Buy Now, Pay Later (BNPL) has exploded over the past year as a payments method. Although the general concept is not particularly new – buying items “on layaway” was popular for decades after the Great Depression, and installment lending was the most popular form of credit prior to 1977 – BNPL has recently seen a massive resurgence, no doubt in part due to the financial uncertainty brought on by the COVID-19 pandemic.

As with any payments method that operates on some form of point-of-sale credit, the primary concern for merchant adoption of BNPL is ensuring that purchases are consistently repaid. Fintechs that offer BNPL must make decisions about which payment types they will accept to settle outstanding transactions. While credit and debit cards are both very popular, one potentially overlooked method is the Automated Clearing House (ACH) Network.

To learn more about the benefits of ACH for BNPL repayment, PaymentsJournal sat down with Brad Smith, Senior Director of Industry Engagement and Advocacy at Nacha, and Sarah Grotta, Director of Debit and Alternative Products Advisory Service at Mercator Advisory Service.

What BNPL offers customers and merchants

There are two main types of BNPL payment. One is a kind of one-off personal loan that tends to be used for the purchase of more expensive items. The other is a “pay in x” model where the customer pays in three or four installments spread out over a longer period. Exercising some flexibility around how and when people make payments is obviously very attractive from a consumer standpoint.

“I think a lot of individuals – given what’s happened during the pandemic – they’ve had a lot of income volatility,” said Grotta. “They’re really not sure what they’re going to be earning over the next, say, month or so. The opportunity to plan for certain purchases in smaller increments can be really helpful.”

Renewed interest in BNPL as a budgetary tool may also be a generational thing. “There are consumers out there in that millennial age group that might be a little bit averse to using credit,” Smith added. “I think that they’re more into being able to spread out the payments as opposed to putting everything on their card.”

As for merchants, there is both value in investing in payments options that are demonstrating significant growth, and value in terms of how BNPL affects consumer behavior. “Shopping cart abandonment is a big deal in the merchant space, especially online,” said Smith. According to a PayPal study, 64% of consumers are more likely to purchase what they have in their cart if they are offered an option to pay in installments with 0% upfront.

The FI perspective – and how ACH can help

While BNPL may be mutually beneficial for merchants and consumers, financial institutions may be left out of the conversation. Smith cited a McKinsey study saying that in 2020, Buy Now, Pay Later was a $97 billion industry that pulled away $8-10 billion in annual revenue from banks. If BNPL continues to grow, as it looks poised to do, that will turn into a larger loss for FIs. “I think they need to be concerned by lost revenue from card swipes, whether it’s debit or credit, or lost revenue from installment loans,” said Smith. “If banks have not been focused on how to combat this potential loss due to Buy Now, Pay Later, they really should be.”

One solution that may help is introducing ACH to the BNPL process. Certainly, banks will want their services to be included in the payments process. “Any way that financial institutions can be a part of the repayment option is great to the extent that they can remind consumers about the opportunity to utilize one of their products,” explained Grotta. “Further repayment, including ACH, including their checking account, would be helpful. That way, a bank has the opportunity to include themselves in Buy Now, Pay Later.”

Smith added: “Barclays and First Citizens have offered their own products to merchants. So, those financial institutions can stay right there and be part of that payback process, so as to reduce the potential for loss from other payment types.”

Convenient, reliable, cost-saving

Granted, what is best for banks is not necessarily what is best for merchants or consumers. So, why would a BNPL provider want to include ACH as a payment option?

The answer is all about maintaining an uninterrupted repayment process. If, for example, the repayment of an item is spread out over 24 months, the card on file to make that payment could easily expire before the final payment is due. Bank accounts, however, don’t expire. “By using ACH, the payment comes out of a bank account,” said Smith, which will “create a much more steady flow of payments back to the merchant.”

ACH is also likely less expensive than other payment methods. Smith clarified: “If they’re offering a longer term loan at 0% and their margin is slim, offering ACH is going to help those Buy Now, Pay Later merchants keep those costs down.”

This, too, will ease the process for the consumer, insofar as the consumer is uninterested in payment delinquency. With ACH, consumers will not have to update their payment information every time a new card comes in the mail, and they will not have to worry about incurring undue interest. “If you get those payments coming out of the banking account by ACH, you’ll see a much more consistent, lower return level type of payment,” Smith added.

ACH is the best option for BNPL

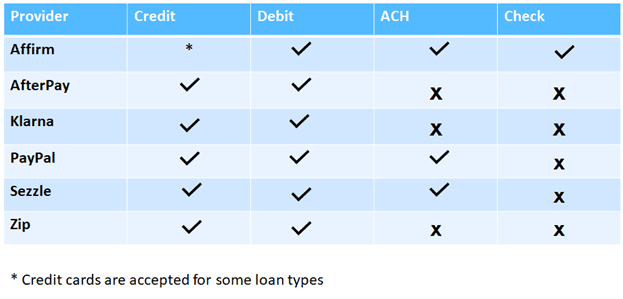

Among six fintechs surveyed [see below], only half offered ACH as a repayment method – Affirm, PayPal, and Sezzle. The other half did not – AfterPay, Klarna, and Zip. But between the tremendous growth of Same Day ACH and the modernization of the ACH Network in the U.S., it may be the strongest option. “I think it really should be prioritized as the number one payment method,” Smith emphasized.

In these unsteady times, finding a flexible and reliable spending model is imperative for consumers. “I think ACH is a much better financial planning solution for those individuals who might perhaps be overextending themselves,” concluded Grotta, who recently published a study on the influence of BNPL. “I just appreciate the opportunity to offer every payment type that isn’t a credit option.”