COVID-19 has made it clearer than ever that the manual account payables processes so many companies rely on are inefficient and prone to security threats. By opting to move away from paper checks in favor of an integrated payables solution, organizations facilitating B2B payments can not only better protect themselves and their customers against fraud, but also increase operational efficiency by reducing the amount of manual work that needs to be done.

To further discuss the value of integrated payables, PaymentsJournal sat down with Steve Putney, Executive VP at BBVA USA Treasury & Payment Solutions, Sara Frommeyer, Senior Managing Consultant and Commercial Payments SME, Advisors, Data & Services at Mastercard, and Steve Murphy, Director of Commercial and Enterprise Advisory Service at Mercator Advisory Group.

The state of B2B payments

What “stands out as sort of a unanimous conclusion is that the digitalization of financial processes has received a major boost as a result of work-from-home necessity, which once again has highlighted the shortcomings of analog processes,” said Murphy.

As a result, B2B buyers and suppliers that have been reluctant to automate are now recognizing the value of modernizing their financial operations and are increasingly motivated to do so. Similarly, suppliers that have been resistant to virtual card adoption are now more readily understanding the advantages of using them.

As companies make the shift, it is crucial that they have strong fraud management protocols in place. “This rings true for payers and certainly suppliers, especially in an environment where all of e-commerce is increasing, including B2B e-commerce,” Murphy added. “Fraudsters adapt very quickly to these scenarios and card not present (CNP) transactions.”

Fraud results in staggering losses each year

Fraud continues to be a major challenge in the payments industry, with 81% of financial organizations reporting fraud attacks in 2019. But there have been industry-wide advances in fraud prevention in recent years.

One of the most noteworthy advances is that a majority of merchants now accept EMV chip cards, making it harder for criminals to commit fraud with stolen cards in the physical world. “This has become a real deterrent to fraudsters,” noted Putney. As a result, “they’ve basically fled the card present market and moved most of their activity to card not present.”

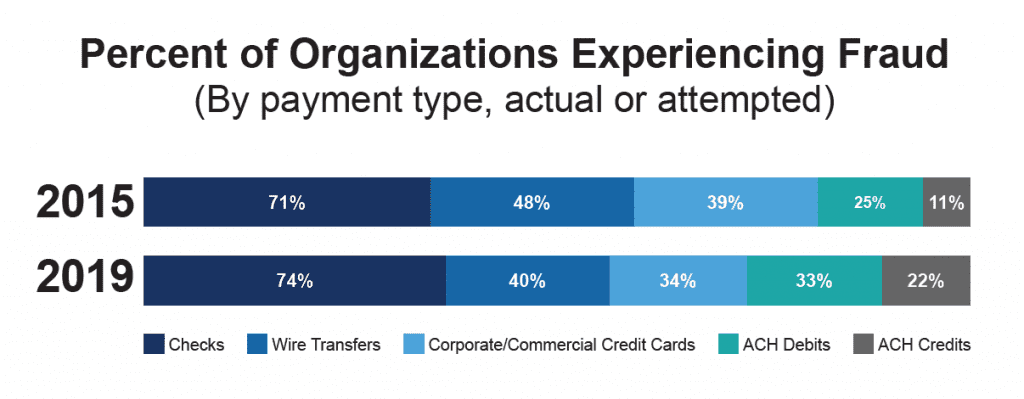

The chart below highlights recent fraud trends in the payments industry:

“While we’re definitely seeing trends for commercial card fraud shifting downward compared to other payment methods, global fraud losses were at roughly $28 billion in 2019, which is up from $24 billion in 2017” said Frommeyer. Out of the $9.5 billion in losses that occurred in the United States alone, CNP fraud made up around 42% of fraud attempts and 67% of total losses.

Fraudsters are growing more sophisticated

Fraud is an issue that’s ever present in the industry, and everyone has to have a proactive strategy to stay in front of it. As card issuers, merchants, networks, processors, and technology fraud management companies adopt machine learning to mitigate fraud, fraudsters are similarly beginning to rely on AI in their attacks.

They also use tactics like identity fabrication and manipulation of authentic personally identifiable information (PII), which can go undetected in older fraud prevention solutions designed to prevent more traditional methods of account takeover. Consequently, there exists a continuous need to improve the algorithms used to detect sophisticated synthetic fraud.

One such improvement is the shift to virtual cards and single use accounts that are only good for one transaction. “By moving from checks to virtual cards, there’s a lot of expense reduction, improvement in processes, and reduced attempts to commit fraud,” explained Putney.

It’s time to move away from checks

Although checks are still the largest component of B2B payments in the United States, suppliers have recently begun swiftly moving payments away from checks and onto cards. This move from checks to cards is finally occurring because organizations are finding that relying heavily on checks “just won’t hold up in the work-from-home environment,” said Putney. Adding that COVID-19 “has revealed that being dependent on somebody going into an office, loading the check printer, and stuffing envelopes can no longer be the norm.”

An integrated payables solution— a platform that can take an entire payables file from clients’ AP systems, including supplier invoices to be paid via card, ACH, wire, check and so on—makes executing those payments automated and seamless in comparison to check-based processes. Beyond reducing manual labor, integrated payables are much more secure, efficient, and enable organizations to have access to daily reporting that reconciles payments.

There’s a dual benefit of using virtual cards and integrated payable solutions. “There is an increase in days payable outstanding (DPO) for the payer and a supplier side benefit of decreasing their days sales outstanding (DSO),” explained Putney. “With the variable interchange rates available through networks today, this can lead to very cost effective transactions for suppliers who make smart decisions.”

How to learn more about integrated payables

BBVA, a leader in the payables landscape, worked with Mastercard to identify issues and opportunities pertaining to accounts payables automaton. The engagement lead to shared insights and process improvements around analysis criteria, cost benefit weightings, and expanded resources to share with clients.

Beyond its work with BBVA, Mastercard Advisors can support issuers across the whole supplier enablement process, from best practice workshops to end-to-end diagnostics with recommendations to holistic campaign communications development.

Recognizing the challenges, issues, and opportunities facing the B2B industry and impacting its own clients, BBVA recently launched its Ascend newsletter with mid-market organizations in mind. Frommeyer explained that recent Mastercard research focused on the middle market found that while large market companies will often research new solutions proactively, middle market companies tend to be more reactive given their leaner staffs, relying more on inbound market and sales information.

As a result, many of them “really appreciate direct outreach via email, which is exactly what the BBVA newsletter intends to do,” she concluded. Key topics covered in this issue of the newsletter are fraud prevention, integrated payables, and customer support.