Identity checks during the account creation process are not simply a compliance exercise. They also present a golden opportunity to build trust and loyalty with consumers. By applying the most effective identity verification method based on the level of risk associated with a digital identity and transaction/activity, organizations can deliver an account opening experience that balances speed and security.

To learn more about the role of identity checks during account creation, PaymentsJournal sat down with Zac Cohen, COO at Trulioo, and Tim Sloane, VP of Payments Innovation at Mercator Advisory Group. During the conversation, Cohen and Sloane discussed data on consumer expectations, the benefits of identity checks, and what organizations can do to deliver an effective account opening experience.

Consumer attitudes have been shifting

The abundance of high-profile data breaches over recent years has influenced what factors consumers consider important during the online account creation process. In the past, consumers primarily valued speed. “We had a very high value put on how easy it was to create that account and how quick and seamless it was to start engaging with that service online,” explained Cohen.

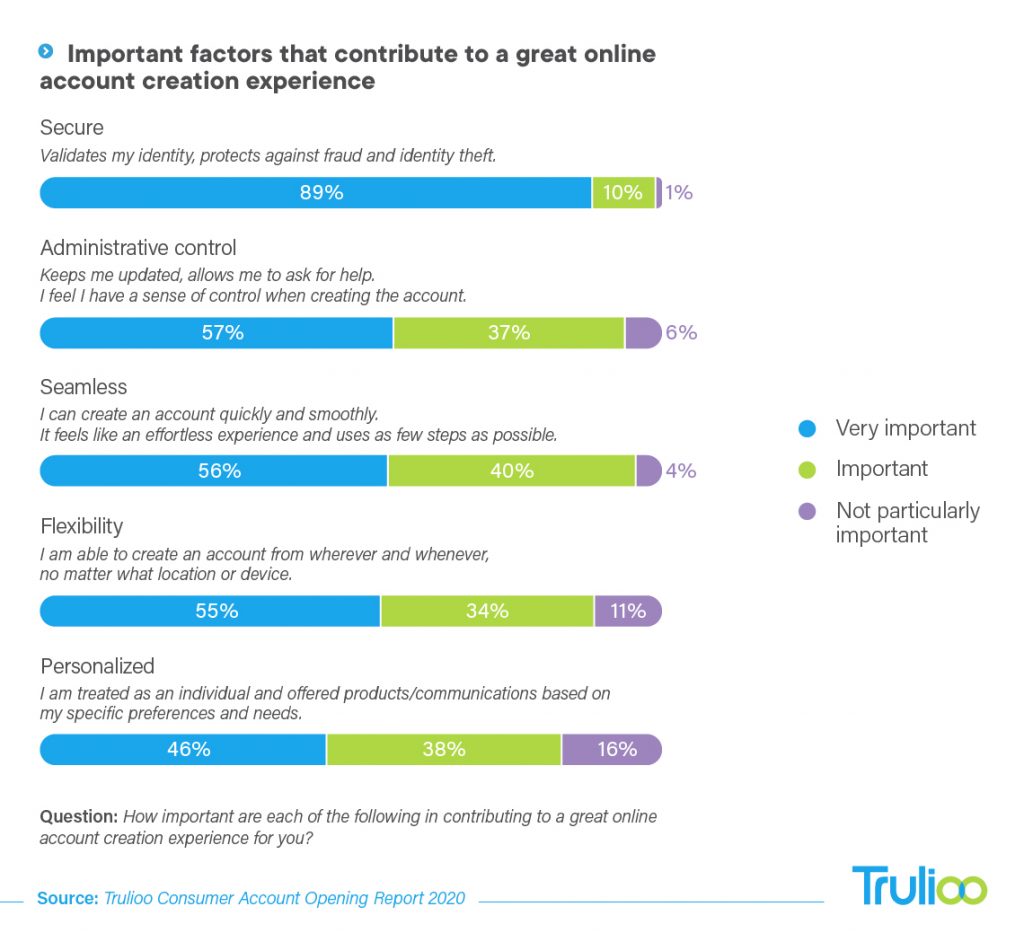

But as more and more people’s personal data was exposed online, security became a paramount concern for consumers. This change is reflected in surveys from Trulioo where the company had consumers rank which factors were most important to a great online account creation experience.

As the survey indicated, security is the most critical factor for consumers, with 89% reporting it was very important. Strikingly, only 1% of consumers viewed security as unimportant.

This shows that consumers “want to make sure that their information is safeguarded, that it is taken seriously and secure, and that the risk of their personal information being stolen and misused and abused is minimal,” said Cohen.

Sloane agreed, noting that data from Mercator Advisory Group reflected this broad concern for security as well. “The onboarding process and the ability to authenticate the user is a critical aspect of building customer trust,” continued Sloane. Having established that consumers are overwhelming concerned with security, Cohen and Sloane transitioned to talking about how companies can provide what consumers want.

Building trust and loyalty through identity checks

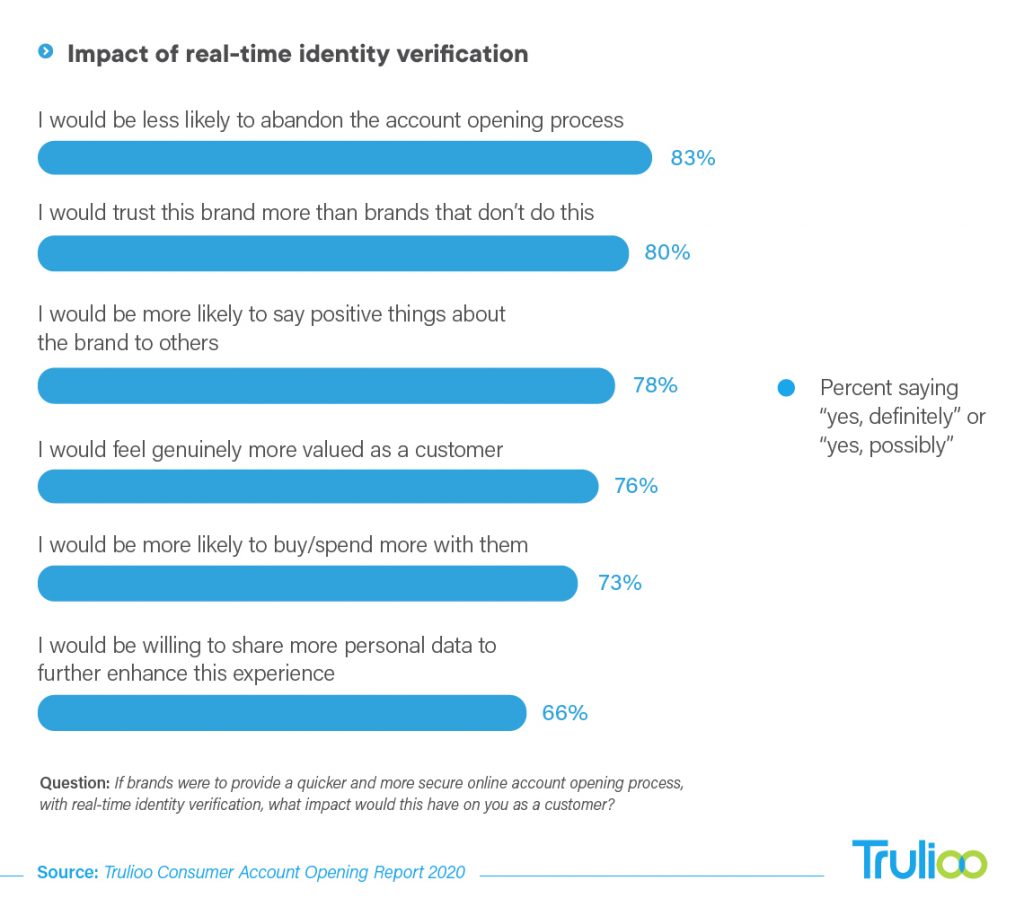

An effective identity check solution needs to be operating in real time. As the Trulioo survey revealed, 83% of consumers are less likely to abandon the account opening process if real-time identity verification is offered. In fact, real-time verification leads to a bevy of other positive responses from consumers, ranging from an increased trust in that company to feeling more valued.

Survey findings like these make salient the importance of the account sign-up process. By simply offering real-time identity verification, a company can improve the customer experience significantly. Cohen put it simply: real-time identity verification “is the golden opportunity to build trust with your consumers.”

Calibrating solutions for individual companies

Implementing an effective verification solution depends on the needs and risk tolerance of the company in question. Since different companies have different customer profiles, engage in different types of online interactions, and face varying levels of risk, there is no solution that works for everyone.

Cohen explained that Trulioo works with its clients to find the solution that will work best for that company’s unique needs. This process often entails bringing different stakeholders into a conversation together, including risk and compliance teams, and the personnel focused on user experience.

“When you have all of those minds meeting together, you’ll actually see quite a clear strategy so that we can satisfy each element and leverage the right amount of friction,” explained Cohen. Moreover, the amount of friction can change depending on which stage of the process the customer is in.

Cohen offered an example involving opening a new bank account. When someone first makes the account, they could be presented with a simple verification prompt. But when someone then attempts to transfer large sums of money—an action that comes with more risk than simply making an account—they would then be presented with a more involved verification prompt.

By utilizing such an approach, “you can balance the interaction and the access that consumers have with your service and introduce the right level of identity or fraud checks along the way,” said Cohen. He contrasted this method with the common alternative of “choosing a zero-sum game where you believe that you have to do all five of these things right at the get-go before anyone can access anything.”

Sloane agreed with Cohen and pointed out that securing the account creation process is essential due to how common fraudulent activity is. “Over 80% of all the current account opening efforts are primarily criminal activity,” he said.

Conclusion: Finding the right solution requires constant testing and customization

As discussed, there is no one-size-fits-all solution for securing the account creation process. Instead, the most effective solution will vary by use case and company. To figure out which solution works best for your company, Cohen stressed that companies should “actually test real-life scenarios to understand what the reaction would have been with a certain tool or service.”

If the solution being tried would not have adequately dealt with that test example, then the company should consider other solutions. Moreover, companies should be sure that the solution is tailored to their specific niche.

Cohen offered an example to illustrate why specificity matters. Two companies may both handle payments but one could be based in North America while the other is in Lithuania. Further, one company could cater to a much older demographic while the other serves teenagers. These differences matter because patterns of normal behavior would almost definitely differ between the two customer bases. Thus, a solution that works well for one company might not work as well for the other.

Finally, since fraud is always changing, companies need to stay agile and flexible in their fraud prevention solutions. And it’s not just fraud that’s changing. Cohen noted that regulations, customer habits and expectations, and a company’s product offerings change over time, sometimes even on a monthly basis.

“So you want to use a technology solution that has that built-in flexibility so you can customize it, evolve it over time as well,” concluded Cohen.

To download the Trulioo Consumer Account Opening Report 2020, fill out the form below