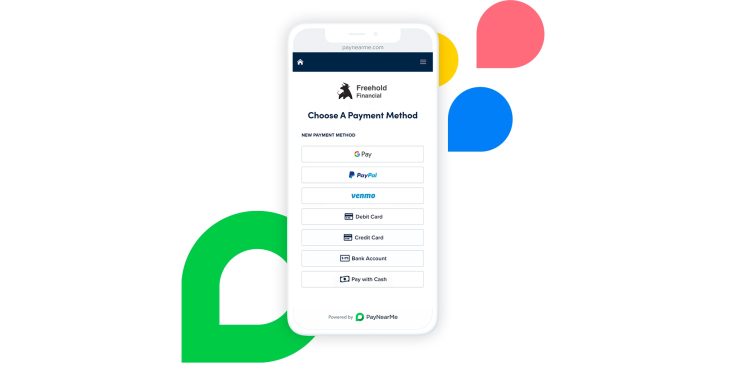

SANTA CLARA, Calif., February 15, 2022 – PayNearMe, the modern and reliable payments platform known for making payments easy for both businesses and customers, today announced the addition of PayPal and Venmo to its growing list of modern payment options in the US. These new digital wallet payment types allow businesses to offer their customers more choices for convenient and frictionless payments.

“Consumers are growing increasingly comfortable using mobile payments to purchase goods and services as well as exchange money with friends and family. Now, they expect the same fast, frictionless experience to make payments and receive disbursed funds,” said John Minor, SVP Product and Support, PayNearMe. “With the addition of PayPal and Venmo, we’re helping businesses meet customers where they are by enabling payments at any time, anywhere, and in any way they want to pay — including credit, debit, ACH, Apple Pay, Google Pay, PayPal, Venmo or cash.”

With more than 400 million active accounts, PayPal is poised to quickly become one of the most widely used payment methods for non-commerce transactions. In fact, 43% of U.S. consumers surveyed say the convenience of using PayPal to pay bills is important or very important, according to PayNearMe’s recent bill payment study.

The same study showed more than 1 in 4 consumers (27%) point to Venmo as a preferred way to pay their bills. Venmo’s popularity is largely driven by the 35% of Gen Z and millennial consumers who want to have the option to use Venmo to pay their bills.

PayNearMe’s native integrations with PayPal and Venmo work out of the box — no third party apps or plugins are required. All transactions are saved to a single ledger to help ensure the reconciliation process is easy for businesses accepting these forms of payment.

Making a payment with PayPal or Venmo is also fast and easy for consumers. There is no need to manually enter credit card details and other personal information. This means transactions can be executed with a single click (or tap), reducing friction and improving the overall customer experience. Consumers can even make a payment with their existing PayPal or Venmo balance, making the process seamless for those who often use these apps and hold a balance.

“Consumer adoption of PayPal and Venmo has grown exponentially since the beginning of 2020 and we expect it to become one of the fastest growing payment types for bill pay and other non-commerce transactions.” Minor said. “By adding PayPal and Venmo to our platform, PayNearMe clients across vertical markets can quickly and easily begin accepting these popular payment types, which will go a long way toward satisfying customers’ expectations.”

PayPal and Venmo disbursement options will be generally available in Q2 2022.

About PayNearMe

PayNearMe develops technology that drives better payment experiences for businesses and their customers. Our modern, flexible and reliable platform helps businesses increase customer engagement, improve operational efficiency and drive down the total cost of accepting and managing payments. PayNearMe enables more ways to pay by offering major payment types and channels in a single platform.

PayNearMe today processes a variety of payment types including debit, credit, ACH, Apple Pay, Google Pay, PayPal and Venmo, and has enabled cash payments through our proprietary cash network since 2009. PayNearMe cash payments are accepted at more than 31,000 retail locations in the U.S. including participating 7-Eleven®, Walmart®, Family Dollar®, Casey’s General Stores®, and ACE Cash Express®, among others.

Thousands of businesses partner with PayNearMe to manage the end-to-end customer payment experience in industries such as Consumer Finance, Property Management, Insurance, Utility and Municipality, and iGaming and Sports Betting.

To learn more about PayNearMe, please visit www.paynearme.com. Follow PayNearMe on Twitter, LinkedIn and Facebook. The PayNearMe service is operated by PayNearMe MT, Inc., a licensed money transmitter.