Identity theft is increasingly common and extremely complex. Knowledge graphs are an important tool in the fraud-fighting arsenal because they leverage identity data to visually connect the dots between seemingly unrelated data points, eliminating inefficient manual case reviews and providing fraud teams with actionable insights in real time.

Did you know that someone is a victim of identity theft every two seconds, costing consumers billions annually? While best practices for identity protection such as changing passwords, protecting personal information and monitoring credit reports can help, they’re not failproof. Modern fraudsters are extremely sophisticated — and the onus falls on fraud teams within consumer-facing businesses to stop them.

Identity fraud isn’t what it used to be, either; it’s much more complex. Sure, cybercriminals continue to commit run-of-the-mill identity crimes by stealing consumers’ personal information and taking over accounts, but they have other tricks up their sleeves. Some create completely synthetic identities by combining a few pieces of legitimate customer information — a street address or social security number — with fake information. The resulting identity seems valid, but it’s not. They use those fake identities to apply for loans and credit cards, and don’t pay back the debt. Other tactics include “piggybacking” — adding a synthetic identity to a legitimate account — or setting up “Frankenstein identities” that build credit over time and apply for larger loans years later. Given the growing complexity of identity theft, it’s no wonder fraud teams are puzzled about how to stop it.

Manual case reviews are costly and inefficient

Historically, manual case reviews — where internal fraud experts review each individual instance of potential fraud manually and make a decision about whether or not they think it’s fraudulent — have been the primary method for preventing identity theft. This involves analyzing vast amounts of structured and unstructured data from various, typically siloed sources, which is inefficient and ineffective. It’s also difficult to surface patterns and discrepancies without context.

To make matters worse, today’s sophisticated fraudsters attack organizations with unprecedented scale and frequency. This puts fraud teams under intense pressure to manually review thousands of individual cases, analyze vast amounts of data for suspicious patterns, and take rapid action. Without automation, it’s impossible to keep up.

According to Fintech news, 45% of banks say their investigations take too long to complete, and 40% say false positives are common. That means good customers are frequently turned away while fraud still manages to get through. Today’s consumer expects immediate responses to loan applications, particularly with new purchasing models such as buy now/pay later. And while AI can help to alleviate the pressure on fraud teams, providing real-time, accurate detection has remained allusive.

Now you see it

Forward-looking fraud teams are using advanced graphing solutions that are more scalable and flexible than legacy graphing tools, and help connect the dots between seemingly unrelated fraud signals and events in real time. These new graphs can support complicated and enriched data, and leverage linkage analysis to build multidimensional connections among entities, groups, money flows, IPs, emails and other attributes.

Why are decisions easier and faster to make using a graph? Because graphs visualize identity data in a way human investigators can more easily understand. Take, for example, a scenario in which a bad actor tries to open a new account via piggy-backing. It’s a common and legitimate practice for an account holder to add family members to an existing account. Knowing this, fraudsters may use similar names to the primary account holder, along with the same address and other information to create a synthetic identity. In this way they can trick legacy fraud systems, even in the absence of valid social security numbers.

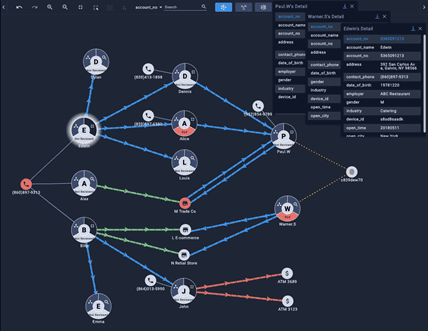

Using advanced graphing tools, it’s easy to visualize what attributes the new applicant shares with the existing account holder and how they differ. You can also see if the same device is being used repeatedly to open different accounts. For example, the knowledge graph below shows data points and users that comprise a transaction scenario. Users are represented by capital letters, and the other nodes represent various attributes and data points related to those users:

Notice there are three types of relationships between the users and the nodes:

- The light gray line represents a binding relationship — the attribute is related to the user. Users E, A and B share the same entity node — a telephone number.

- The line with arrows represents the transaction relationship, and the color of the lines represent different transaction types.

- The yellow dotted line represents a shared value relationship. In this case, users P and W share a device ID.

In the top right corner of the graphic, there are three small pop-up windows that display the details of the various user profiles. Clicking on the user nodes will display others’ profile details, providing additional insight that can help fraud investigators easily compare users’ attributes and signals, and spot any suspicious patterns.

Graphs can be used for various fraud scenarios, including application and transaction fraud, account takeovers, insurance fraud, money laundering activities and money mules. Fraud teams can leverage graphing to monitor and assess business and credit risk as well as policy violations, by enabling teams to evaluate and analyze vast amounts of data from various sources holistically, rather than investigating events or suspicious activity in isolation. AI-generated results — including output from unsupervised machine learning algorithms — provide a level of automation to present the data in a linked graph structure, illuminating hidden connections that couldn’t be discovered manually. In this way, they enable fraud teams to skip the tedious job of manually reviewing fraud cases and provide critical data insights investigators can see.

To Fight Modern Fraud, Level-up Your Tools

Fraud teams aren’t the only ones leveraging advanced AI. The modern-day cybercriminal is armed with an array of advanced techniques for committing identity theft and other forms of fraud — and they learn fast. Reports of AI-based voice manipulation, “deep fakes” and automated bots are becoming increasingly common, and relying on traditional rules-based solutions and manual reviews for identifying fraud no longer works.

To fight modern identity fraud, you must fight fire with fire. Combined with machine learning and AI, advanced graphing tools that deliver real-time insights can eliminate guesswork, so you can cut fraud off at the pass.