When people have a conversation in person they don’t only listen to what’s being said. In addition to the spoken words, they read each other’s body language and take into account the context in which the conversation takes place in order to accurately understand the intent behind the words.

While chatbots can be trained to navigate some behavioral clues – e.g. typing in all caps, certain phrases that communicate anger or dissatisfaction – they are still challenged to adequately interpret customer intent without a more complete understanding of the context in which they start the conversation.

This is especially true when it comes to money matters.

Financial institutions view the chatbot as a vehicle to deliver better service and a more satisfying customer experience by engaging customers in natural, “human-like” conversations.

At the same time, they run the risk of creating an experience that falls far short of customer expectations. Without a clear understanding of each customer’s unique situation, even the best natural language processing model may fail to adequately address the customer’s needs.

When dealing with one’s finances, the bar is set especially high. Achieving an accurate understanding of the customer’s intent and needs in the course of an interactive conversation requires real-time analysis of transaction and account information – as relaying information that is not 100 percent current can be damaging to the customer and instantly erode trust in the financial institution.

Rather than relying solely on the customer’s words, a smart chatbot can simultaneously analyze the customer’s up-to-date financial data to construct a more accurate and complete understanding of the customer’s intent during the conversation. Compare it to stepping into a branch where every bank employee not only knows you by name, but has a 360-degree understanding of your finances the minute you walk in.

Armed with that knowledge, the bot can conduct an intelligent conversation that not only accurately responds to service requests but goes a step further to proactively offer personalized guidance.

Here are a few scenarios of how a chatbot’s advanced understanding of the customer’s financial body language comes into play:

- Reading contextual clues around the action the customer is trying to perform

Chatbots should be skilled at analyzing context – in its most simplistic use the context may include information such as the latest customer activity. A question such as, “what are your current interest rates?” may be interpreted differently when invoked while the customer is looking at the mortgage page vs. the savings page.

- Evaluating the customer relationship with your institution

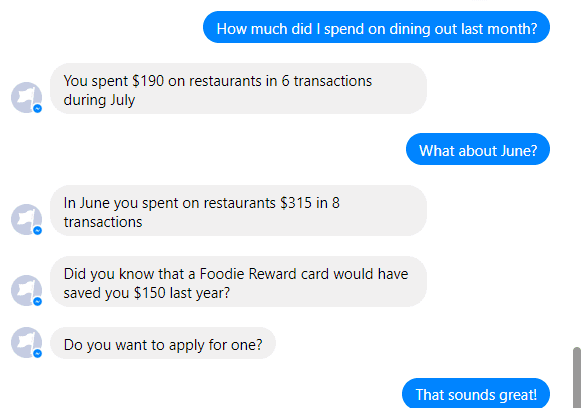

Knowing which products are frequently used and whether the customer is eligible for rewards or promotional offers can further help tailor the chatbot’s response, as outlined in the following example.

- Analyzing real-time account and transaction data

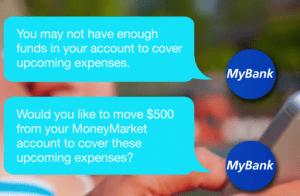

When a customer asks about overdraft options, the chatbot should be able to interpret the question in the context of the person’s account status at that moment, such as current funds available and whether overdraft protection is in place. Using predictive analytics capabilities, it can even consider whether the account is expected to be overdrawn in the coming weeks and tailor the response accordingly.

The proactive bot: using financial ‘body language’ to anticipate customer needs

Customers have a life to lead, and keeping tabs on their bank account – while important – is not always top of mind. While customers go about their day-to-day lives, a smart bot will observe their financial body language. It will analyze transaction data to anticipate customer needs – offering tips and advice that can help the customer avert trouble ahead of time.

These tips can be simple – like which card to use to avoid foreign transaction fees while traveling abroad – or more sophisticated – such as alerting the customer on a low balance based on cashflow forecast for the coming week.

Machine learning: enabling constant improvement

Machine learning: enabling constant improvement

As well as your bot was designed, it can always get better. Analyzing the way individual customers react to the chatbot message – tapping to read more, engaging in a conversation, or just ignoring it altogether – as well as explicit feedback offered by the customer (e.g., rating the interaction) provide valuable input that can be used to improve future interactions. Using machine learning technologies, the chatbot can adjust to individual preferences and get smarter with time – delivering highly personal conversations that keep customers engaged and satisfied.

Not all bots are alike

Creating a bot is easy these days – more than 100,000 Facebook bots were created in just one year. Creating a good and useful chatbot is a whole different story. Many financial institutions are actively testing and working on chatbot projects, but will they be up to the challenge?

Machine learning: enabling constant improvement

Machine learning: enabling constant improvement