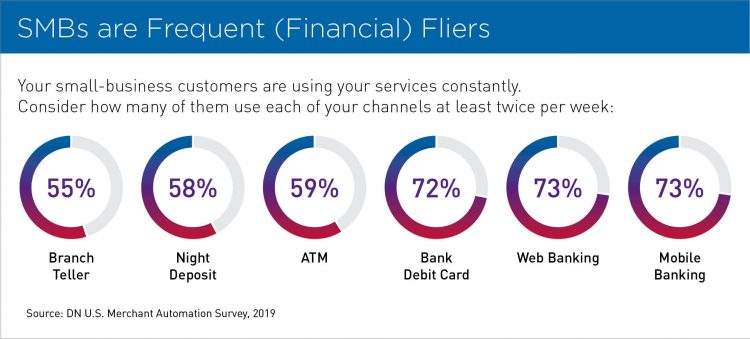

Small business is actually really, really big business in the United States. A whopping 99.9% of all companies in the U.S. have fewer than 500 employees and are classified as small by the U.S. Small Business Administration. Small and medium businesses (SMBs) are the most active and profitable segments in retail banking (see Fig. 1)—and when you own the business relationship, you can likely monetize the personal banking side as well.

In the current environment, servicing the SMB market means grappling with inherent paradoxes.

Financial institutions (FIs) are at a crossroads: in a recent poll we conducted with banks and retailers, 85% of FIs say the merchant segment is a growing focus, but only 28% say their service offerings to merchant clients are sufficient. In the current environment, the bulk of interactions with the SMB segment are transactional in nature, and often the bank isn’t interacting directly with the business owner but rather a staff member who doesn’t have an ownership stake in the business itself.

These transactional interactions are labor-intensive, cash heavy and often occur during a branch’s busiest times. Then there’s the management and reconciliation of after-hour deposits, which can be costly and time-consuming. But the biggest challenge in serving this critical segment may be the paradoxical ways they view their relationship with their bank:

- Getting in and out of the branch quickly is paramount as time is money for sole proprietors and SMBs with just a few employees … yet they value the connection and personal touch of engaging directly with someone at the bank who knows them and knows their business history.

- Three out of four merchants we polled say they would like to use automated or self-service technology to conduct business withdrawals and deposits … yet more than half say that if they were forced to use self-service instead of a teller, they would consider switching banks.

The evolution of banking is happening, but FIs must address the problem of inertia.

Until recently, self-service solutions often couldn’t provide the level of support SMBs need. Deposit bundle acceptance and withdrawal limits were designed for the average consumer, not a business professional with large daily cash-in and cash-out requirements. The after-hours deposit process left SMBs waiting hours or days for reconciliation and funds availability. And retailers were faced with the prospect of leaving their business (and forgoing sales) to run to the bank, or sending staffers out to make deposits, collect floats and change and break large bills.

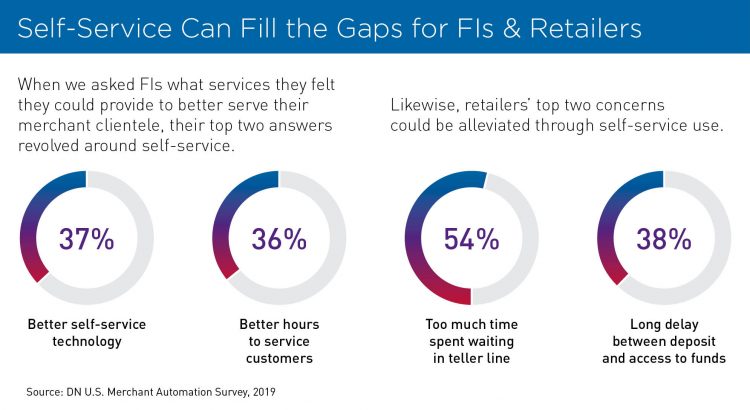

Yet retailers and FIs both express a desire to use automation where it makes sense (see Fig. 2).

Modern self-service has evolved to accommodate SMBs’ distinctive needs. Our new line of self-service systems, DN Series™, enables larger, envelope-free cash and check deposits, more flexibility in denomination choice and immediate funds availability. Paired with new mobility and cardless access solutions, retailers even have the option to administer a one-time PIN or QR code that staffers can use with their own mobile devices (and not limited function “deposit only” merchant cards) to conduct transactions, ensuring greater security when business owners can’t get to the bank themselves. And they can do it all when they want, without the limits of bankers’ hours.

Define the journey, then educate SMBs to choose the new path.

One of the first steps we take in the branch is working with FIs to develop a playbook that includes lobby management, self-service education for staff and consumers, and specific action items for employees. Lobby leadership and consumer education are crucial to the success of new self-service implementations.

The cash cove on DN Series, for example, is the enabler for much larger bundles, but consumers don’t necessarily intuit the reason for the change. The right concierge or lobby manager can recognize an SMB as they enter the branch, direct them to a self-service terminal and describe the benefits of new features like the cash cove, cardless access, etc. Branch staff can also point out the features that are especially beneficial to an SMB, including e-receipts that make tracking cash much easier and streamlined, and electronic pre-staged transactions that are more secure, traceable, reconcilable and allow for instant account credit of cash deposits.

Remember, your goal may not be to migrate ALL your business transactions to self-service; depending on your branch environment, it may just migrate long lines at the teller to long lines at the ATM. But in a world where nearly a quarter of SMBs we polled say they engage with a branch teller daily, it’s only common sense to offer these key customers more options that fit their needs. Plus, educating and empowering SMBs to bank the way they choose can help deepen their relationship with your brand, while enabling you to repurpose staff to conduct higher-value transactions and focus on advisory conversations.

Learn more about Diebold Nixdorf’s revolutionary new line of self-service systems at DieboldNixdorf.com/DNseries.

Fig. 1

SMBs are Frequent (Financial) Fliers

Your small-business customers are using your services constantly. Consider how many of them use each of your channels at least twice per week:

Branch Teller: 55%

Night Deposit: 58%

ATM: 59%

Bank Debit Card: 72%

Web Banking: 73%

Mobile Banking: 73%

Source: DN U.S. Merchant Automation Survey, 2019

Fig. 2

Self-Service Can Fill the Gaps for FIs & Retailers

When we asked FIs what services they felt they could provide to better serve their merchant clientele, their top two answers revolved around self-service:

Better self-service technology: 37%

Better hours to service customers: 36%

Likewise, retailers’ top two concerns could be alleviated through self-service use:

Too much time spent waiting in teller line: 54%

Long delay between deposit and access to funds: 38%

Source: DN U.S. Merchant Automation Survey, 2019

About the Author

James Flannery, Global Advisory – Banking Channel Transformation

Jim Flannery is a Senior Manager for Diebold Nixdorf’s global advisory services business. Jim is responsible for the database management and development activities within DN’s advisory services practice. This includes functions related to the collection, processing, and data modeling – as well as the integration of the analysis into new products and services. Jim is an expert with customer profiling and segmentation, channel profiling, and location based channel optimization.

In his 19 years with Diebold Nixdorf, Mr. Flannery has participated in hundreds of customer engagements specializing in customer analysis, consumer research, delivery channel usage, behavior analysis and location planning. Jim has extensive international experience working with Bank’s customer data in all parts of the globe. Prior to joining Diebold Nixdorf Jim has worked in advertising and has held various positions with SoftBank Services Group and ClientLogic

Flannery completed a BS degree in Management Information System from Canisius College in Buffalo, NY.