the idea of an app that brings together a multitude of activities or mini-apps under a single platform, similar to the concept of the Chinese apps WeChat Pay and Alipay.

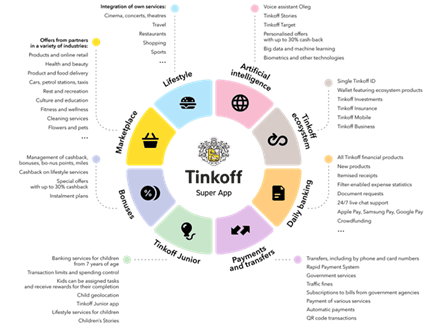

This image from Tinkoff is, I think, the best taxonomy to describe a super app I have seen:

While I don’t believe there will be super apps of this breadth in the U.S., The American Banker published a detailed article on the evolution of multifaceted apps that are poised to launch, including what retailers like Walmart may be considering and also the strength of PayPal’s solution. Here are some excerpts from the article:

PayPal Holdings, recently sketched out strategic plans that summon the industry’s long-held fears about the tech giants. At the firm’s investor day in February, PayPal executives promised to build a mobile app that will allow consumers to shop at millions of merchants, while also accomplishing most of what they currently do at banks. Already, the app’s users can transact with debit cards, borrow to make purchases, pay their bills, get paid by their employers, cash checks, make investments, send money to relatives overseas and more.

PayPal wants to weave consumer financial services into an ecosystem that draws strength from its existing relationships with merchants. Consumers will come to PayPal to make purchases, either in physical stores or, more likely, online; they’ll receive personalized offers and rewards based on their purchase history, which will encourage them to return more frequently; and eventually, they may treat their PayPal digital wallet like it’s their primary bank account.

“Basic financial services are just going to be a part of any platform that has hundreds of millions of consumers, because it’s all tied in to the everyday transactions that we’re going to see,” PayPal President and CEO Dan Schulman said in a Feb. 11 presentation. “Our digital wallet can bring together previously disparate capabilities that range from payments, to shopping, to financial services, and even new forms of digital identification into one super app.”

Overview by Sarah Grotta, Director, Debit and Alternative Products Advisory Service at Mercator Advisory Group