With traditional branch-based banking on the decline as consumers embrace mobile apps to quickly and simply manage their financial needs, financial institutions are scrambling to adjust to the new world order of digital-first banking.

This trend has been accelerated as digital-native millennials –far removed from the days of queuing at a brick-and-mortar bank, meeting with a teller, and cashing physical checks – have come to dominate the workforce. And while most banks are committed to providing digital solutions to meet their customers’ financial needs, there is considerable room for growth.

Fintech developments have spurred a sharp increase in mobile banking, with 51 percent of mobile phone users accessing financial services via their phones in 2016, compared to only 18 percent in 2009. Not only is there competition among banks to create the best app experience, but in an era of innovative fintech solutions, competition extends to emerging non-bank players who offer money management tools as well. MagnifyMoney’s annual survey reviewed the best mobile banking apps of 2017, and while few apps made major improvements, the study found that no banking apps were perceived to be particularly bad.

So how can banks rise above the competition, improve their app experience, and stand out in an ever-expanding sea of options?

Fuss Over Features

Features come first and foremost. A Citibank survey found that 80 percent of people are likely to remain with a bank whose app that has five or more features. Consumers rely on their banking apps for a host of different purposes and needs, and banks need to design accordingly.

But which added features do customers want to see? App reviews on Apple App Store and Google Play Store provide some important takeaways: Consumers want quality customer service features, and given the nature of the services, users naturally prize security features, such as face-recognition and fingerprint-ID. Instant advice, personalized budget tools, and cash rewards programs are also popular with many customers, an Accenture survey found.

Hand Over Control

Naturally, customers want and expect to feel firmly in control of their banking experience. By giving users the right features to take ownership of their finances, banks can empower consumers and engender greater loyalty, forging mutually beneficial relationships. Money management tools such as budget notifications or insights derived from spending analytics will equip consumers with the kind of actionable information they need to make intelligent financial decisions. Similarly, apps that allow users to allocate their own funds or create customized spending schemes enable consumers to create financial plans that make sense for their own goals and aspirations.

A Knockout User Experience

Just as the users need to feel like they have a secure handle on the digital banking experience, so too they must feel like the app was designed for them. While mobile banking began as a cost-cutting strategy for big banks looking for ways to lessen traffic in their local branches, the focus has completely shifted. Over the last five years, banks have stopped emphasizing functionality for themselves and come to recognize the importance of user experience.

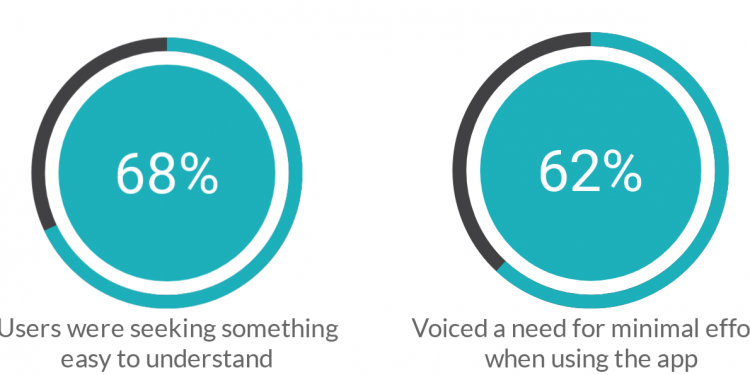

What good is having multiple great features if customers are struggling to navigate the app interface? When asked about their financial institution’s digital experience, 68 percent of users were seeking something easy to understand, and 62 percent voiced a need for minimal effort when using the app. Prioritizing UX means that app-users can perform any banking tasks with ease, from wherever they are.

Combining Forces

Coupling several high-demand features with an easy-to-use design will help facilitate a great mobile-banking experience. While this may not seem groundbreaking, tweaking the UX and adding features is the real difference between a good app and a great one. But the real takeaway is to remember who is using the banking app: When digital banking puts customers’ needs first, everyone wins.