CO-OP Financial Services will be demonstrating how it can help credit unions build deeper relationships with members by owning more “life moments” during three days of exhibition at CUNA GAC, starting Sunday afternoon.

As the dedicated payments and digital engagement partner for credit unions, CO-OP has built an ecosystem of payments and fintech solutions designed to speed the path towards Primary Financial Relationship status with members. During GAC CO-OP will showcase how payments are the way to increase member engagement, allowing credit unions to own more member moments and leading to more revenue opportunities.

“Credit unions excel at helping members at key life stages, such as lending for education or a home; but they can also grow the overall relationship by being equally good at servicing their lifestyles through payments,” said Samantha Paxson, Chief Experience Officer for CO-OP. “At GAC, we will show how the CO-OP Pay, Integrate, Engage, Protect and Consult solution lines are designed within our ecosystem to maximize member engagement, usage and delight. It is what will help credit unions stay top of the wallet for the things their members do every day.”

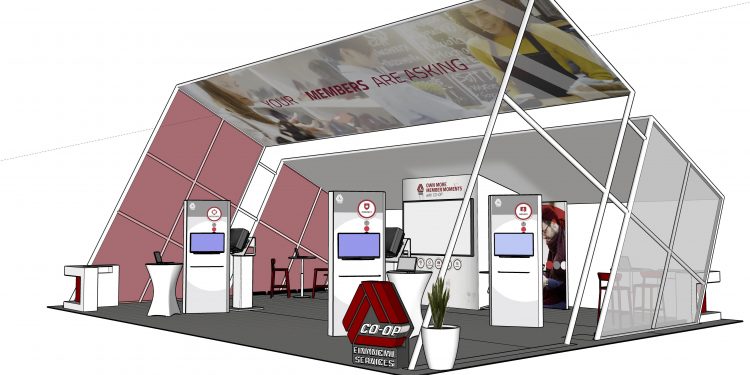

CO-OP will be in booth 301, right at the entrance of the GAC exhibition hall. Highlights of CO-OP’s presence include:

- CO-OP will kick-off exhibition hours on Sunday, February 23, from 5 p.m. to 7 p.m. with a celebration featuring a mixologist and D.J.

- Live demonstrations of CardNav by CO-OP, a card controls and alerts app, enabling members to manage both credit and debit cards from a single account; and CO-OP Developer Portal, an Application Program Interface management system that houses CO-OP APIs in a single, digital library, enabling credit unions to more quickly deliver new services to their members.

- CO-OP will host the CO-OP Networking Lounge, located on the same floor as the GAC registration area. The Lounge will offer busy conferees an opportunity to connect with colleagues, check email, or just rest and recharge with some feet-up time.

- A drawing will be conducted during the conference with the winner receiving a free trip to CO-OP’s THINK 20 conference, being held in Dallas, Texas, May 4-7, 2020. Details are available at the CO-OP booth (#301) and the winner will be announced at the booth at 3 p.m. on Tuesday, February 25.

- CO-OP’s President/CEO Todd Clark will be among the panelists of a breakout session on “Data Privacy,” running from 3 p.m. to 4:15 p.m. on Tuesday, February 25. Conferees can check the GAC agenda for exact location upon arrival.

- CO-OP is a sponsor of the GAC Closing Party, starting at 7 p.m., Wednesday, February 26, at the Marriott Marquis, near the Walter E. Washington Convention Center.

Exhibition hours for GAC 2020 extend from Sunday, February 23, through Tuesday, February 25, and is being held in Washington, D.C.

For more information, visit www.coop.org.

About CO-OP Financial Services

CO-OP Financial Services is a payments and financial technology company

whose mission is ensuring the success of the credit union movement. CO-OP

payments solutions, engagement services and strategic counsel help credit

unions optimize member experiences to consistently provide seamless,

personalized multi-channel offerings, while delivering secure, sophisticated

fraud mitigation service. For more information, visit www.co-opfs.org.