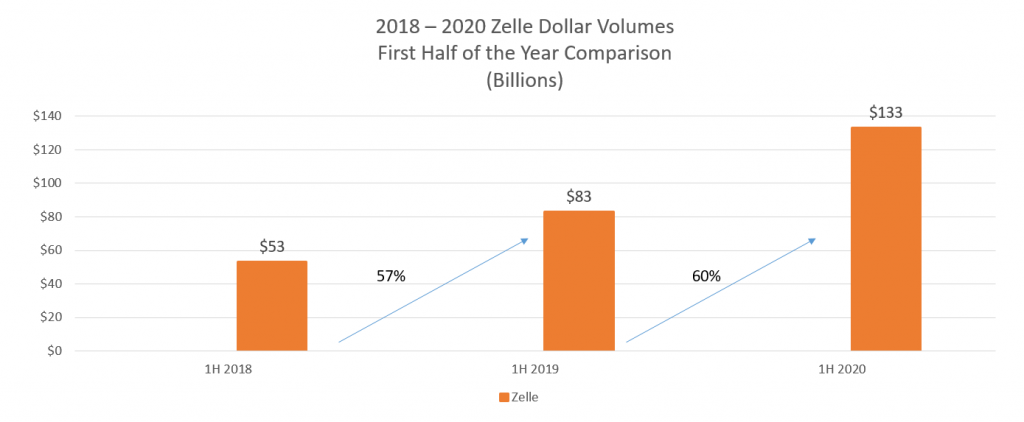

Early Warning announced results of Zelle person-to-person activity for the first half of 2020. As has been suspected, volume was up, way up, during the pandemic as consumers found greater need to pay others electronically as they interacted less in-person during lock downs and periods of curtailed activities. Here’s a graph of that past few years’ Zelle growth, comparing the first half of the year for 2018 through 2020:

As the press release outlines, the use cases have shifted:

Physical distancing requirements continue to drive strong adoption of Zelle, with enrollment growing 17% over the prior year. Active sender usage – those who have sent a payment in the past 90 days – increased by 43% year-over-year. Average transactions sent per user increased 10% year-over-year, with many consumers using Zelle to pay back neighbors for groceries or to send money to friends and family. Network-wide payment transaction values increased by 60% year-over-year, while payment transaction volume increased by 63%.

“Zelle has become an everyday essential for consumers who need to send and receive money fast,” said Lou Anne Alexander, Chief Product Officer at Early Warning. “Consumers across all generations have embraced Zelle during these challenging times as a contact-free way to safely exchange funds.”

While Zelle and other P2P apps continue to grow through new consumer adoption, and a greater use among existing users, Zelle will also grow as more financial institutions convert their existing portfolios of users to the Zelle network. A recently released survey of financial institutions from the Federal Reserve Bank of Boston: Financial Institutions across the U.S. Participate in the Mobile Landscape Transformation, indicates that 48% of institutions surveyed plan to implement Zelle. While these institutions are smaller in size, they will collectively contribute to future growth.

Overview by Sarah Grotta, Director, Debit and Alternative Products Advisory Service at Mercator Advisory Group