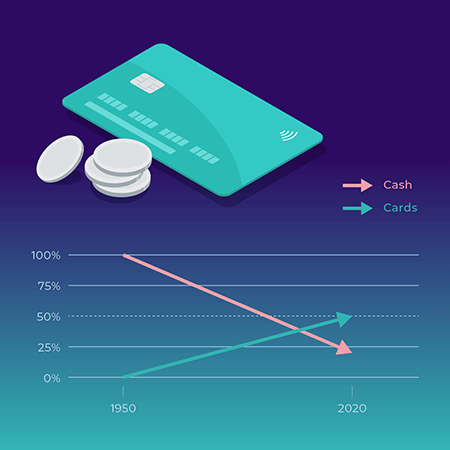

The world’s first payment card was introduced in New York back in 1950. A year earlier, businessman Frank McNamara was dining out; when it came time to pay the bill, he realized that he had forgotten his wallet. Luckily, his wife saved the night and paid the tab. This embarrassing incident sparked the idea to create a card to pay instead of using bills and coins1—the Diners Club Card was born. There and then, the global migration from cash to card payments was ignited. Ever more merchants offered their customers the option to pay by card as an alternative to cash, and ever more consumers migrated their payments from cash to card. The increase in card payments has been steady year over year ever since. Fast-forward 70 years and card payments have proved to be an enormous success; breaking the 50% barrier for the first time in 2020 (more than 50% of the world’s in-store payments were by card).2 This makes cards by far the most used method of payment globally. During the same period, cash payments have gone from virtually 100% in 1950 down to 20% in 2020.3

The first Diners Club Cards were made out of cardboard with printed ink displaying the card details. In 1959, American Express introduced plastic cards.4 In the 1970s, cards with a magnetic stripe (magstripe) containing the card details emerged, which in many markets were replaced by chip cards some 20–40 years later. Quite recently, the migration from contact to contactless cards was set in motion, and today almost 70% of all the world’s issued cards are contactless.5 Contactless cards are tapped onto the payment terminal, as compared to swiped through or inserted (dipped) into the payment terminal. The Covid-19 pandemic accelerated the migration from swiping and dipping to tapping as 82% of global consumers “view contactless as the cleaner way to pay”6 when seeking to decrease cash usage and physical contacts. According to Mastercard, between Q1 2020 and Q1 2021, “more than 100 markets saw contactless as a share of total in-person transactions grow by at least 50 percent”.7 As cards replace cash, contactless cards have allowed even small purchase amounts (historically carried out with cash) to be made by card, “where propensity to pay with cash has fallen, the shift has almost entirely moved to contactless payments”.8

Physical cards gearing up for the future

As we just mentioned, the original cardboard payment cards were replaced by plastic cards some 60 years ago. In 1999, yet another milestone in the development of payment cards was marked when American Express launched the Centurion card, made out of titanium.9 This by-invitation-only card targeted the most high-end range of customer. In more recent years, a combination of new technologies and evolving consumer preferences has made the usage of metal cards evolve from only High-Net-Worth customers to the growing mass affluent segment. A textbook example of how appealing metal cards are to this segment is the 2016 launch of the Chase Sapphire Reserve metal card. Interest in this card was so high that Chase ran out of the material to mint it within weeks of the launch.10 Also, FinTechs and Neobanks have recently proved that metal cards are an incredibly efficient asset when establishing and building their novel brands; not least towards the growing Millennial segment.

Even still, a vast majority of the 6 billion payment cards produced each year11 are PVC plastic cards. One of many environmental challenges we now face is how to make sure this plastic doesn’t end up in our oceans—there is a 1 to 5 ratio of plastic to fish by weight in our oceans today. If we continue at the current pace, that ratio will be 1 to 1 by 2050.12 In order to contribute to a circular paradigm and a sustainable future where, for example, plastic waste is recycled instead of ending up in landfills or potentially in our oceans, we now see the payment world rush to cards made out of recycled PVC.

In 2019, Thomas Likar from PayPal wrote, “If there’s one word to describe the direction that the payments industry has headed over the past year, I think it’s this: convenience”.13 Most payment developments will eventually strike a balance between convenience and security. At no other time in payments history has this been more evident than with the introduction of biometric readers incorporated onto physical cards. Instead of entering a PIN, the cardholder simply touches the card’s biometric reader. Not only is this very convenient, it is an extremely secure method as the cardholder’s fingerprint authenticates the payment.

Physical cards as a tangible symbol of trust in a digital era

We can cite many examples in recent history where the physical has been replaced by the digital: CD collections have given way to Spotify, video rental stores have been replaced by streaming services, and you hardly ever see someone reading a newspaper on the morning commuter train anymore. However, many physical form factors remain. Most of us still scribble down notes in a physical notebook and continue to read paperback books. Even companies like Google still use paper in the first stages of product design. In fact, it’s mandatory for all Google designers and engineers to take a mandatory course on how to draw on paper rather than a tablet.14 In a further example, US book sales of hardback, paperback, and mass market books have increased from 72% of total book revenue in 2018 to 74% in 2020.15 During the same period, the share for e-books dropped from 14% in 2018 to 11% in 2020.16 It is human nature to gravitate towards physical experiences because it gives us something that’s tangible. “As many who have used an e-book will attest, there is something missing–and that thing is touch. It is the weight of the book, the texture of the spine and the edges, and the roughness of the pages … there is a reason why physical book sales are growing and e-books are declining, and that is because consumers, deep down … prefer touch”.17

Zooming in on physical payment cards, we mentioned in a previous article (in the SEE ALSO rubric at the bottom of this page), and it’s worth repeating, that consumers are not only familiar with using their cards, they trust them. The card is also increasingly becoming an accessory that reflects of the lifestyle and values of the cardholder—social media is flooded with pictures of people posing with their cards. In an example of how physical cards can go viral, Razer recently launched a card in Singapore that lights up the company logo in their signature green on payment. The same day this card was announced, “Razer prepaid card” was the third most frequent Google search in Singapore and gathered tremendous engagement on various social media channels.

Physical cards leveraged into phenomenal marketing tools

Numerous banks around the world have realized how the physical card can be leveraged into a phenomenal marketing tool beyond just “a piece of plastic to pay with”. One example is by using design to make a card that really stands out, not least in crowded wallets. Think about looking down into a wallet—a card can immediately be identified when the edge of the card is colored. Banks like Boursorama Banque from France are reinforcing their brand by coloring the card edge in their corporate color.

We also see how the card is being transformed into a vehicle for supporting environmental causes. RHB in Malaysia has launched the RHB VISA WWF Debit Card. When customers apply for any participating RHB Islamic Current or Savings account, they have the option to donate RM3 or more to Universiti Malaysia Terengganu (UMT)’s research fund through the Ocean Harmony initiative. CaixaBank in Spain launched a campaign in which it planted a tree for each new card, among other initiatives.18 Other banks, such as HSBC, are setting up ambitious CRS goals like focusing on carbon emissions reduction and switching to payment cards made out of recycled PVC as a step towards a net zero business.19

Other banks have very successfully turned cards into “limited edition” symbols of exclusivity. The first customers, the most longstanding customers, and the most frequent customers are being “rewarded” with these “limited edition” cards. It’s worth noting that these rewards are not necessarily reserved only for the “wealthiest” customers, as in more traditional segmentation approaches. Last year a bank offered a very exclusive card to the first couple of thousands of clients who signed up with this bank: a card exclusive only to the first clients. Kuwait-based bank Boubyan gave a specially designed metal card to their longest standing clients in conjunction with their 15th anniversary: a card exclusive for the longstanding clients.

Physical cards standing strong in a digital era

The physical payment card continues to evolve and find its place in our fast-changing world for more than 70 years. In today’s digital era, we see how the card stands stronger than ever, not least as a tangible symbol of trust and a carrier of the bank’s brand identity.