Ant Financial today launched the Software-as-a-Service (SaaS) version of its technology product OceanBase, a financial-grade distributed relational database that has been a key computing infrastructure for Alipay since 2010.

OceanBase is highly stable, scalable, reliable and budge-friendly compared to other traditional database solutions. In October 2019, OceanBase was ranked number one in terms of performance by the Transaction Processing Performance Council (TPC), a global non-profit that defines transaction processing and database benchmarks.

It became clear in 2010, two years after Alibaba first launched its annual 11.11 Global Shopping Festival, that traditional commercial database solutions could no longer keep up with growing user demand for a seamless, stable, scalable, and reliable payment experience on Alipay. In response, Ant Financial began to develop OceanBase, and finally replaced all legacy database solutions with this new financial-grade product in 2016.

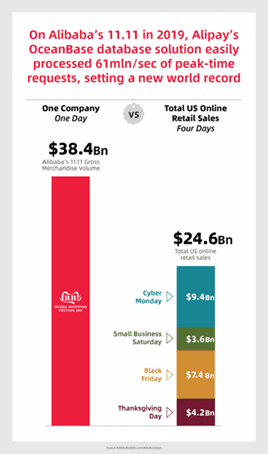

OceanBase processed 61mln/sec of peak-time requests during the 2019 Alibaba 11.11 Global Shopping Festival

During the 11.11 Global Shopping Festival in 2019, Alibaba’s Gross Merchandize Volume (GMV) reached USD$38.4 billion in just 24 hours. This exceeded the total online retail sales of USD$24.6 billion generated during U.S. retail’s biggest shopping holidays in the same year, from Black Friday to Cyber Monday, according to data compiled by Adobe. OceanBase adeptly and swiftly processed all transactional database requests during the 11.11 Global Shopping Festival, including at a peak of 61 million per second.

In September 2018, Ant Financial announced an initiative to open up a full suite of its technology products to support the growth of financial institutions, including helping them to optimize the user experience and reduce costs. Since then, various major financial institutions, such as China Construction Bank, Bank of Nanjing, PICC Health, Bank of Suzhou and Guangdong Rural Credit Union, have deployed the OceanBase database solution. OceanBase has helped to improve their database query capabilities, support broader business operations and significantly reduce software and hardware costs.

The launch of the SaaS version of OceanBase marks a new milestone. The SaaS solution will provide a more flexible and cost-effective option to small-and-medium enterprise customers and developers, enabling them to access all of the computing capabilities that OceanBase has to offer.

To date, Ant Financial has provided more than 100 technology products and solutions, accelerating the digital transformations of over 200 financial institutions.

To learn more about the SaaS version of OceanBase, please visit its product page.