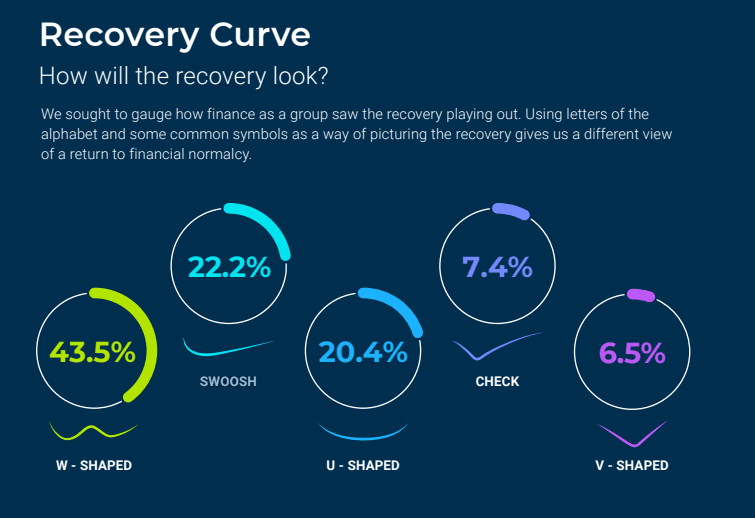

In an ideal world, the economic recovery from the COVID-19 crisis we’ve all weathered for months would be V-shaped, meaning a sharp rise back to pre-pandemic activity and beyond. It appears many organizations are expecting a different letter to symbolize the recovery, when we are all said and done.

Per the Treasury Coalition Global Recovery Monitor,an estimated 44% of treasury professionals expect the recovery curve to take a W-shape, meaning we might see a recovery and another dip in economic activity before we get back to what’s considered normal. A further 22% expect a “swoosh” and another 20% think a U-shape is in our future.

Regardless of the form that eventual recovery takes, it’s clear that “normal” is not upon us just yet, and the biggest concern for every business is the direct financial impact the experience is having. For nine straight weeks, Strategic Treasurer’s initial “Global Crisis Monitor” and “Global Recovery Monitor” found that financial impact was the number one concern for businesses surveyed, which is no great surprise.

Right now, businesses are by and large feeling trepidation. They’re building their cash reserves and feeling the negative impacts on liquidity that we would expect when their customers are reluctant to spend or slow to pay. Organizations are searching for process efficiency and cost cutting opportunities across business operations to allow them to weather the moment, and accounts payable and accounts receivable are key focus areas for finance teams.

Considering the fact that 58% of professionals surveyed by Strategic Treasurer have no plan to return to the office from work from home, finance teams are finding that short-term workarounds created to keep AP and AR running in a remote environment might become longer-term strategies to enable a virtual workforce that are efficient, effective and secure.

Most challenges represent a new set of opportunities, so what are the opportunities for finance teams to emerge better, stronger? There are three core areas businesses can focus on to help them survive the moment and thrive over the long haul.

1. Enhance accessibility

Finance teams have traditionally worked from the office, a necessity when paper invoices needed to be received, entered, approved and paper checks needed to be issued. There has been a steady shift toward digital processing of invoices and electronic payments, but that shift is accelerating quickly with finance teams working remotely.

The shift from in-office to home office accounts receivable, accounts payable and treasury effectively mandates staff having the ability to access documents and data via the cloud or their mobile devices. Without that access, those teams risk either traveling back and forth to the office or being unable to perform their core duties and keep financial operations running. Finding solutions that can provide this access, serve as an extension of any existing ERP and banking systems, and add greater visibility to cash flow and reporting is critical now, and the benefits of doing so will last well into the future.

2. Bolster security

In the Crisis Monitor, one in five businesses surveyed had not factored security into their business continuity plans. As my colleague Chris Gerda wrote in PaymentsJournal back in April, 82% of businesses were targeted by business email compromise (BEC) scams in 2019, and fraud incidents and sophistication are rising in the age of COVID-19. With AP and AR staff working from home, it’s harder to poke your head into an adjacent office or reach someone on the phone to verify that a bank account change or transaction is not fraudulent.

Better technology is necessary to fight back, preferably in the form of solutions that have an integrated approach to fraud detection and prevention, including machine learning, geolocation and multi-factor authentication. Organizations need to take the impetus of detecting fraud off staff that have enough on their plates and hand it over to solutions capable of doing so. Again, the benefits will resonate for years to come.

3. Transform into a digital-first organization

Better accessibility and better security are part of thinking digitally, but they’re not enough on their own. Taking a digital-first approach to invoices, payments and other financial documents is necessary to enable remote, from-anywhere workflows and approvals. Electronic payments like virtual card, ACH and real-time payments can strengthen buyer and supplier relationships during a time when cash flow and access to data are more important than ever.

Regardless of how you choose to tackle these priorities, the importance of tackling them shouldn’t be in question. If businesses are going to recover from COVID-19 and thrive in the future, digitizing and streamlining everything ranging from staff access to data to security to payments, matters now more than ever.